Poland’s Defense: Facing Shifting Political Winds and Policy Revisions

Poland’s ambitious military modernization program will undergo significant changes in coming months, following key elections this year and a much-needed reevaluation of previous financial and operational planning assumptions.

Almost three years after Poland launched its ambitious military modernization plans, major political changes present a chance to take stock of the progress achieved to date and address key implementation challenges ahead.

The revised TMP will determine the direction of the country’s armed forces, defense industrial landscape, and long-term contribution to European security in the 21st Century.

A new 10-year Technical Modernization Program (TMP) should be unveiled early next year, arriving on the heels of two hotly contested multi-billion-dollar contracts and a new Polish government later this year. The revised TMP will determine the direction of the country’s armed forces, defense industrial landscape, and long-term contribution to European security in the 21st century. The original TMP, covering the period of 2013-2022, assumed a total budget of PLN 131.2 billion ($35 billion based on year-to-date average exchange rates), 70% of which involved weapons procurement across 14 different operational areas in the air, land, naval, and joint domains. Progress to date has been uneven with predictable delays in implementation for a program of such scale and complexity. Notably, the Polish Ministry of National Defense (MND) this year made an initial procurement decision on two of its largest projects – the $5.3 billion air and missile defense program known as Wisla and the $3 billion acquisition of 50 multi-purpose helicopters. The selection of the winners – Raytheon and Airbus Helicopters, respectively – reflected a political logic that favored a split US-European buy on the part of a committed NATO ally and increasingly assertive EU member state.1 That logic, however, could be challenged in the aftermath of last spring’s presidential elections and the upcoming parliamentary elections this fall.

Shifting Political Consensus

The unseating of President Bronislaw Komorowski by his political opponent Andrzej Duda of the conservative (PiS) party could presage a wholesale change in Poland’s political fortunes.

The 2017-2026 TMP offers an opportunity to revise previous financial commitments and timelines and put the modernization of the Polish armed forces on a more realistic and sustainable path.

Even if incumbent prime minister Ewa Kopacz succeeds in defending the Civic Platform (PO) party’s eight-year hold on power at the October 25 elections, the resulting uneasy cohabitation of Poland’s two main opposition parties (and potentially smaller ones if a victorious PO fails to secure an outright majority of votes) will force a new political consensus on a wide range of topics, including defense and foreign policy.

Regardless of who secures this fall’s electoral spoils, a new government and a new defense minister will assume responsibility for the next TMP extending through 2026. The 2017-2026 TMP offers an opportunity to revise previous financial commitments and timelines and put the modernization of the Polish armed forces on a more realistic and sustainable path.

