On the Horizon: HHS Strategic Plan Within and Beyond COVID-19

Nearly 20 months into a global pandemic, the US Department of Health and Human Services continues record high spending to combat COVID-19 and its impacts on public health.

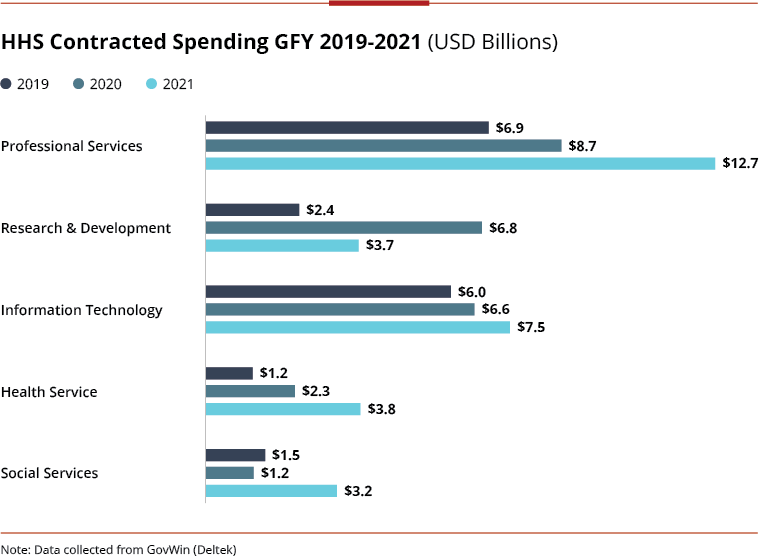

GFY2021 HHS spending nearly matched that of GFY2020 at about $40 billion, much of which can still be attributed to pandemic response and emergency services like COVID testing, vaccine distribution, wrap-around services, and clinical trial support.

However, the government’s focus has begun to shift, focusing on the future and healthcare in a post-pandemic world. The priorities for the department in GFY22 and beyond, identified by the Biden administration in part through its new HHS Strategic Plan, can be grouped into two categories:

- Near-Term Mission and Process Improvements

- Long-Term Transformational Health Outcomes

How is HHS Driving Near-Term Mission and Process Improvements?

In the wake of the COVID-19 pandemic, the Biden administration continues to build on pandemic-related preparedness and response spending while also moving forward with a more ambitious vision for accelerating scientific and research advancements and technological modernization. These priorities are well-established and contribute to both existing programs and defined opportunities.

Public Health Preparedness & Response

The COVID-19 pandemic revealed longstanding gaps in public health preparedness and response. As we emerge from the immediate crisis, the Department of Health and Human Services is working to ensure – via its new HHS Strategic Plan – that we are better prepared for the next public health emergency at the federal, state, and local levels.

GFY21 activities – while still predominantly focused on pandemic response – set the stage for investments in readiness and long-term public health response, such as $80M from the American Rescue Plan for public health informatics and data science and increased spending on ATSDR’s Public Health Assessment Activities IDIQ.

In its GFY22 Budget Request, the Biden administration has earmarked a number of surveillance & monitoring, emergency response training & planning, and evaluation accounts for additional investment, which will likely translate to increased outsourcing.

Representative increases include:

- A historic budget increase for the CDC (+$1.6B increase over GFY21). In part, these funds will be used to improve implementation at the state and local levels, an area where the US faltered in its initial response to the pandemic.

- Biomedical Advanced Research and Development Authority (BARDA) funding is also being restored, with a GFY22 request of $823M, $227M above the FY21 enacted level. This will drive novel medical countermeasure platforms for public health responses to infectious diseases.

- Supply chain resiliency is another key focus, given the identified weaknesses during the past two years. The GFY22 budget calls for a $200M increase for the Strategic National Stockpile. An early 2021 executive order required departments to design pandemic supply chain resilience strategies.

