“All in” for Space: The FY22 NDAA

Avascent’s June analysis of the FY22 Presidential Budget Request (PBR) highlighted National Security Space (NSS) as the clear “winner” amongst major investment accounts. With an NDAA finally in hand (now just awaiting the President’s signature) we take a look back at some of the initial questions raised, and discuss programmatic winners and losers (hint: only winners this time around).

The FY22 PBR set space investment spend (procurement and RDT&E) at $15.3B, 13.8% above FY21 levels. The NDAA adds $645.7M to the PBR – a 4.2% increase, which brings FY22 space investment spending to 18.6% above FY21 levels. Of the $645.7M increase, $548.7M went to the Space Force, representing 90% of its unfunded investment account priorities.

The vast majority of plus-ups went to RDT&E accounts, with classified spend alone receiving an additional $205.2M.

![]()

FY2022 PBR vs. FY2022 NDAA (by Customer Investment Account)

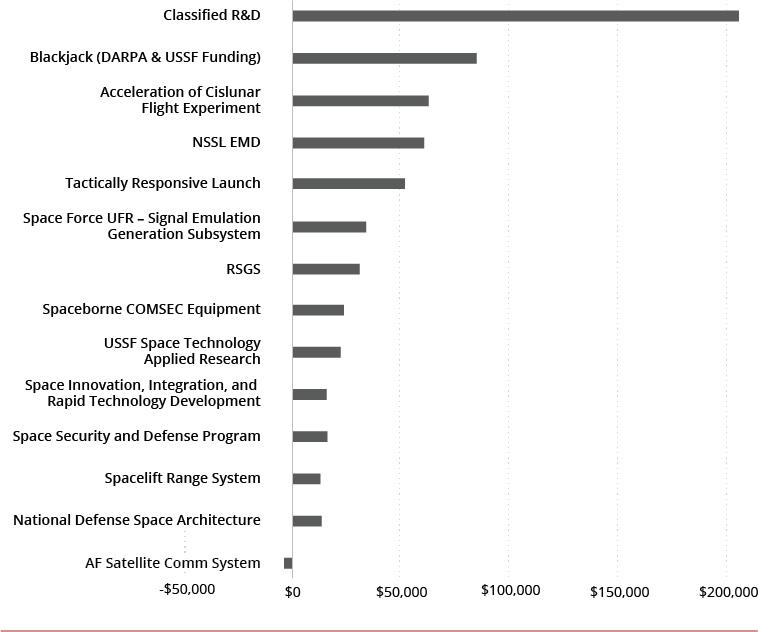

At the programmatic level, launch saw the greatest plus-up, with Tactically Responsive Space receiving $50M, up from zero in the PBR, and National Security Space Launch receiving $59.2M, primarily to ensure sufficient Phase III competition for DoD specific requirements.

As noted in Avascent’s prior analysis, these increases do not come as a surprise given past congressional interest in sustaining the launch industrial base and ensuring assured access to space.

Beyond launch, Congress demonstrated urgency in developing capabilities beyond GEO, adding $61M to accelerate a Cislunar space domain awareness flight experiment. DARPA saw its space budget nearly doubled, adding $85M to the $101M in the PBR.

The addition will go towards Blackjack, DARPA’s pLEO development program, and RSGS, a GEO robotic servicing mission. Blackjack also received an additional $28M for radio frequency payloads on top of its $55M in new DARPA funding through the Space Systems Prototype Transitions Program.

The Space Development Agency not only maintained its PBR funding – it saw a modest increase, receiving an additional $12M for laser communication terminals and technology investment.

![]()

NDAA 2022 Adjustments from PBR by Program ($K)

The NDAA also revealed a somewhat surprising about face by Congress. MDA’s HBTSS and SDA’s Tracking Layer – two programs previously called into question by congressional leaders as offering somewhat redundant capabilities – were both fully funded.

Another question going into the NDAA was whether some long-term recapitalization programs would remain fully funded given competing nearer-term priorities. ESS (Enhanced Strategic SATCOM) in particular seemed vulnerable to cuts given the expected longevity of its predecessor, AEHF (Advanced Extreme High Frequency).

But instead of “robbing Peter to pay Paul,” Congress added $645M in topline spend, and in the process, sent a clear message that it’s “all in” for space. In fact, only one space program saw a reduction from the PBR – AF Satellite Communications Systems, which was lowered by $4M due to “insufficient justification.”

![]()

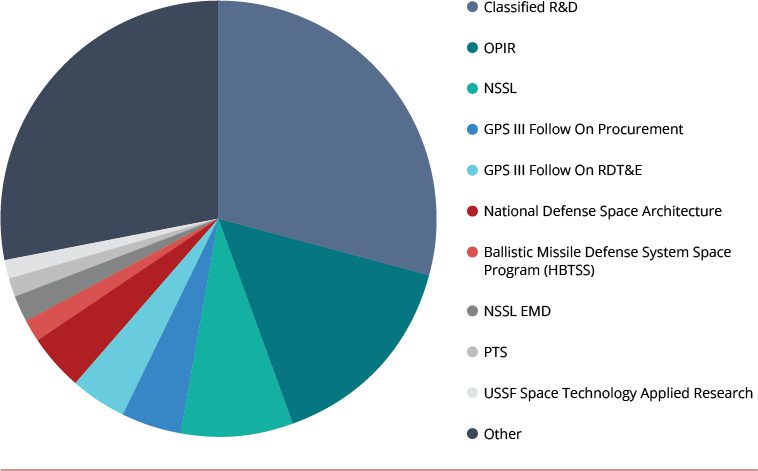

FY22 NDAA Top Programs

Taking a holistic view of space investment, classified RDT&E spend comprises nearly 30% of all FY22 NDAA space investment, undoubtedly a major factor behind congress’s push to declassify more of the budget where possible. Missile warning (OPIR), National Security Space Launch, and PNT (GPS) are the next largest recipients, together comprising the next third of spend.

And while the Space Development Agency’s National Defense Space Architecture only makes up 4% of FY22 space investment, successful T0 Transport and Tracking layer deployments could justify full constellation build-out, which could easily push spend beyond 10% of future National Security Space Investment.

Space industry leaders on the whole should be pleased with the NDAA which reaffirms Congressional recognition of space as a warfighting domain while laying the groundwork for the next generation of resilient space capabilities.

Subscribe to the Avascent Apogee

We invite you to subscribe to the Avascent Apogee – Insights delivered to your inbox on critical issues shaping the Space industry’s future.