Infrastructure Investment and Jobs Act – Implications for Industry

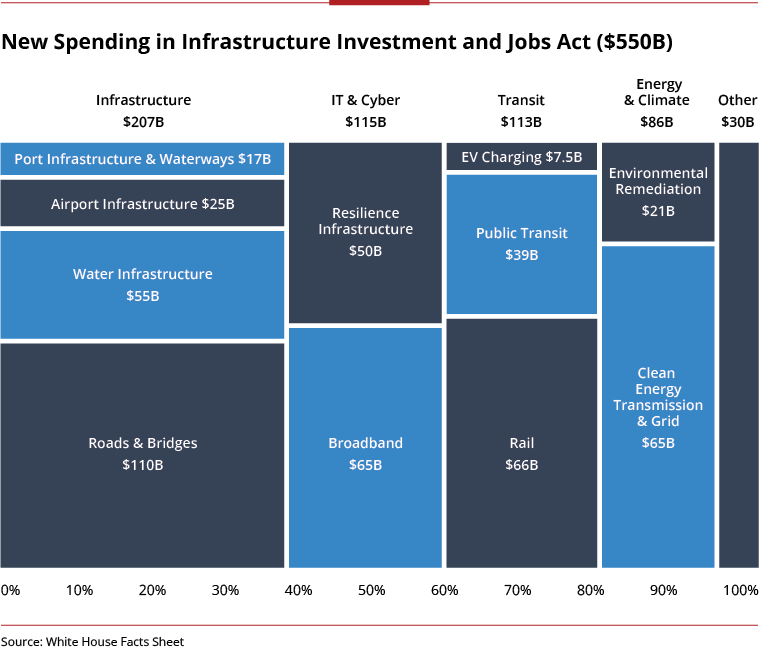

After months of debate, the US House passed the $1.2T Infrastructure Investment and Jobs Act (HR 3684). While part of the bill goes to reauthorizing existing programs, the bill also authorizes $550B in new investment.

This new investment offers some industry-accessible dollars today, although the timing and method of disbursement will vary. Long-term, this bill could also jumpstart new areas of investment.

Most of this planned spending at a high-level will be locked-in for the planning, design, engineering, and construction of infrastructure projects (see Figure 1).

However, these large projects may require significant implementation, program management, and other related advisory support.

While 60%+ of funding is to be made available as soon as FY22, this funding may be harder to access than traditional federal government contracts given the planned distribution methods.

Some spending will raise the investment levels of existing programs (e.g., safe and clean drinking water), but much will flow through new contract, grant or loan programs.

While some funding will be available immediately via federally-implemented programs (e.g., plugging orphaned wells), most will flow from federal to state, local, public utility, or other entities as the majority of non-defense public infrastructure is maintained at the local level.

Any funding made available to existing programs from the Infrastructure Investment and Jobs Act may be distributed more quickly, thanks to existing funding channels. However, any new programs will require additional planning, delaying spending.

While the timing of disbursement and implementation will vary, the new investment does have potential to jumpstart funding for new areas of investment. New R&D and pilot funding is available for cutting-edge research areas such as carbon capture.

To further understand the bill’s impact, Avascent reviewed the Infrastructure Investment and Jobs Act against major segments:

- Infrastructure

- IT & Cyber

- Transit

- Energy & Climate

Infrastructure

Roads and bridges:

The Infrastructure Investment and Jobs Act reauthorizes the Department of Transportation’s surface transportation programs for five years and provides additional funding for the Highway Trust Fund to support new programs such as building infrastructure resiliency and reducing carbon dioxide emissions from on-road highway sources. It also offers emergency funding for other projects, including $40B for bridge repair and replacement and $5B for Safe Streets grant program.

Water infrastructure:

$55B is allocated for the planning, design, and construction of infrastructure projects for potable water. These funds, alongside set-asides for contaminant and lead pipe mitigation, earmark a portion of spending for small, disadvantaged, and tribal water systems, as well as specific geographic areas, notably drought-stricken Western states, targeting treatment, storage, and reuse projects ($8B).

Implications for industry:

In many regards, the infrastructure projects are most shovel-ready and visible, providing significant opportunities for architecture, engineering and construction (AEC) firms. These projects are also likely to create the largest segment of new jobs.

IT & Cyber

Cybersecurity improvement plans:

The Infrastructure Investment and Jobs Act provides for a DHS-administered $1B grant program running from FY22-26 in which state, local, tribal, and territorial governments apply for funding for implementing and administering cybersecurity improvement plans. These plans must include detail as to how entities will make enhancements to security assessments and to monitoring, workforce, and incident response plans.

Grid resilience:

$550M is provided for enhancements to electric grid cybersecurity, which covers a blend of testing and vulnerability reporting processes for systems commonly used in the energy sector, financial incentives for making enhancements to cybersecurity postures, and technical assistance and grant support for rural and municipal cybersecurity.

Cyber response fund:

The law sets aside $140M for a Cyber Response and Recovery Fund, which will provide funding to both federal and non-federal governments for incident response and remediation in response to DHS-approved declaration of major cyber incidents.

Implications for industry:

Firms best positioned for this spending will be those with sales channels to access fragmented non-federal public sector markets or that hold expertise in public utility and operational technology cybersecurity.

Transit

Rail:

The Infrastructure Investment and Jobs Act authorizes the largest rail investment since Amtrak’s founding, allocating $22B for fleet acquisition and improvement projects and $44B to Federal Railroad Administration for state grants and rail projects. $36B in funding will go towards projects relevant to Amtrak’s Connect Us initiative to expand new intercity passenger rail, with funds specifically earmarked for Northeast Corridor projects.

EV charging:

The Biden Administration is placing significant emphasis and expectations on electrification as a climate change mitigator. On the demand side, alongside existing tax breaks for electric vehicles (EVs) that have helped customer adoption, the Administration is now looking to develop a national charging station infrastructure. Spending for electric school buses—a market dominated by particulate-emitting diesel technology – is also prominent ($1B).

Implications for industry:

Alongside rail equipment providers, charging equipment manufacturers, and electric bus makers, grid operators and utilities may be best positioned to benefit. The design, installation, and sustainment of rail infrastructure and the charging network will demand an increased role by AEC firms. A modernized rail and growing charging network will also require support for SCADA and network functions and systems, including enhanced cyber protection.

Energy & Climate

Clean energy transmission & grid:

On the supply side of electrification, the Infrastructure Investment and Jobs Act offers new investments in the electric grid, strained by increased demand, aging infrastructure, geographic misalignment with renewables, and natural disasters. The Bill sets aside ~$20B in grid expansion and modernization, with support extending to new technologies and energy solutions such as advanced and small-modular nuclear power, green hydrogen, and carbon capture, sequestration, and use (CCSU) technologies (over $42B in FY22). Existing nuclear and hydropower electricity providers, such as utilities, also benefit from this funding source.

Environmental remediation:

The Bill appropriates an additional $3.5B in spending and transfers $3.5B in general revenue to the Superfund for legacy contaminated sites on the National Priorities List (NPL). Adding a degree of flexibility, the Bill lifts state cost sharing requirements, allowing the EPA to expend funds with no state participation. In addition, $1.5B is allocated to EPA brownfield sites, and $11B to abandoned mine land reclamation.

Implications for industry:

For grid modernization, utilities and grid operators will be first to capture funding, which will quickly flow to AEC firms and supporting expert and consulting firms. Significant R&D-focused energy and climate funding is likely destined for non-profit and research institutions, including universities. Remediation work, on the other hand, will be largely destined for traditional for-profit engineering and remediation specialist firms.