Aerospace R&D (and ROI): Suppliers Need it Here’s How to Find It

In the months before the COVID-19 pandemic, the global aviation industry was just beginning to respond more seriously to mounting pressure to:

- Reduce emissions and noise,

- Improve fuel efficiency, and,

- Reduce its environmental impact.

Avascent analysis indicates that airline-driven environmental initiatives were three times higher in 2019 compared to the prior year, including examples such as:

- Sustainable fuel agreements,

- Investments in electric aircraft projects, or

- Reducing plastic consumption

While many of these were undoubtedly prioritizing publicity over impact, many major carriers like Air France, Qantas, Delta, and JetBlue still made serious pledges to cut net emissions growth. Others, like KLM, embraced the Swedish flygskam “flight shame” movement and urged its customers to fly less.

Fuel cost has and will remain the dominant motivator for airlines’ fleet considerations, and in turn, drive most aerospace R&D activity, but this newfound environmental awareness has increasingly motivated industry to target emissions as well – especially as the skies become increasingly congested with more aircraft each year.

Although air traffic growth is resilient in the long run, the pandemic has of course illustrated its short-term fragility. According to the latest International Civil Aviation Organization’s (ICAO) estimates, by the end of 2020, the airline industry is expected to see

- A 47% to 52% reduction in capacity, and

- $350 to $400 billion in lost operating revenue due to COVID-19.

Avascent’s air traffic forecast models estimate 2020 travel demand will fall nearly 60% below pre-pandemic predicted activity.

Aircraft emissions have inevitably declined while a large share of the global fleet has spent most of 2020 on the tarmac.

Yet now that demand for building and sustaining aircraft has plummeted, any temporary emissions benefits are far overshadowed by the more lasting financial losses occurring across the supply chain.

As suppliers now focus simply on survival, many have suspended self-funded innovative research that was poised to help usher in a variety of transformational efficiency initiatives underway for the next decade.

a good thing for the environment if we can use

this period to actually invest some money in

helping the industry get back but also put it

back in a more sustainable manner."

– Alan Newby,

Director of Aerospace Technology, Rolls Royce

However, despite the pandemic, an array of stakeholders remains interested in “green aviation;” in many ways, some now even seek to now accelerate its arrival.

As Rolls Royce Director of Aerospace Technology and Future Programs has stated, “There is general pressure from both the public and government to try and grow back greener.”[1]

The momentum behind these environmental initiatives speaks to the general importance of external aerospace R&D as a diversification path, especially during difficult industry downturns.

Fortunately, the groundswell of interest in low-emissions technologies is also directing attention toward other disruptive ideas that can transform the aviation sector.

Now more than ever, embracing this rapidly changing innovation environment offers more than just near-term financial relief: it will present opportunity to reshape suppliers’ roles for decades to come.

Rising Pressure: Why Aerospace R&D is Needed More than Ever

Aerospace technology investment has always focused on improving airline economics. Yet now, the flygskam movement, coupled with multiple global industry mandates, have highlighted the importance of pursuing innovations that can also reduce aviation’s environmental impact.

On the one hand, the International Air Transport Association has required airlines to stabilize, and eventually reduce net CO2 emissions by 50% by 2050, relative to 2005 levels.

Meanwhile, new ICAO rules require future aircraft designs to abide by a new CO2 emissions standard.