These GFY22+ and HHS Strategic Plan 2022-2026 priorities were already beginning to manifest in late GFY21: multiple Operating Divisions have begun investing in supply chain system modernization (e.g., $14M FDA Drug Supply Identify Trace Drug Shortage System, $3.4M NIH Supply Center Inventory Management System).

BARDA has a potential opportunity for a disaster response system called Resource Information Tracking and Medical Communications Application (RICTA). Other opportunities can be expected as ASPR, BARDA, CDC, and others invest for better preparedness.

Scientific Research & Development

The Biden administration is also seizing on momentum from COVID-19 policy to propose an ambitious investment in research and development to bring the US to the forefront of scientific discovery and excellence.

Goal #4 of the new HHS Strategic Plan aims to accelerate advancements in science and research. Under the GFY22 budget request, nearly all federal agencies would see an increase in their R&D funding relative to GFY21, and the largest of these R&D increases would go to HHS (up $7.7B or 17.8% from GFY21).

The NIH, which accounts for nearly 97% of total HHS R&D funding, received a $52B budget request, a $9B increase over the GFY21 enacted level.

This includes a significant investment of $6.5B towards the establishment of the Advanced Research Projects Agency for Health (ARPA-H)—a new agency inspired by Defense Advanced Research Projects Agency (DARPA)—that would focus on high-risk, high-reward capabilities to drive medical breakthroughs and accelerate innovation in medicine and health.

This proposal is preceded by numerous new science and R&D contracts awarded in GFY21, including:

- NCI Biomedical Information Technology, Software Development, and Informatics Support (BITSDIS) IDIQ ($1.1B, awarded 8/2021)

- FDA Scientific Support Services IDIQ ($25M, awarded 9/2021)

- ASPR Scientific Recruitment and Retention of SME for COVID-19 medical countermeasure development ($24M, awarded 9/2021)

- NHLBI Trans-Omics for Precision Medicine Administrative Coordinating Center ($18M, awarded 9/2021)

These recent awards and longer-term stated priorities indicate that research and analysis of current and future disease burdens plaguing our nation (HIV/AIDS, cancer, Alzheimer’s, emerging infectious diseases) will remain a top priority for the foreseeable future.

Technology & Data Modernization

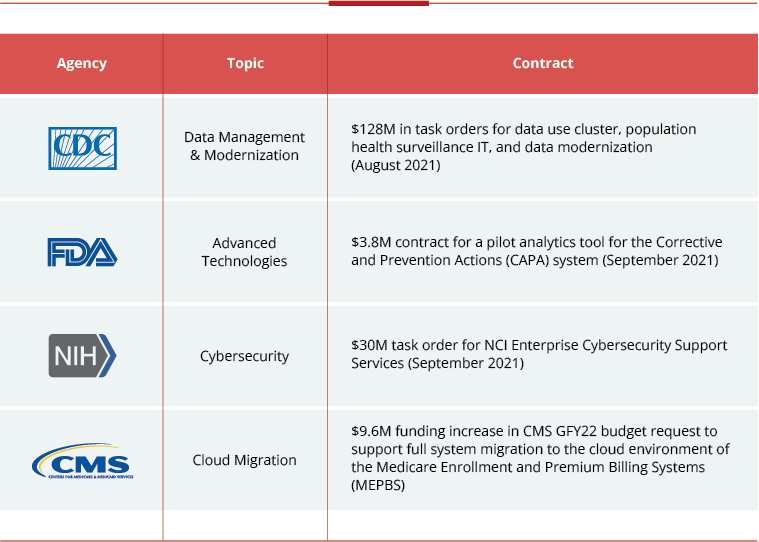

Technology modernization continues to be a priority for HHS under the Biden administration, which has set near-term goals for the modernization of legacy IT systems and data management. GFY21 alone saw a $900M or 11% increase in Information Technology spending from GFY20.

The GFY2022 budget request for HHS Information Technology is, notably, flat compared to the GFY21 enacted level.

