Funding the Final Frontier: A Look at the FY23 National Security Space Budget

Unprecedented Growth

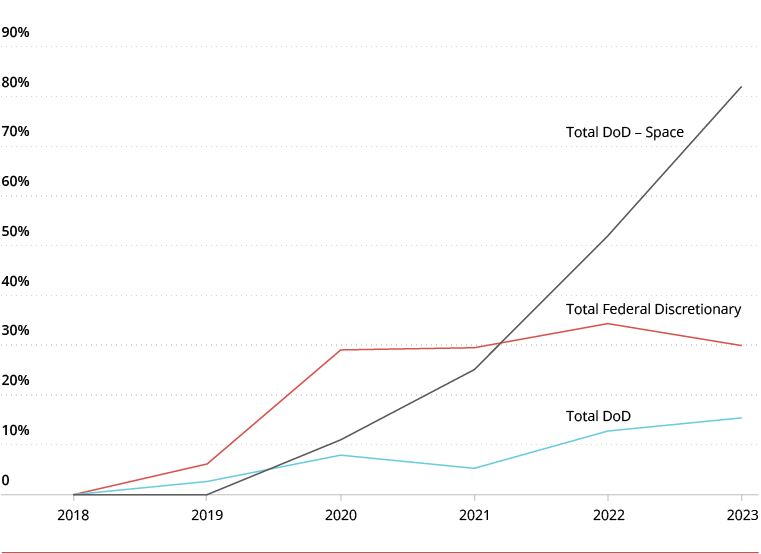

The FY23 President’s Budget Request (PBR) picked up where the recently passed 2022 Defense Appropriations Act left off, with another record-breaking national security space budget.

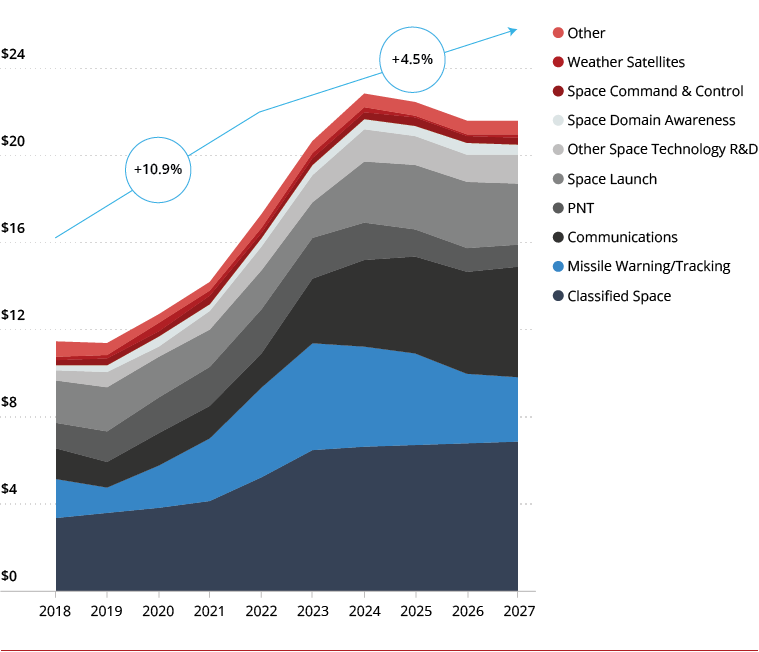

The FY23 national security space budget request allocates $20.8B to National Security Space investment accounts – a 19.5% increase from FY22. Missile Warning/Tracking, Communications, and classified mission sets all saw substantial increases above their FY22 projections, with few segments seeing any meaningful decline.

If appropriated at the requested PBR level, DoD space investment will have nearly doubled from 2018, having outpaced other Federal discretionary spending growth by nearly three-to-one (including the COVID related plus-ups) and other DoD investment by five-to-one.

![]()

FY18-23 Budget Growth

Missile Warning/Tracking and Communications Emerge as Top Missions in the National Security Space Budget

The missile warning/tracking mission is a clear winner, with Next-gen GEO (NGG) and Next-gen Polar (NGP) OPIR programs receiving significant funding through the FYDP.

Emerging LEO and MEO resilient tracking layers help sustain outyear spend with billions in new investment through 2027 – a vote of confidence for the Space Warfighting Analysis Center’s OPIR Force Design and further acknowledgement of the growing on-orbit threat from China and Russia.

The Space Development Agency’s Transport layer leads early comms spending, peaking at $1.68B in FY24.

The later half of the FYDP is driven by the recapitalization of legacy comms programs, with Evolved Strategic SATCOM (ESS) and Protected Tactical System (PTS) growing by 12% and 15% from FY25-27, respectively.

At nearly $5B, Classified spend continues to comprise the largest portion of space investment and is projected to grow to $5.3B by 2027.