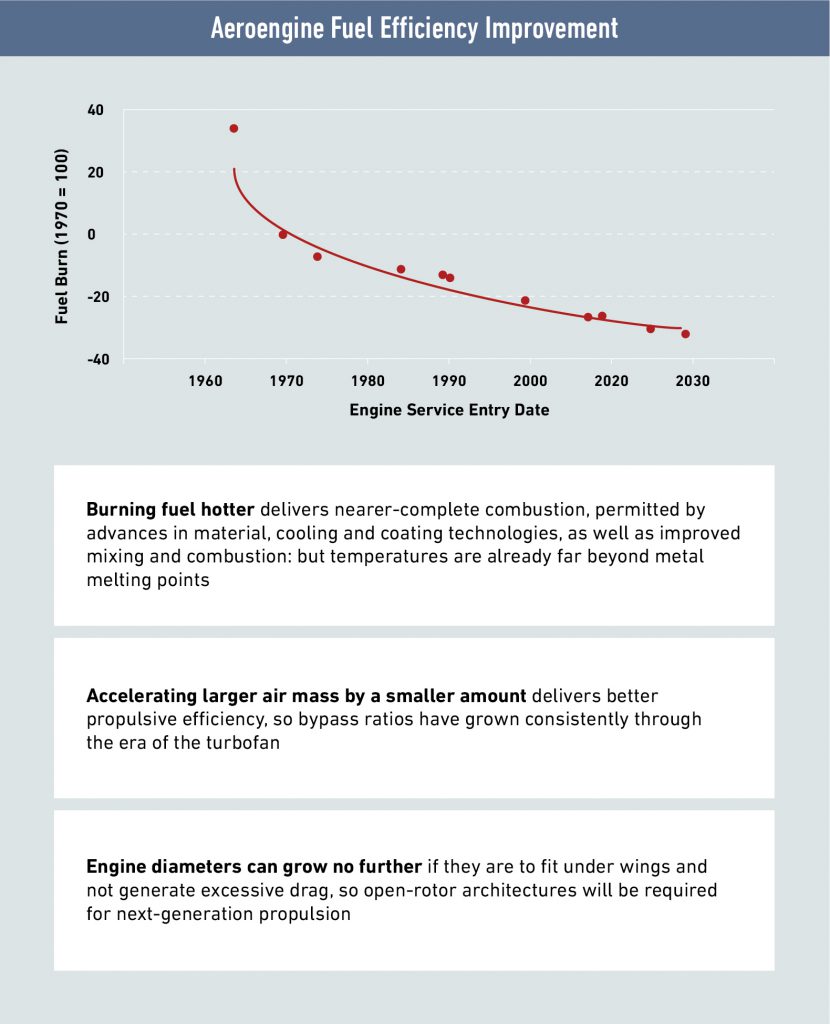

Translating these commitments into actions has always been a tall order. Conventional airplane and propulsion architectures are reaching their technological limits; that is, there is not much room for significant improvement within current paradigms.

Although adoption of new sustainable fuels holds promise, meaningful emissions reductions will only come through radical transformation of aircraft and engine designs, enabled by major improvements to a range of enabling technologies.

Exhibit 1: A flattening curve illustrates the limits of current propulsion architectures

Much of this required aerospace R&D– which is being pursued broadly, deeply, and aggressively by startups, large companies, and everything in-between – is ultimately targeting a reduction in the use of and reliance on kerosene fuel.

Most attention is directed to electrification architecture ideas such as all-electric, hybrid-electric, hydrogen, or some combination thereof.

Yet other aerospace R&D initiatives will play a role as well. Artificial intelligence and autonomous technologies are enhancing air traffic management solutions and increasing cockpit automation, both of which help promote optimized flight paths and airspace safety.

Rolls Royce’s 2019 acquisition of Siemens’ “eAircraft” business area typifies the momentum we see around electrification. On the autonomy front, it is notable that the FAA recently certified the Garmin Autoland, which allows the Piper M600 to land itself without a human at the controls.

Despite the promise of these types of advanced technologies, their direct application to large commercial aircraft (LCA) is far off.

Yet Boeing, Airbus, and other OEMs are reexamining their product policies for a battered, post-pandemic market, and are beginning to reconsider previous expectations regarding the maturity timelines for disruptive technologies.

“Where do we want to invest our scarce and precious dollars?” asks Pratt & Whitney President Christopher Calio. “Maybe we need to skip ahead to technologies that we thought were further away. This pandemic may actually [offer us an] opportunity to pull [technologies] forward.”[2]

This refreshing openness to rethinking innovation provides new opportunities for suppliers, but it remains difficult to predict, let alone gear up to supply OEMs with technologies they may neither want nor be able to implement.

