Out of Reach? Defense Industry May Struggle to Integrate New Technologies

Avascent survey on Innovation and Competitiveness shows U.S. Aerospace & Defense leaders see the importance of integrating commercially driven R&D and innovation but are in immediate need of improved approaches

Setting the stage

Impenetrable slums inhabited by tens of millions of people. Autonomous weapons engaged in ground combat against other machines. Bio-enhanced soldiers possessed of superhero-like speed and strength.

Defense is severely out of step with commercial R&D. A serious shakeup must occur, led by OSD thought leaders, to affect any change. – senior A&D executive

This is the future of war, according to the U.S. Army, which is preparing today to “Win In A Complex World,” the title of the latest Army Operating Concept.

Meanwhile, the Department of Defense is working to make cutting-edge technologies an asset, not a liability, through the Pentagon’s Third Offset strategy and Silicon Valley outreach. The tactical – and strategic – imperative is real. For a deployed soldier, their concern isn’t which lab or company invented their squad’s micro drone scouting rooftops for lurking snipers, it’s whether technologies that improve mission effectiveness and save lives can get to their unit in the first place.

Access to the R&D-driven innovation that produces the kind of equipment and systems the U.S. military wants is far more challenging than is currently appreciated, according to Avascent’s second annual survey of senior aerospace, defense, and technology leaders.

Survey and Methodology:

Avascent’s 2015 survey on global innovation, R&D, and aerospace and defense industry competitiveness, is the firm’s second exploring defense market dynamics from the perspective of senior A&D leaders from around the world. For this survey, there were over 200 respondents presented with 23 open-ended questions. Participation was global, led by US executives.

Commercial Innovation’s Impact Is Far Reaching Across A&D Sector

As Defense Secretary Ash Carter’s recent trips to Silicon Valley reveal, finding new sources of innovation is a Pentagon priority. The survey reflects this conviction within the A&D industry as 91% of executives believe R&D-driven innovation is important in maintaining military parity/superiority relative to rivals, and that government should always or often support commercial R&D-driven innovation (92%).