![]()

Estimated National Security Space Spending FY18-27 (USD Billions)

Too Much Space…?

But such elevated levels of growth may not be sustainable indefinitely – nor are they projected to do so.

With consolidation of space investment under the Space Force, the potential perception of “too much space” could put a damper on future investment.

The FYDP for national security space already projects declines, with FY23 to FY24 spending expected to grow at a modest 4.2% before leveling off by FY27.

And with inflation eroding the value of any planned increases and a potential recession looming, space investment in real dollars may have reached its zenith.

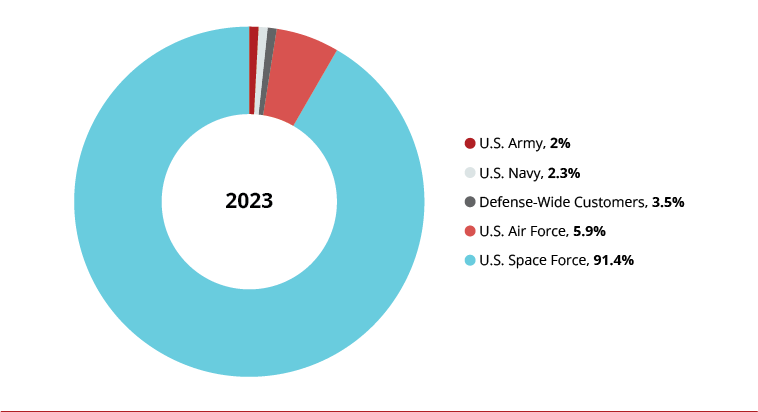

![]()

FY23 DoD Budget by Customer

…Or Too Big to Fail?

Yet there is also a growing recognition among lawmakers and the public alike of the critical enabling role space plays across DoD missions and a wide array of civil applications.

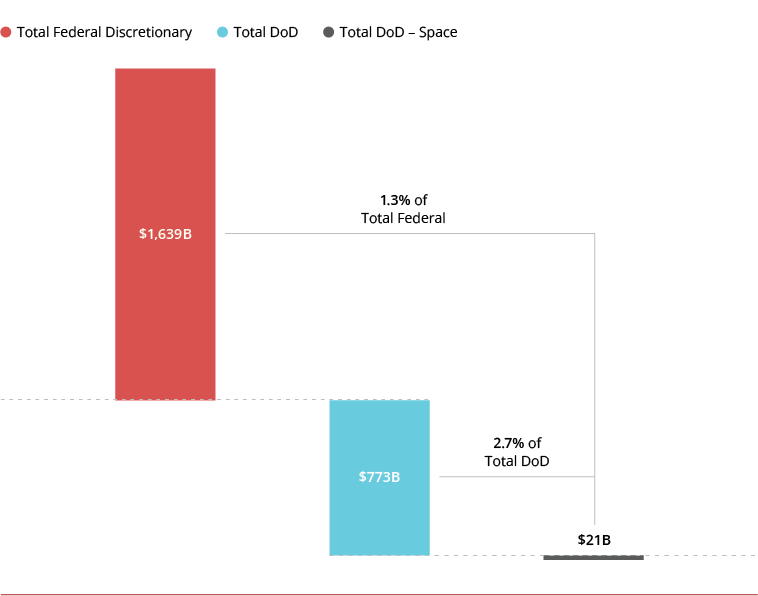

And with the National Security Space Budget comprising only 1.3% of Federal discretionary investment and 2.7% of DoD spending, it delivers a strong “bang for buck” which should help maintain budget growth moving forward. DoD leadership appear to acknowledge this, and, despite FYDP projections, are calling for continued space investment, with Air Force Secretary Frank Kendall stating in a recent House Appropriations Subcommittee hearing: “I do not anticipate the future budgets will remain flat or go down for the Space Force – quite the opposite.”

![]()

FY23 Federal Budget Comparison

Remaining Questions…

Despite recent congressional support and the strong (and growing) arguments in favor of continued space investment, spending levels for the national security space budget will ultimately be shaped by a host of exogenous factors as well as the attitudes of Congressional Appropriators today – and tomorrow.

For those in industry, or investors evaluating space opportunities, several questions must remain top of mind:

- Which mission areas will demonstrate the greatest “stickiness” in an austere budget environment (and conversely, which will be bill payers)?

- How concentrated is mission spending across programs of record, i.e., is there a broad set of opportunities to pursue, and how frequently are those programs recompeted?

- Which customer communities have traditionally been the most effective advocates for program ownership, and what is the company’s exposure to those communities?

- What innovation areas are breaking the cost curve to enable next-generation capability at current (or lower) price points?

- Are there civil and/or commercial applications within the company which could help augment or hedge against a flattening DoD space spending trajectory?

Subscribe to the Avascent Apogee

We invite you to subscribe to the Avascent Apogee – Insights delivered to your inbox on critical issues shaping the Space industry’s future.