As Rolls Royce’s Alan Newby points out, there are a lot of balls in the air: “You’ve got hybrid electric in the mix; you’ve got fuel cells, and you’ve got hydrogen. I think you’d be unwise to back one horse at the moment.”[3]

Therefore, suppliers must find ways to identify, prepare, and develop a range of technologies that the OEMs will eventually need, but with creative approaches that do not depend on significant internal investment.

Fortunately, external capital is available to fund this development and, in many cases, can deliver a financial return as those new technologies are applied to more attainable, near-term, non-LCA applications.

Filing a Flight Plan

Suppliers’ flight plans must work backwards by:

- Defining the aircraft OEMs’ end-goals for 2030 and beyond,

- Identifying the critical technologies that will be required to achieve them, and

Finding adjacent market steppingstones that will help fund the development of those capabilities – ideally while also providing near-term revenue.

Exhibit 2: Developing the Flight Plan

There are many areas where OEMs need new technologies to realize their efficiency and sustainability goals.

Batteries will have to store more energy in relation to their mass. Converters and switches that manage aircraft power must become more efficient and tolerate higher thermal loads. New image recognition sensors and algorithms are needed to enable more automated flight planning and navigation.

The long-term aerospace transformation vision is becoming clearer, with benefits that are easier to see – especially for elected officials holding purse strings to R&D funds.

Governments in developed countries generally regard aerospace R&D as critical infrastructure investment, and, with a clearly articulated green aviation mission, there has been greater impetus to offer financial support to protect the industry during the pandemic.

In June, France announced a $17 billion public-private support plan for its aerospace industry, emphasizing the development of a green jetliner to preserve jobs. Airbus’s ZEROe hydrogen and electric propulsion concept designs released just weeks later represent a step forward in this regard.

Meanwhile, Germany designed an almost $60 billion stimulus plan for investments in everything from artificial intelligence to wind power, including more than $1 billion for environmentally friendly aircraft.

To remain competitive on the world stage, the U.S. government is like to follow suit in some form.

External funding is not only coming from the public sector; venture capital companies are beginning to back many startups that aim to transform aerospace with zero-emission and autonomous aircraft, and these offer traditional suppliers a new avenue for near-term revenue generation.

Four Steps to Prepare an Effective Aerospace R&D Roadmap

These are difficult but not impossible times for the aerospace industry. Suppliers can take four steps to identify new lines of business and offset near-term losses, while still positioning themselves for future success as innovation leaders.

1. Prepare

In the new environment of feverish innovation and desperate economics, forecasting has become harder, yet more important than ever. Validating the credibility of both near- and long-term projects that span a wide range of competing designs will ensure that precious resources are allocated in accordance with the market’s likely trajectory.

For example, an electric power system provider seeking a key role on the next generation of single aisle aircraft must first establish a well-founded view of the most likely end-state architectural requirements.

With a myriad of theoretical options under consideration, including battery-electric, hybrid-electric, hydrogen fuel cell energy storage and direct hydrogen fuel burn, it is important to confirm the most viable long-term approaches across different future aircraft classes.

These inputs will ensure proper focus on the right customer needs that align with a company’s core capabilities – whether that be aspects like intelligent energy management solutions or high-strength hydrogen storage.

Similarly, an aerostructures manufacturer should begin to explore how more aerodynamic fuselage and wing concepts like Airbus’s “Wing of Tomorrow” or Boeing’s truss-braced wing could influence future airliner design.

More durable composite raw materials that are incorporated into faster, out-of-autoclave production methods exemplify where new focus is needed in anticipation of future airframe visions.

For an avionics developer, cockpit automation will continue to increase and inch closer to autonomous flight. In addition to flight operations efficiencies and safety considerations, expectations of a growing pilot shortage have stimulated much of this innovation to date.

