FY22 National Security Space Investment Quick Look

The long-awaited FY22 President’s Budget Request (PBR) was finally revealed by the Biden Administration on May 29, albeit without a Future Years Defense Program (FYDP).

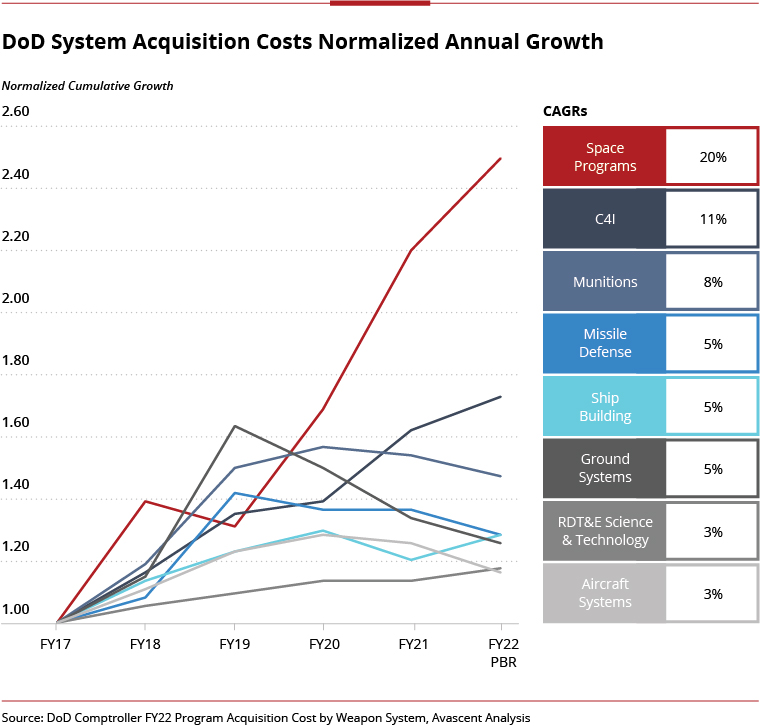

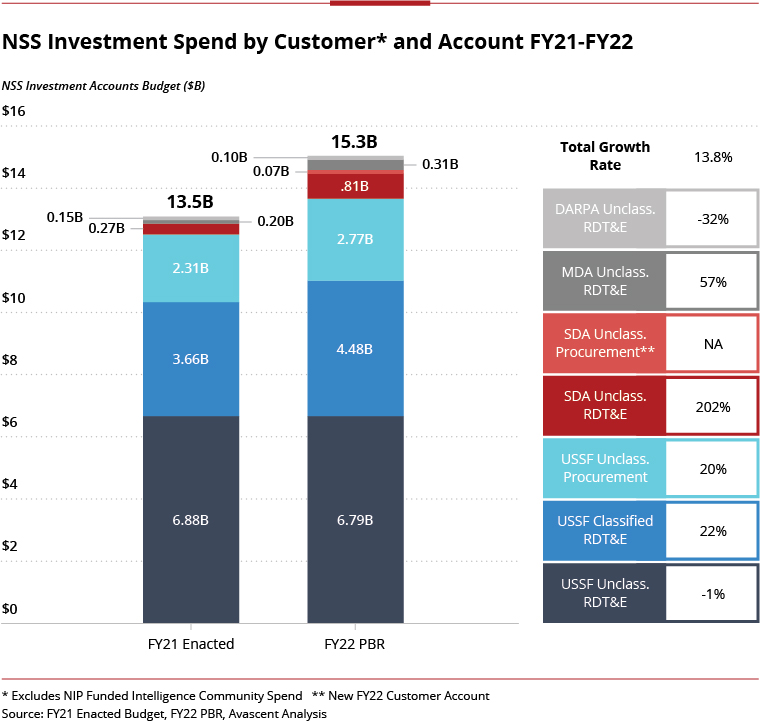

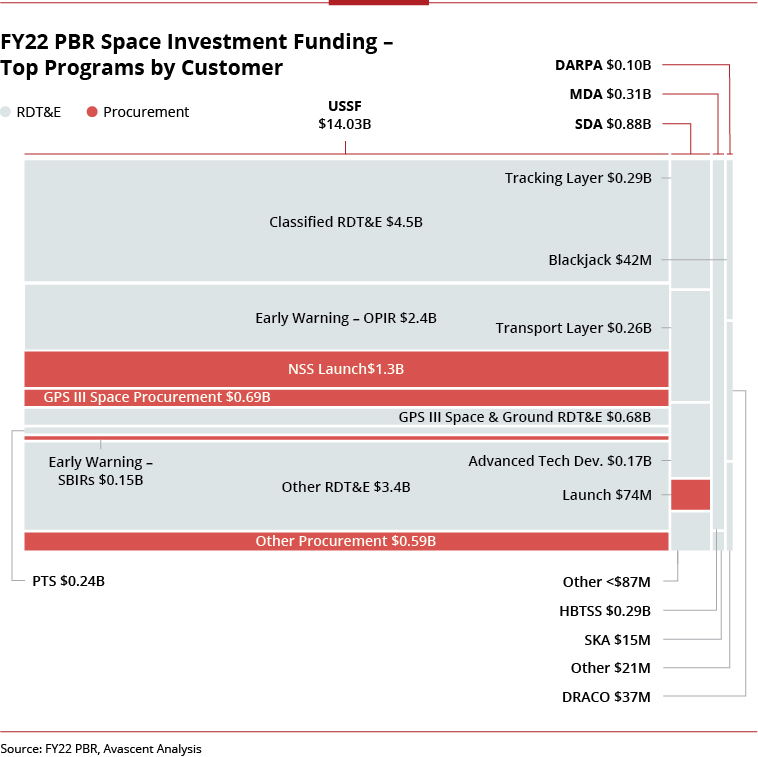

Within the FY22 PBR, National Security Space (NSS) was a clear “winner” amongst major investment accounts. FY22 national security space investment spending (Procurement and RDT&E) grew by 13.8%, compared to ~1% for the rest of DoD, and 6.7% for C4I, which showed the next highest rate of annual growth.

