Impact Investing Opportunities: The Public Sector’s Role

Impact investing has exploded onto the scene. Driven by rising awareness of critical issues like climate change, ESG funds have grown to ~$3 trillion under management, up from ~$1 trillion in 2020.

As capital continues to flow, private equity and venture capital firms have a newfound incentive to acquire and scale profitable companies focused on impact.

But doing so will require investment managers to navigate new questions, notably:

- Which “impact” markets (e.g., climate tech, healthcare) are best-suited for growth?

- How will political dynamics affect the outlook of these markets?

- And which companies in each market are poised for success?

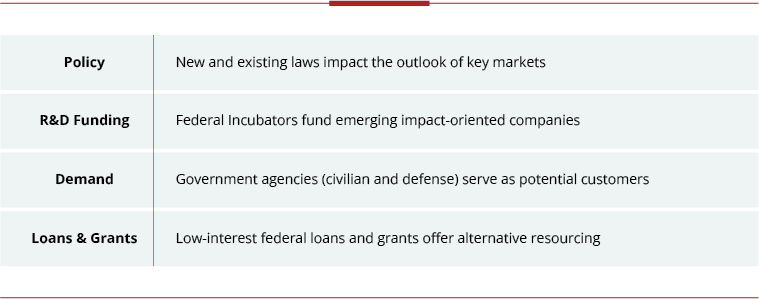

Answers to these questions will in part be answered by four distinct public sector levers:

Policy

Federal policy is rapidly gaining momentum as a lever to guide and incentivize impact investing.

The Inflation Reduction Act (IRA) opens significant pockets of opportunity across cleantech markets. For instance, the IRA provides hefty tax credits to stand-alone energy storage projects, incentivizing broader use in grid-scale applications.

Further, developers are eligible for additional tax credits if components are produced domestically, motivating expansion of US supply chains.

The bill not only benefits investors by incentivizing adoption of several technologies, including wind, solar, hydrogen, nuclear, and carbon capture and storage.

It also extends wind, solar, and energy storage production and investment tax credits across a 10-year time horizon, helping investors build more assured long-term business cases around cleantech.

Beyond federal stakeholders, others – such as state governments – have taken the helm on impact investing policy. California is a case in point.

Its Obama-era fuel efficiency standards caused a significant shift in supplier behavior as Ford, Honda, BMW, and other major manufacturers opted into its more ambitious targets even as the Trump Administration rolled back federal standards.

Now, California’s move to ban gasoline-powered cars will likely have meaningful ripple effects across the national market.

Outside of green energy, other key policies (e.g., the 1977 Community Reinvestment Act) [CRA], incentivize impact investing in historically underserved communities. Currently the Treasury is looking to revamp the CRA with an emphasis on digital modernization.

To make the most of emerging opportunities, impact investors will have to grapple with several questions, including:

- Which markets stand to benefit the most from the “Climate Bill”, CRA modernization, and similar?

- And, how will federal stakeholders coordinate impact-oriented policies – and how will they flow downstream, as to state and local entities – especially as the federal government takes a more active role?

R&D or Pilot Funding

The federal government also houses R&D accelerators, which are a unique source of potential high-return investments.

Since the late 1950s, accelerators have helped mature transformational technologies, including computers, GPS, and mRNA vaccines. Now, these accelerators are doubling down on impact.

In 2009, the Department of Energy established ARPA-Energy, dedicated to commercializing clean energy technologies. More recently, the Biden Administration stood up ARPA-Health, aimed at developing therapeutics to critical diseases like Alzheimer’s, diabetes, and cancer.

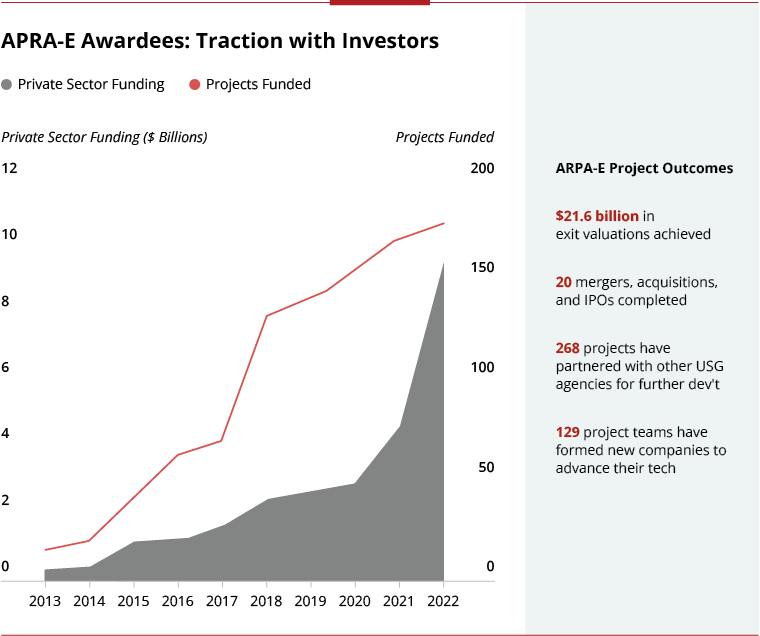

ARPA-E is a strong case study for the value of federal accelerators to impact-oriented companies. Since 2009, ARPA-E has distributed over $2.9 billion in R&D funding.