Airbus recently completed two years of flight testing for its Autonomous Taxi, Take-off, and Landing project, and its expectations for more autonomy are high. “We certainly believe that the next generation of single-aisle aircraft will be single-pilot capable,” says Mark Cousin, the CEO of Acubed, Airbus’s Silicon Valley innovation incubator.[4]

Although a pilot shortage is a lesser concern in 2020 as COVID has forced thousands of pilots into early retirement, the shortfall will return with a vengeance as air traffic returns to its prior growth trend.

Avionics companies should be asking themselves where early implementation possibilities will exist, and on which enabling technologies they should place their bets.

2. Scout

With a more confident vision of the market’s evolution in mind, suppliers must next identify the specific enabling technologies that translate to viable products required by future customers.

- What semiconductor base materials will deliver the best performance for future power conversion needs?

- What liquid or air-cooling subsystem designs will optimize power subsystem weight and performance?

- How can artificial intelligence algorithms be used to optimize battery management and motor control?

These elements need to be mapped to a company’s internal capabilities to see what gaps may exist and if actions are needed to address them, either organically or inorganically.

Scanning the horizon also involves an assessment of what is already being developed, thereby ensuring a company is optimizing its contributions to specific challenges while avoiding duplicative efforts that waste time and resources.

seeking a future role in the industry must

be fully understood; many may bring competitive

technologies forward, while others will need

help navigating the technical and regulatory

hurdles of the aviation sector."

For example, it will be important to understand Raytheon Technologies’ explorations into high-power hybrid-electric drivetrains as part of its Project 804 demonstrator aircraft project.

Boeing, meanwhile, has not only has resumed internal development of flight controls, navigation, and networking technologies that it once had abandoned, but it has also invested in startups focused on a range of enabling innovations, including high-performance batteries and 3D printing of aircraft components.

Rolls Royce is leading a project to build the world’s fastest all-electric aircraft as part of its testing and maturation of propulsion technologies.

These example activities from traditional aerospace OEMs will not necessarily preclude other suppliers from similar pursuits, as many projects will in fact necessitate external supplier support.

But it does warrant careful analysis of where there may be competitive overlap.

Furthermore, the startups and non-traditional players seeking a future role in the industry must be fully understood; many may bring competitive technologies forward, while others will need help navigating the technical and regulatory hurdles of the aviation sector.

Hyundai, for example, is investing $1.5 billion into Urban Air Mobility over the next five years, to build not only new aircraft but an unprecedented mobility environment.

Hyundai will naturally bring valuable automotive capabilities to the table, such as batteries and motors, but it has no experience building other aircraft systems or with integration – which could create a beneficial partnership opportunity for the right suppliers.

3. Pursue

Once aerospace firms have identified relevant and critical technologies and better understand the competitive dynamics, they must identify how innovation requirements can translate into tangible products or capability demonstrations.

There is an overwhelming array of options within the public sector alone where aerospace R&D activities can formalize innovation.

This includes more well-known aerospace-relevant agencies like the FAA, NASA, and DoD, but Department of Energy (DOE), the Environmental Protection Agency (EPA), and private university projects can be just as fruitful.

The Advanced Research Projects Agency – Energy (ARPA-E) within DOE, for instance, awarded $33M in August 2020 to 17 different corporations and universities that are investigating all-electric powertrains and advanced thermal management solutions for net-zero emission aircraft.

The international equivalents of these U.S. research agencies are just as meaningful, if not more so, as they are now benefitting from a recent influx of government stimulus funding.

Venture-backed startups can also help traditional suppliers. For one, startups’ aircraft prototypes can serve as a new potential revenue stream and offer unparalleled insights into the new field of disruptive aerospace OEMs.

Should suppliers’ financial positions allow, they can look to acquisitions or investments in the startup community that fill key capability gaps.

The aforementioned “scouting” analysis will tend to reveal a host of candidates that can advance strategic goals.

Examples of this include Honeywell’s partnership and investment in artificial intelligence specialist Daedalean.AI, or Moog’s acquisition of SureFly’s eVTOL operation.

In other cases, a technology license agreement may be a highly beneficial, non-traditional approach. For example, Prometheus Labs secured a technology license in September 2020 for an ethanol-to-jet-fuel conversion process developed by researchers at the Department of Energy’s Oak Ridge National Labs.