Financial Planning Assumptions

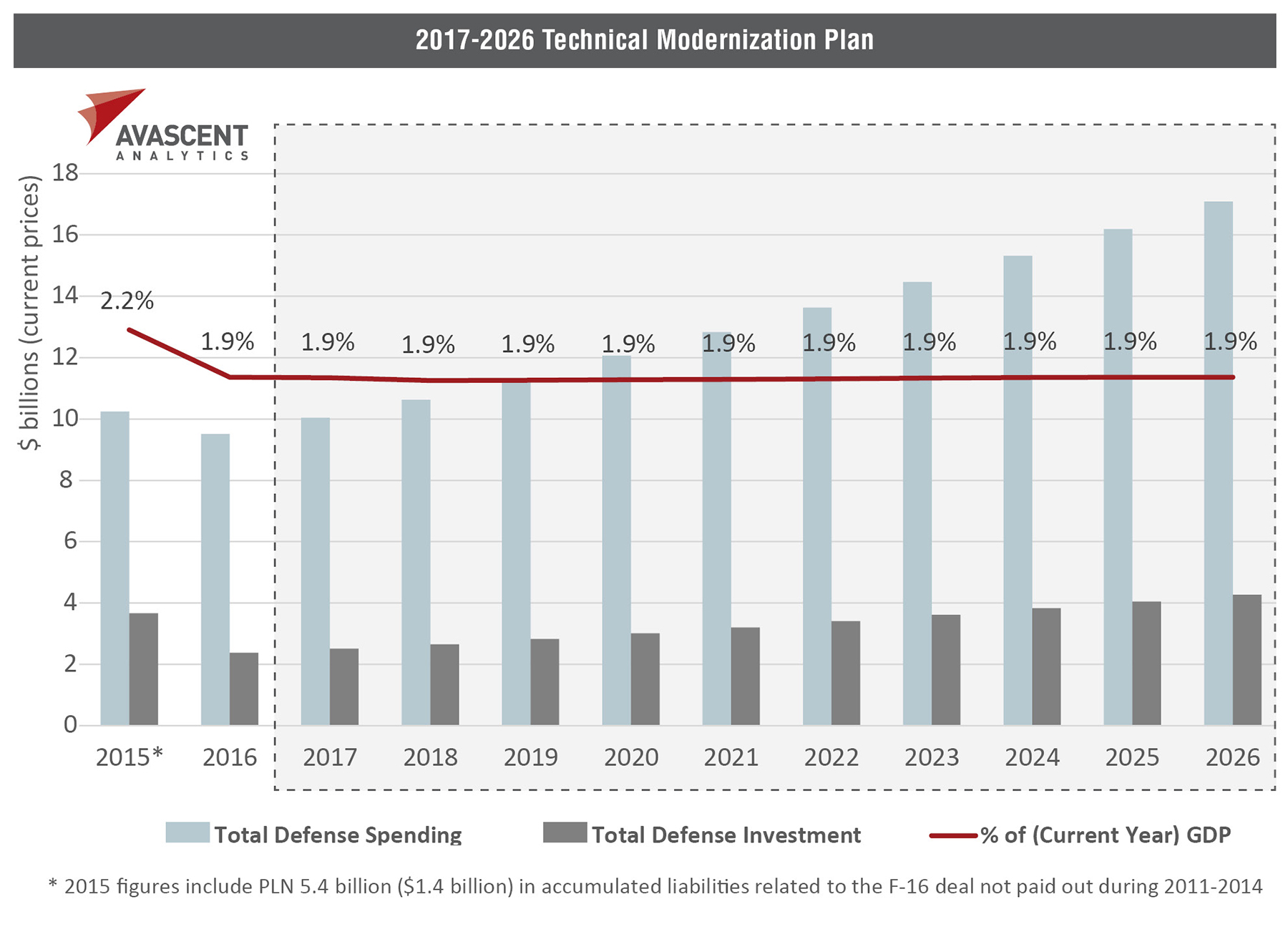

Assuming the MND can stick to a defense spending level of 2% of the previous year’s GDP throughout the forecast period2, the total defense budget should exceed PLN 500 billion (about $135 billion) over the 2017-2026 period. Of this, no more than 25%, or about PLN125 billion ($34 billion), is likely to be available for defense investment given competing spending priorities for personnel (increasing number of active forces, reform of the reserve forces) and ongoing operations (including demanding military exercises in view of the continued intense situation in Ukraine). Available procurement funds will have to accommodate accumulated project and payment delays from the previous TMP as well as make room for additional multi-billion-dollar procurements, including the replacement of MiG-29 fighter aircraft and Su-22 close air support aircraft. Additional combat helicopters and armored vehicles are also needed.

The rising healthcare and social security costs of a rapidly aging Polish population make additional defense spending growth beyond the committed 2% of GDP unlikely, particularly past 2020. The inevitable funding gap resulting from these competing pressures will force a reevaluation of TMP priorities and the overall scope of the modernization process.

Initiatives aimed at improving the country’s deterrent and long-range strike capabilities, such as the Orka submarine and the WR-300 Homar multi-rocket launcher programs, meet critical national security priorities. Cyber security and ISR are also high priorities. Beyond these areas, it is hard to see how Poland’s military modernization can be kept on budget and schedule without difficult trade-offs and adjustment in expectations.

Industrial Base Implications

Poland’s desire to ensure strategic autonomy is closely tied to another key priority: the development of a strong indigenous defense industrial base.

Poland’s desire to ensure strategic autonomy is closely tied to another key priority: the development of a strong indigenous defense industrial base. The participation of a wide range of Polish companies in the implementation of the TMP is a requirement well understood by foreign providers eager to secure a share of the Polish market. At the center of the government’s ‘Polonization’ efforts is the Polish Armaments Groups (PGZ), a $1.3-billion national champion created in 2014 through the combination of some 60 mostly state-owned entities under a single roof. As PGZ embarks on its own internal restructuring process, its fate and future evolution – including its ultimate composition and portfolio – will to a large extent be shaped by the next phase of the country’s military modernization.

PGZ’s ability to secure leading niche positions and new markets will be tested by the 2017-2026 TMP. Without foreign customers and carefully selected strategic alliances – in the form of joint-ventures, joint R&D, co-development or even a partial merger with some Western partner – PGZ will struggle to survive as a robust and innovative supplier within the global defense market.

Looking Ahead

Considering the execution challenges of the previous TMP, Poland’s next government has an opportunity to reassess current defense needs and commitments to ensure a feasible execution of the 2017-2026 TMP. This is a time of heightened instability to the East and a broader realization across Europe of the need to address a multitude of threats. It is also a moment that must not be squandered as government spending for the next TMP will probably be the last of its scale given expected pressures on public finances.

Footnotes

1. See Christina Balis, Poland’s Balancing Act: A Briefing for the Defense Sector, Avascent White Paper, August 2014.

2. In late July 2015, departing President Komorowski signed into a law an amended spending bill that envisions allocation of at least 2 percent of the previous year’s GDP starting in 2016. The current rate stands at 1.95 percent of the previous year’s GDP.