This continues a period of historically strong growth in space-related spending, with the segment growing 20.0% annually from FY17 to FY22, nearly double the next highest investment area.

Despite persistent calls from senior US Space Force (USSF) leaders to declassify a larger portion of NSS spend, classified accounts remained the single largest growth driver in the space sector, contributing about $817M (44%) of the $1.9B increase in national security space investment between FY21 and FY22.

With the Missile Defense Agency (MDA) and the Space Development Agency (SDA) both pursuing new LEO constellation development, these customers contributed the second largest portion of growth, with a combined $725M, or 39% of the total increase.

The bulk of new LEO funding will go towards SDA’s initial Tracking and Transport Layers, while MDA will apply its funding increases to Hypersonic and Ballistic Tracking Space Sensor (HBTSS) prototypes, and Space-based Kill Assessment sensors (SKA).

It is worth noting that this is the first time the PBR gave HBTSS funding to MDA. In prior years, Congress had unilaterally funded HBTSS and its predecessor, the Space Sensor Layer (SSL).

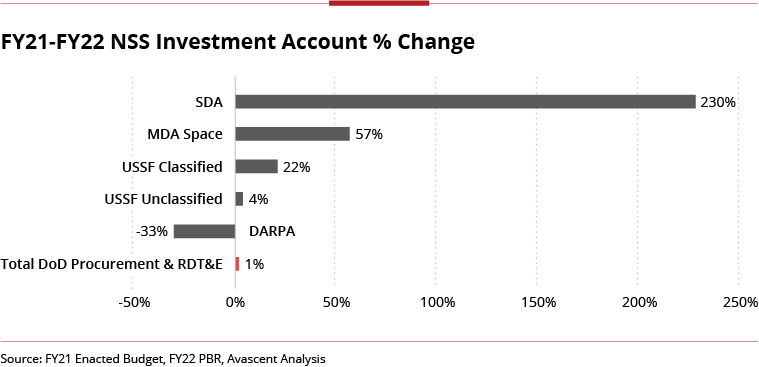

Amongst space customer investment accounts, the greatest growth took place within SDA (+230%), MDA Space (+57%) USSF classified RDT&E (+22%) and unclassified USSF procurement (20%).

The Space Force’s unclassified RDT&E budget experienced a marginal decline (-1%) likely due to a continued portfolio shift towards space superiority systems which tend to be classified. With the exception of DARPA’s space related funding, all NSS investment customer accounts dramatically outpaced aggregate DoD.

Increased funding for NSS activities spanned a wide array of projects, including a mix of major programs of record and other initiatives aimed at developing new technologies and concepts.

- Within USSF RDT&E accounts, OPIR Block 0, Protected Tactical SATCOM (PTS), and M-GPS user equipment received the lion’s share of unclassified funding, while Narrowband SATCOM (MUOS mods, Service Life Extension, and initial replacement studies) made its first budget appearance with a request of $112M;

- USSF Procurement funding is led by National Security Space Launch (NSSL), which received funding for the previously planned five launches in FY22; GPS III was the next largest recipient at $686M (complemented by an additional $678M for GPS III RDT&E);

- SDA spending is focused on Tranche zero for both Transport and Tracking layer development and provides funding for initial Transport Layer Tranche 1 investment;

- MDA would receive $292M to HBTSS and $15M for SKA;

- DARPA would receive $42M to continue its Blackjack development program.

While the FY22 PBR is merely the first offer in what will be a drawn-out negotiation with Congress, the lack of major surprises or course corrections suggests we are unlikely to see sweeping changes to the above request. If anything, given the threat environment and broad bipartisan support for space, a marginal topline increase could be possible in the final National Defense Authorization Act and in Defense Appropriations.

That being said, some potential areas to monitor are:

- HBTSS and Tracking Layer: Will Congress continue to fully fund both projects, despite their claimed complementary nature, or will Congress push the Space Force to consolidate the two?

- Evolved Strategic SATCOM (ESS): Funding more than doubled from $71M to $160M in FY22. Given the anticipated longevity of the AEHF constellation, Congress could choose to push ESS funding to the right in order to pay for other near-term priorities;

- National Security Space Launch: NSSL R&D funding has long been a contentious topic on the Hill. With the FY22 PBR proposing ~$66M less than the previous budget’s projections, this could be a plus-up candidate.

- Tactically Responsive Launch: In FY21 Congress added $15M to this project. The FY22 PBR zeroes out the program, which could be the beneficiary of another congressional add.

Subscribe to the Avascent Apogee

We invite you to subscribe to the Avascent Apogee – Insights delivered to your inbox on critical issues shaping the Space industry’s future.