However, there are clear pockets of opportunity and growth given the expected cost savings of investing in modernization, consolidation, and sunsetting legacy systems. Major areas of investment include:

- Cybersecurity: GFY22 cybersecurity budget request of $715M, a 20% increase from GFY21 – it is highlighted as a priority for the CMS and NIH, both of which handle large amounts of sensitive data.

- Agency-Specific Tech Modernization Plans: There are also funding increases to several agency-level tech modernization plans throughout the budget, including,

- FDA – $44.5M (+$44.5M from GFY21) for an Agency-wide centralized enterprise data modernization effort to strengthen common data infrastructure established through FDA’s Technology Modernization Action Plan (TMAP) and Data Modernization Action Plan (DMAP)

- CDC – $150M (+$100M from GFY21) for CDC’s public health Data Modernization Initiative (DMI), a multi-year strategy transforming data collection and use by consolidating core data, continually improving systems at a pace that matches technological advancements and shifting public health priorities, and harnessing forecasting and predictive analytics to prevent future crises

- CMS – $37M for CMS’s Medicare Payment Systems Modernization (MPSM) initiative to modernize 40-year-old Fee-For-Service systems

Customers across HHS are at different stages of technological modernization, driving support needs ranging from managing and consolidating data systems, to transitioning to cloud or secure infrastructure, to employing advanced technologies such as AI, machine learning, and blockchain.

Investments outside of traditional budget accounts also support IT modernization priorities. The Technology Modernization Fund (TMF) received a significant $1B investment through Biden’s American Rescue Plan – and HHS OpDivs are looking to build on the progress made with these funds.

While the Senate’s 2022 Financial Services and General Government appropriation proposes no new TMF investment, agencies may adjust by setting up their own revolving IT funds under the Modernizing Government Technology Act.

What is the HHS strategic plan to influence long-term transformational health outcomes?

Pandemic response and future preparedness are rightly at the forefront of recent spending and near-term investments.

However, the Biden administration is clearly seeking to balance those near-term emergency requirements with long-term transformational initiatives that are already beginning to shape outsourced spending and opportunities for industry.

Expanding Health Access & Improving Quality of Care

In the draft HHS Strategic Plan 2022-2026, HHS identifies strengthening equitable access to high quality and affordable healthcare as its first strategic goal.

The White House has taken steps already to expand access to healthcare by extending the enrollment period for Americans to purchase coverage through the Affordable Care Act.

It is pushing for Congress to fund continued lower premiums, ensuring the public insurance option remains affordable. Biden and Congressional Democrats are also pursuing options to lower the Medicare eligibility age from 65 to 60 while adding vision, dental, and hearing coverage.

In addition to expanding access to and breadth of public insurance options, HHS remains focused on driving quality improvements through new payment and incentive models.

CMS has requested a 33% increase for Medicare Quality Improvement Value-Based Transformation activities, focused on value-based care and new health equity efforts to reduce health disparities for vulnerable populations, and a 10% increase in the Quality Payment Program aims to better incentivize quality of care over volume.

CMS looks to industry to provide advisory on innovative payment models, statistical analysis, quality evaluation, and more. Beyond CMS, we see other Operating Divisions investing to support the mission of improving healthcare quality and outcomes:

- NIH has a requirement to enhance its SEER-MHOS data resource that helps examine health outcomes and care delivery for Medicare patients with cancer

- AHRQ is looking to revamp its retired National Guideline Clearinghouse to support evidence-based clinical practice guidelines

Additional opportunities for supporting this key mission area are likely to emerge in the next several years, although customers may look to industry to define the realm of the possible at the federal level.

Centering Equity in Healthcare

It is impossible to discuss this administration’s strategic goals related to healthcare access, quality, public health, and more without noticing the intentional mention and prioritization of equity throughout.

The pandemic was a critical illustration of how social determinants of health such as location, race, economic status, and gender factor into a person’s health and the care they receive.

