Where Next? Aviation Market Trends – Airframe & Supplier Challenges

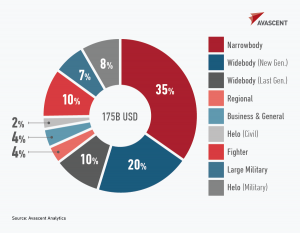

Global New-Build Aircraft Deliveries Value 2018

Speaking at the Farnborough Aerospace Consortium Annual Conference 2018, Ian Ferguson reviewed recent and forecast aircraft programs to identify current and upcoming aviation market trends and strategic challenges for players across the supply chain ecosystem.

He noted that airliner programs represent 60-70% of the ~$175B value of aircraft to be delivered in 2018, as well as the area of highest growth, adding that while fighters represent only 10% of that value, they lead technologies and are a rare growth area in military aerospace.

While the recent history of high fuel prices and low interest rates stimulated airlines to demand more fuel-efficient aircraft, it was technology investment by the engine OEMs that unlocked the huge current backlogs for delivery – and delayed the advent of open-rotor technologies and other significant changes.

Ian highlighted the difficulties that recent airliner programs have had in recovering Non-Recurring Investment within a reasonable number of deliveries, and noted the shifting model towards an “Enterprise Value” approach more similar to that that engine manufacturers have used for years – with a goal of locking-in years of revenue in aftermarket services and materials.

The supplier ecosystem has already felt significant pressure from the revenue/margin goals that Boeing and Airbus have set themselves, and Ian compared the two approaches and progress to date as well as the likely impact of Boeing Vertical Integration activity on systems value and aftermarket revenue going forward.

He took the chance to review the three “filters” that any Big Data program in aerospace must pass through and asked: are there satisfactory means to get the data off the aircraft in timely manner, can the claims of stakeholders like Pilot Unions, MROs and others be resolved, and can contracts be structured to allow clever engineering algorithms to deliver negotiable financial value?

He also questioned the attractiveness to the supply chain of forthcoming airliner programs given the constraints and pressures of the current economic model.

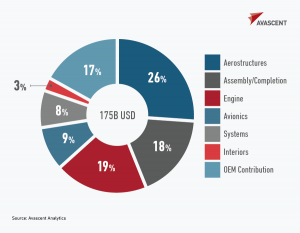

Aerospace Delivery Value 2018

Airframe OEMs have been studying and developing a number of technologies expected to play into next generation single aisle and regional transport, including battery and electrical performance, new configurations and alloys as well as the potential for significant steps away from the current Brayton Cycle (suck-squeeze-bang-blow) gas turbine, which will be required to maintain the current 1-1.5% annual fleet improvement in fuel efficiency at a 2035 service entry.

Many functions are now software intensive and have safety/security implications – digital systems development engineering productivity and certification have potential to be serious challenges to the next generation as functionality increases exponentially.

There are options open to executive managers looking for productivity improvements in software development – from strategic re-use architectures at one end of the scale to recruitment of staff on the autistic spectrum at the other end (as applied within US DoD, UK MoD and elsewhere).

However, structural improvement may be exceptionally hard, and help from the scale and speed of developments in automotive technology may be required. Aerospace has already borrowed from automotive (notably the CANbus) and has safety-critical development experience that may be of value in return.

The industry will look significantly different for the next aircraft generation given the current aviation market trends:

- the center of gravity of commercial aerospace will have moved East,

- emerging market challengers may be competitive in airframe or perhaps even propulsion technologies, and

- a globalized market may be fragmenting into tariff-protected domains

The scale of technology investments required and the supply chain pressures noted currently may encourage suppliers to diversify beyond aerospace, with hopes to escape cyclicality and defense market softness.

Ian finished with a provocative scorecard of challenges for suppliers and airframers looking at those things that they needed to solve yesterday, and those things approaching tomorrow.