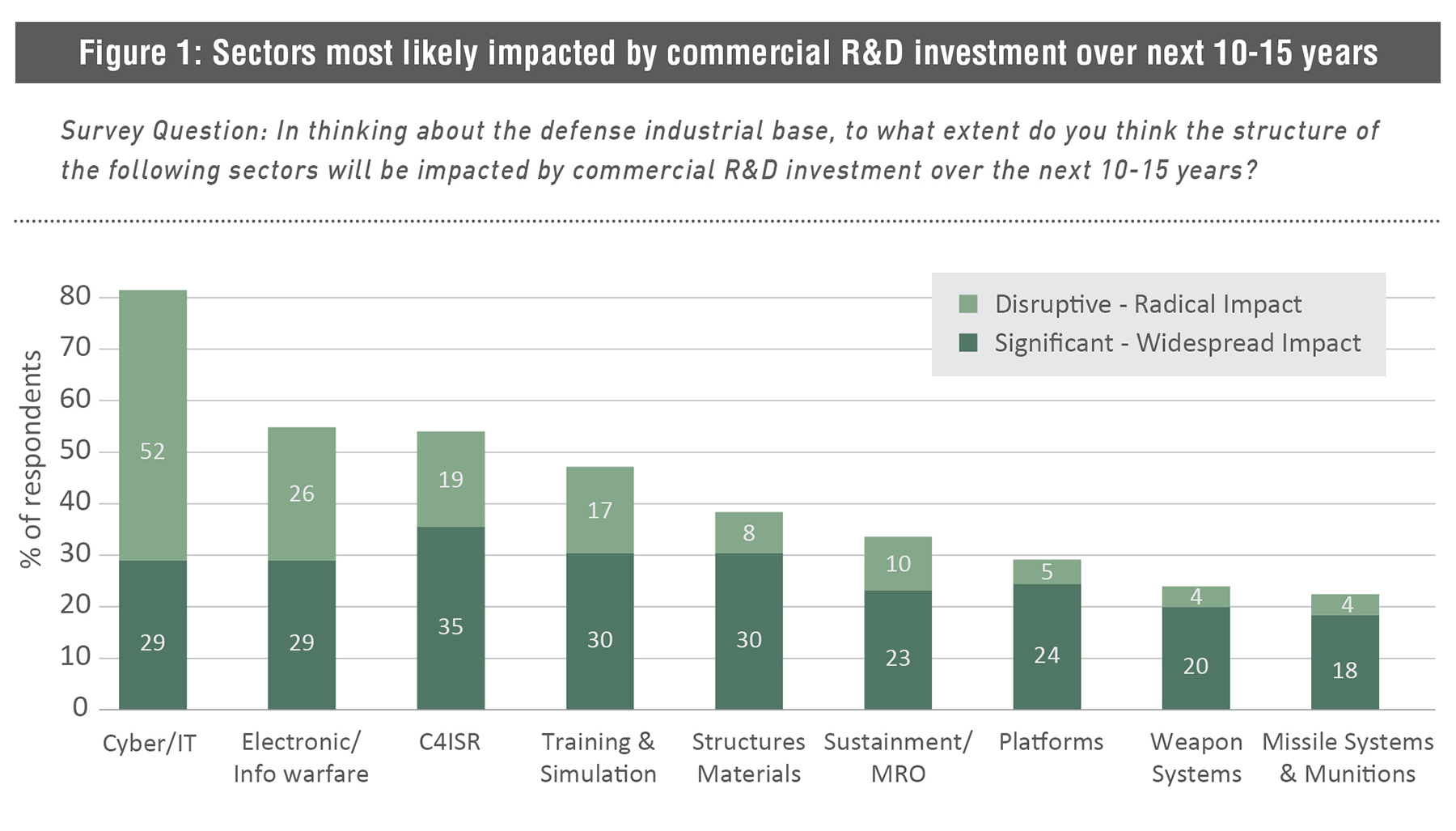

Senior industry leaders see commercial R&D having a major impact on their markets over the coming years. This trend is most prevalent in markets such as cyber/IT, electronic warfare, C4ISR, and training and simulation, though the majority of markets are expected to be impacted radically or significantly. See figure 1.

A&D Companies Concede They Are Not Ready for Commercial Technologies

According to the 2015 survey’s results, approximately half of surveyed executives say their companies are not ready to take advantage of commercial technologies. In addition, many saw a wide gap between defense and commercial innovation:

“ Defense is severely out of step with commercial R&D. A serious shakeup must occur, led by OSD thought leaders, to affect any change.” – senior A&D executive

Fortunately, the survey also gives insight into specific steps the A&D industry and U.S. government can do to ensure the Army and the other services are equipped to “win in a complex world.”

Targeting Commercial Innovation

The challenge for industry and government alike in this quest for innovation is apparent in a key finding from the survey: 44% of executives note their companies are not ready to leverage commercial R&D. This is a significant admission given the near unanimity concerning the importance of R&D driven innovation to military superiority. A more general belief also existed that internal R&D spending needs to increase. As one executive made clear:

“Industry needs to step up internal R&D to keep up and should leverage [the] commercial market for its products.”

According to the survey, as it turns out the biggest obstacle to achieving success with commercial R&D is not profitability or IP restrictions, or lack of awareness, or cultural fit—but rather paperwork and admin.

Barriers to A&D Innovation

From Avascent’s experience, A&D companies are constantly looking for new and better ways to innovate. However, many firms face internal and external challenges that make it difficult to do so effectively.

Externally, when asked about the biggest obstacles to achieving meaningful impact with commercial R&D, defense companies cite a number of challenges including a lack of interest from commercial firms, intellectual-property restrictions, lower profitability of defense applications, and a long lead time compared to commercial markets. By far the biggest obstacle is “burdensome contracting requirements.” See figure 2.

Companies also are concerned about their internal ability to innovate. When asked about the degree to which commercial developments are a driver of innovation or market disruption in the A&D sector, and the challenges executives face at their companies, 45% of respondents say the “speedy evolution of commercial market offerings is out of step with the slower-moving defense sector.” This response outpaces security and IP (35% of respondents state significant risk) and cultural fit with commercial providers (25%).

“According to the survey, as it turns out the biggest obstacle to achieving success with commercial R&D is not profitability or IP restrictions, or lack of awareness, or cultural fit—but rather paperwork and admin.”

All-Source Innovation: What Can Be Done

Identifying a valuable software algorithm for autonomous ground vehicle operations in the civilian sector at home or abroad is one thing, acquiring it for a defense contractor’s use is another.

The commercial sector’s lead in many technologies exceeds what traditional A&D companies can currently offer their customers. That can, and should, change. The “Third Offset Strategy” is predicated on major changes to Defense Department acquisition, particularly the sources. If the Pentagon is turning to Silicon Valley, industry can as well. It need not stop there, either, as major U.S. allies such as the United Kingdom, France and Germany represent viable partners for joint defense R&D projects and establishing new channels for accessing international technologies that are otherwise out of reach.