The GFY2022 budget request is rife with examples of how the administration plans to tackle these issues of inequity:

- The Indian Health Service is requesting a 36% increase to $2.2B to address chronic underfunding, expand access to high quality healthcare, and address significant infrastructure challenges for Native Americans

- HRSA is investing $138M, a 200% increase from the FY21 enacted level, to improve maternal health, reduce maternal mortality and morbidity, and tackle disparities based on race, income, and geographic location

- CDC and NIH are similarly investing in research and analysis related to disparities in maternal, children, and rural health, such as the CDC Maternal Mortality Review

HHS is increasingly discussing climate change as a public health issue – one that drives significant health inequity. HHS established an Office of Climate Change & Health Equity in August 2021, which will lead the department’s efforts.

NIH is requesting a $100M increase to support research aimed at understanding the health impacts of climate change – and how underserved communities tend to be most vulnerable.

The CDC’s Climate and Health Program is dedicating an additional $100M (a 1000% increase) to identify potential health effects associated with climate change and implement health adaptation plans.

We are seeing new potential opportunities arise from these efforts already. Deloitte recently won a Health Equity Accelerator contract with CMS.

NIH has requested proposals for a new “AIM-AHEAD” Coordinating Center (Artificial Intelligence Machine Learning Consortium to Advance Health Equity and Research Diversity).

The HHS Office of Minority Health released an RFI for Disparity Impact Strategy Implementation Support earlier this year, born directly from Biden’s Executive Order #13985 for Advancing Racial Equity & Support for Underserved Communities.

Many more requirements of this type – for research, evaluation, and advisory – are set to emerge in 2022.

Prioritizing Behavioral Health

The COVID-19 pandemic exacerbated existing mental health, suicide, and substance abuse crises. Behavioral health is increasingly seen as a key component of physical health – demonstrated by the administration’s HHS Strategic Plan objective to better integrate and expand access to behavioral health in the US healthcare system.

The GFY2022 HHS budget requests historic investments in behavioral health, in large part through grant programs, including +$1.6B to the Community Mental Health Services Block Grant and +$3.5B to the Substance Abuse Prevention & Treatment Block Grant.

Other OpDivs are taking on responsibility as well, albeit at a smaller scale. CMS requested $16.3M, nearly 5x the prior budget, to improve access to substance use disorder prevention, treatment and recovery services and leverage data to drive action and impact.

FDA allocated $38M for medical product safety specific to opioids, and AHRQ requested $10M (+$7M increase) for research to prevent, identify, and provide integrated treatment for opioid and multiple substance abuse disorders. CDC and NIH have highlighted substance abuse – including opioids – as key research areas.

Alongside these investments, contractor-addressable requirements are likely to emerge or expand for evaluation, surveillance, and research related to substance use and mental health.

Even ahead of these budget impacts, SAMHSA’s IDIQ for outsourced support for mental health and substance abuse activities saw a 62% increase in spending in GFY2021.

New tasks have been awarded in recent months, such as the Program Evaluations for Prevention Contract (PEPC), suggesting this trend may continue in 2022 and beyond.

The Road Ahead: Opportunities for Industry

The Biden administration’s goals for modernizing and transforming US healthcare are complex, expansive, and likely to require years, if not decades, of commitment from both government and industry to succeed.

Early activity toward key priorities in late GFY2021 and early GFY2022 demonstrate the government’s reliance on contractors to help drive success. Diverse priorities will allow a variety of contractors to be at the forefront of new initiatives, but the long-term nature of those priorities will also require companies to identify areas of alignment and focus between their capabilities and government priorities to guide investment and enable commitment.

With its expertise in federal contracting and healthcare, Avascent can help companies examine their portfolios and priorities to identify areas of strategic alignment and develop investment and execution plans to achieve long-term success and leadership alongside government partners in the drive to permanently improve US healthcare systems, access, and outcomes for all citizens.

Subscribe to the Avascent Healthcare Pulse

We invite you to subscribe to the Avascent Healthcare Pulse – Insights delivered to your inbox on critical issues shaping the Healthcare industry’s future.