As of January 2022, ARPA-E’s awardees had attracted over $9.9 billion in private-sector follow-on funding – a nearly $5 billion increase from February 2021, suggesting a rapid uptick in private-sector investment in ARPA-E awardees.

Example companies with ARPA-E investment – included below – have seen significant growth stemming from their R&D work:

- CubicPV: A company developing cheaper, faster, and cleaner ways to manufacture silicon semiconductors for solar panels. Received $4 million from ARPA-E in 2009. Announced plans to build a $300 million manufacturing facility in 2021.

- AutoGrid: A grid-management software provider, AutoGrid, secured $3.5 million from ARPA-E. It then raised ~$107 million across six funding rounds and was ultimately acquired by Schneider Electric in 2022.

- Antora Energy: Antora is working on a green-energy thermal battery for industrial applications. After earning a $4 million ARPA-E award in 2018, Antora attracted $50 million in a 2022 private-sector financing round led by Breakthrough Energy Ventures.

As ARPA-Health matures alongside other government R&D programs like ARPA-E, and new potential accelerators are established (e.g., ARPA-Climate), impact investors may continue to find high-impact, high-return targets amongst their awardees.

Customer Market

Impact companies looking for scale may find meaningful opportunities within the public sector.

For instance, while impact investors have historically balked at companies working with the Department of Defense, recent commitments have created green energy opportunities across the US armed forces.

Demand is only growing. Rising cyber security concerns have increased the demand for insulated microgrids at military bases, driving demand for on-site renewable generation and energy storage.

The DoD’s FY23 budget includes $2 billion for installation resiliency and adaptation, including $550 million for the Energy Resilience and Conservation Program.

Startups are supporting this transition across DoD and the broader federal government. 270 ARPA-E awardees have partnered with government for follow-on work, up from 16 in 2013.

That number will continue to grow. And as defense customers look to integrate other green technologies into operations (e.g., sustainable aviation fuel, hydrogen), other growth avenues will open.

Federal agencies are also weaving other types of impact into their FY23 budgetary priorities, including health and wealth equity.

HHS is requesting $850 million for the Ending the HIV Epidemic Initiative and $470 million to improve maternal health outcomes.

And the DOE is requesting over $502 million to weatherize homes and promote energy efficiency across low-income residences.

These budget allocations are indicative of a broader story. Government agencies are often willing to invest in the public interest, making them ideal targets for impact investors looking to scale portfolio companies and smooth their transition to commercial markets.

Loan or Grant Funding

Federal grant/loan programs provide seed funding for impact-oriented projects that might seem unattractive to investors.

But as projects mature, investment cases for grant/loan recipients become more attractive, creating a pipeline of investment opportunities across interest areas, including the environment and health:

Environment:

Environmental development projects often originate in rural America requiring working capital investments many private sector investors are unwilling to make.

For instance, agencies like USDA and EPA support several projects to promote sustainability in rural locations (e.g., Rural Development, and Energy Efficiency and Conservation).

Private sector grant/loan recipients like Bioenergy DevCo, who partners with USDA and EPA to promote biogas recovery and methane emission reduction, have used this funding to scale operations.

As new sustainability policies emerge, these environmentally focused grant/loan programs will likely grow, supporting a wider network of private sector companies.

Health:

Healthcare grant/loan programs help promote access to high quality care in marginalized communities.

USAID’s Development Innovation Ventures (DIV) grant program funds breakthrough solutions for traditionally unattractive development challenges.

Dimagi, a health IT company, used DIV funds to develop CommCare, an offline health data collection app designed to support front line workers and improve outcomes for patients in traditionally under-resourced areas.

Closer to home, the CDC has expanded grant/loan programs to improve care for underserved and disproportionately affected communities during the COVID-19 pandemic.

Across the board, grant/loan programs can provide critical seed funding for impact-oriented companies, helping them achieve initial returns, scale, and truly make an impact on critical issues.

Conclusion

The public sector can be a critical enabler of growth for impact-oriented companies.

Favorable policies create and expand pockets of opportunity. R&D and loan/grant funding rapidly mature solutions and demonstrate their value to the market.

And government customers buy down risk and facilitate commercial market entry.

And so, investors who have a robust understanding of the push and pull of public sector influence on target markets will be uniquely positioned to achieve strong returns.