It is critical that the pursuit of these various opportunities be tracked along vectors of time, capabilities, and on-ramp options, and across funding avenues: market (both civil and governmental), segment, and market application. The message? Don’t restrict yourself.

4. Implement

Although casting a broad net is needed to understand the full market environment, prioritization is still essential, and should be influenced by a careful evaluation of the capability alignments, competitive threats, timing, intellectual property (IP) dynamics, and relationship-building benefits that influence each opportunity’s ROI.

If a company chooses wisely, it can reap multiple benefits with a small number of pursuits: for example, DARPA-sponsored research into high-rate, single structure composite manufacturing is highly transferrable for future airliners that will need more aerodynamic configurations produced in a faster amount of time.

These same capabilities can also support emerging short-range aircraft OEMs, whose business cases may depend on high volume, low-cost production.

Building a stable of exploratory partnerships can be just as meaningful.

For instance, engine component manufacturer MTU is working with German research organization DLR to pursue hydrogen fuel cell R&D, while Embraer’s innovation unit, EmbraerX, is exploring cargo VTOL aircraft opportunities with startup Elroy Air.

Memorandums of Understanding are becoming increasingly popular ways for diverse companies to collaborate and stay abreast of the rapidly changing technology landscape.

As suppliers finalize their roadmaps, final bets must still be sure to account for IP rules, which will vary widely across each customer group and heavily influence an aerospace R&D strategy.

For instance, Department of Defense entities are increasingly allowing industry to retain critical IP, but careful analysis of these guidelines is warranted on a case-by-case basis.

New Trajectories

“Why are we doing this now in a crisis?” stated Grazia Vittadini, the Airbus Chief Technology Officer at the ZEROe hydrogen aircraft announcement event in September 2020. “We do not have a choice.”[5]

It is a truth widely acknowledged that companies that invest in R&D wisely during a downturn prosper when conditions improve.

A 1995 study published in Research Technology Management compared R&D spending over two recessions and found that “companies that invest heavily in R&D continue to grow while competitors with modest investment suffer sales decline” regardless of company size, type of ownership, or market structure.

Investing wisely, however, does not mean going it alone, or self-funding. As we have seen, there are multiple sources of new investment capital looking to drive collaborative, multi-stakeholder innovations that improve:

- Aircraft efficiency,

- Reduce carbon emissions, and

- Unlock new urban and regional aviation markets.

Maximizing the return on these aerospace R&D investments depends on placing smart, informed bets on technologies that can be applied broadly across future aircraft architectures – both for the benefit of airlines’ bottom lines, as well as for governments’ and passengers’ environmental ambitions.

“You’re seeing a lot of stimulus packages for the industry, not just more of the same, but looking at different ways of growing back in a sustainable manner,” says Alan Newby, Rolls Royce director of aerospace technology.[6]

Every aerospace supplier’s priority in 2020 is to stay afloat. But it will also be critical to retain institutional knowledge through this downturn, not only because it is costly and difficult to reacquire lost talent, but also to be ready to compete for future opportunities.

Traditional and emerging markets are both predicted to be enormous; Avascent estimates that single-aisle aircraft deliveries will exceed $2 trillion between 2030-2040, while Morgan Stanley expects that the Urban Air Mobility market alone will reach $1.5 trillion a year by 2040.

Despite the current challenges, aerospace suppliers must strive to proceed along two essential and mutually reinforcing flight paths: investing in aerospace R&D where appropriate and designing those investments for a rapid and much-needed ROI.

[1] Aviation Week, “Generation Jumpstart,” August 31 – September 15, 2020

[2] Ibid. “Generation Jumpstart.”

[3] Ibid. “Generation Jumpstart.”

[4] FlightGlobal, “Acubed works toward single-pilot A320 replacement, begins autonomy development flights,” August 28, 2020.

[5] AIN, “Airbus commits to hydrogen airlines entering service in 2035,” September 21, 2020.

[6] Op. cit., Aviation Week, “Generation Jumpstart.”