First Step: Look Outside, Not Just Inside

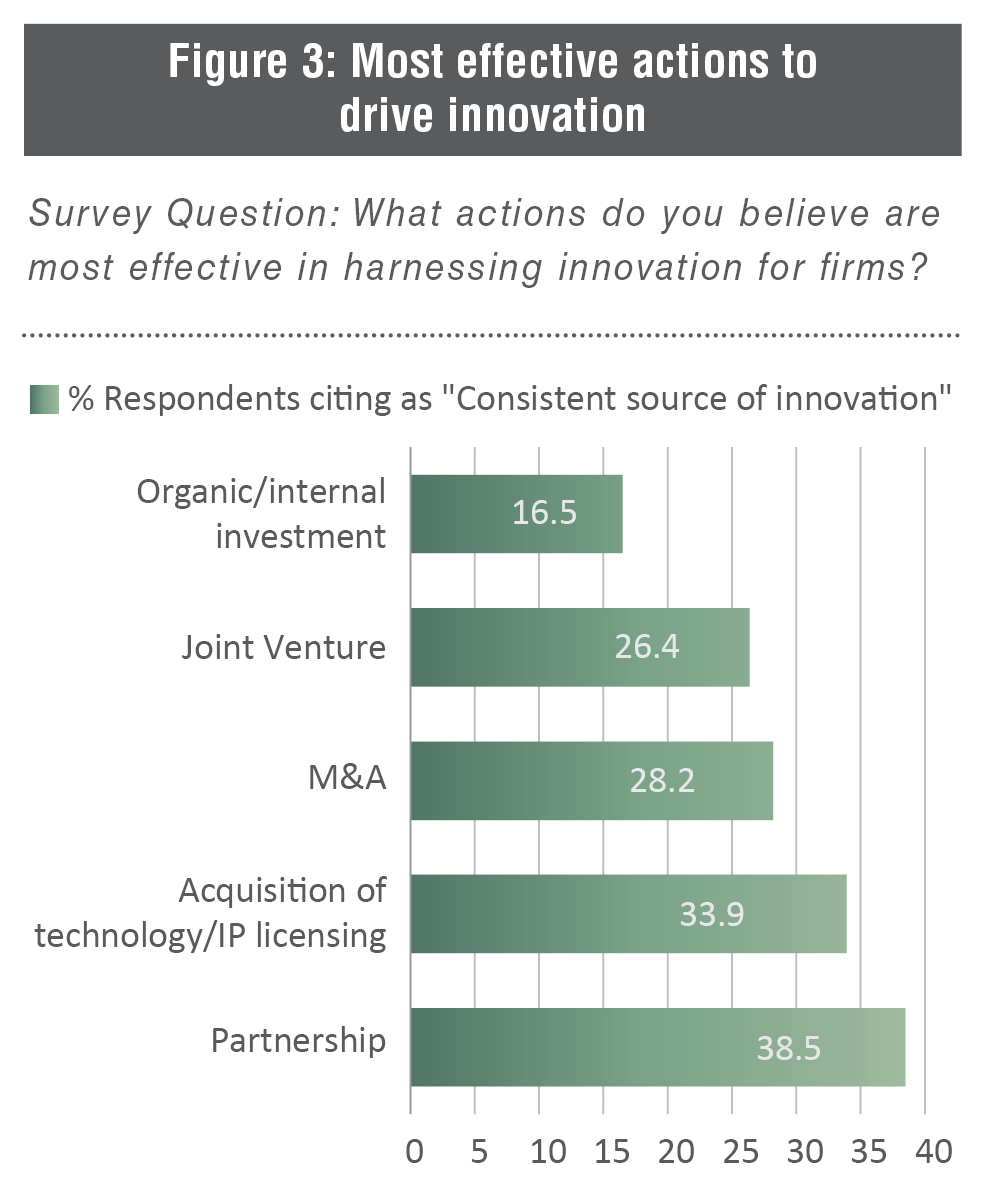

When companies evaluate approaches to harness innovation, they are essentially making strategic decisions. They can involve joint ventures, less formal partnerships, IP licensing, or mergers and acquisitions. While the survey shows these all can be effective in harnessing innovation to varying degrees, the least effective approaches reported are organic and internal investment. Only 18% of respondents cite organic approaches and internal investments as being consistent sources of innovation within the aerospace and defense sector. See figure 3.

The implication is that while many companies may have core competencies in leading edge technologies, it will be important for success to develop an external innovation strategy as well, that evaluates a combination of IP, M&A, partnerships, and more formal joint ventures.

If many innovative technologies are in fact out of grasp, from a corporate or acquisitions perspective, what can be done to ensure they are accessible to industry, and U.S. warfighters, in the near future?

Taking Avascent’s 2014 and 2015 survey results into account, as well as Avascent’s experience helping corporate and government clients make sound strategic decisions about technology investments, there are steps leaders can take:

A&D Industry:

- Develop core competency in external partnerships, joint ventures, IP licensing, and M&A based on portfolio analysis – recognize that internal initiatives are likely not enough to achieve success

- CEO/board leadership should prioritize commercial-market engagement

- Review internal processes targeting “paperwork” and organizational structure that may impede speed and success of innovation

U.S. Government:

- Work with defense industry to develop commercially oriented outreach in markets prioritized for high levels of disruption (e.g. cyber, unmanned/robotics, EW, C4ISR)

- Assess U.S. government ability to bring commercial innovation to defense markets, including identifying barriers to success

- Improve intellectual property policies to favor A&D innovation

Allied Governments:

- Sponsor international industry R&D investment programs

- Prioritize shared development of disruptive/innovative technologies

- Advocate for allied R&D role in developing “Third Offset” strategy