Dynamics of International Military Modernization

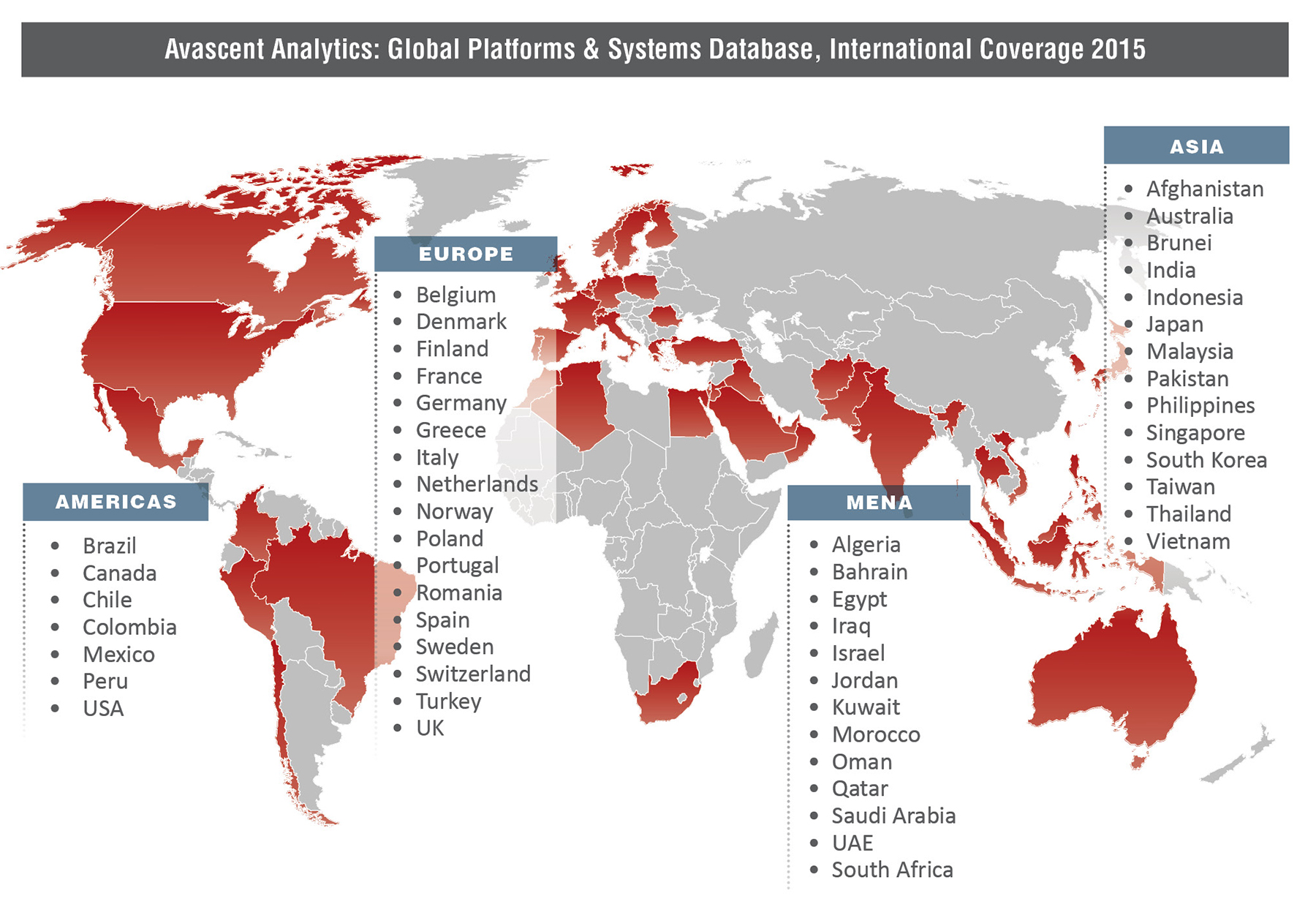

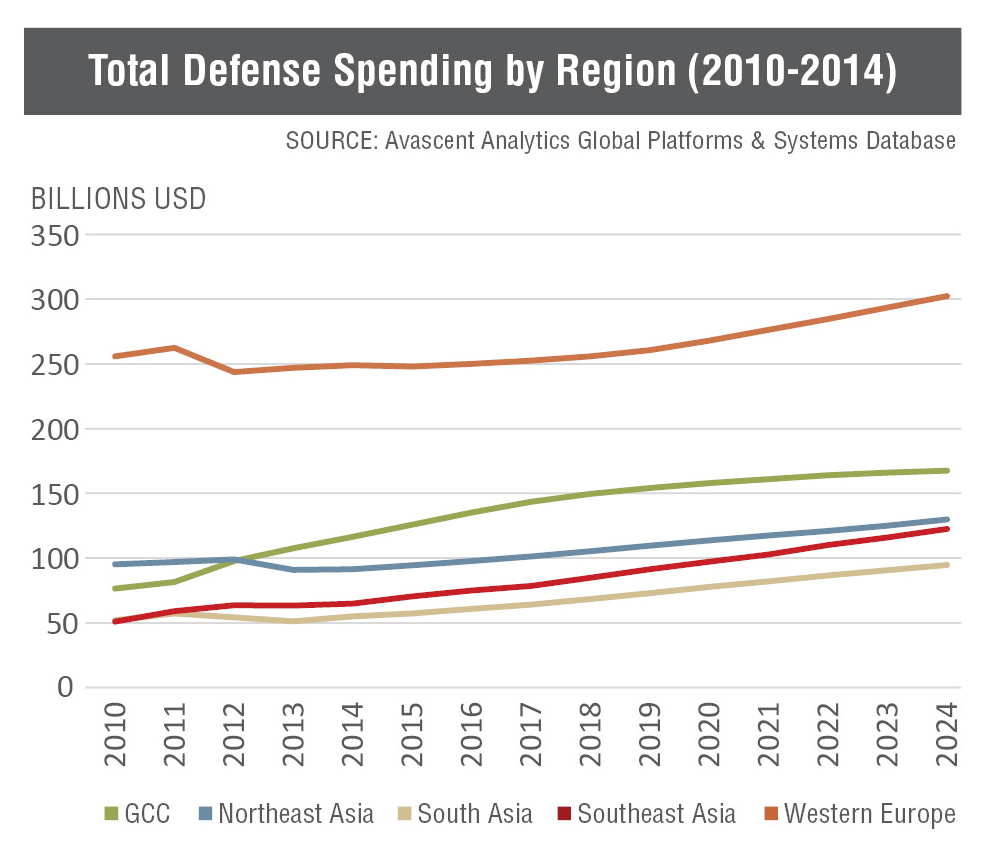

Avascent Analytics analyzes the defense spending of the United States plus 50 other countries in its Global Platforms and Systems (GPS) database, which covers approximately 95% of international defense spending accessible to Western defense suppliers. The database is composed of ongoing programs, announced competitions and planned future acquisitions, as well as Avascent Analytics’ projections of future requirements. Projections are based on both top-down and bottom-up analysis that considers multiple factors, including economic indicators, threat perceptions, mission area gaps, historical investment behavior, industrial base and political considerations. The database does not include data on non-accessible defense markets such as China, Russia, and Iran.

Executive Summary

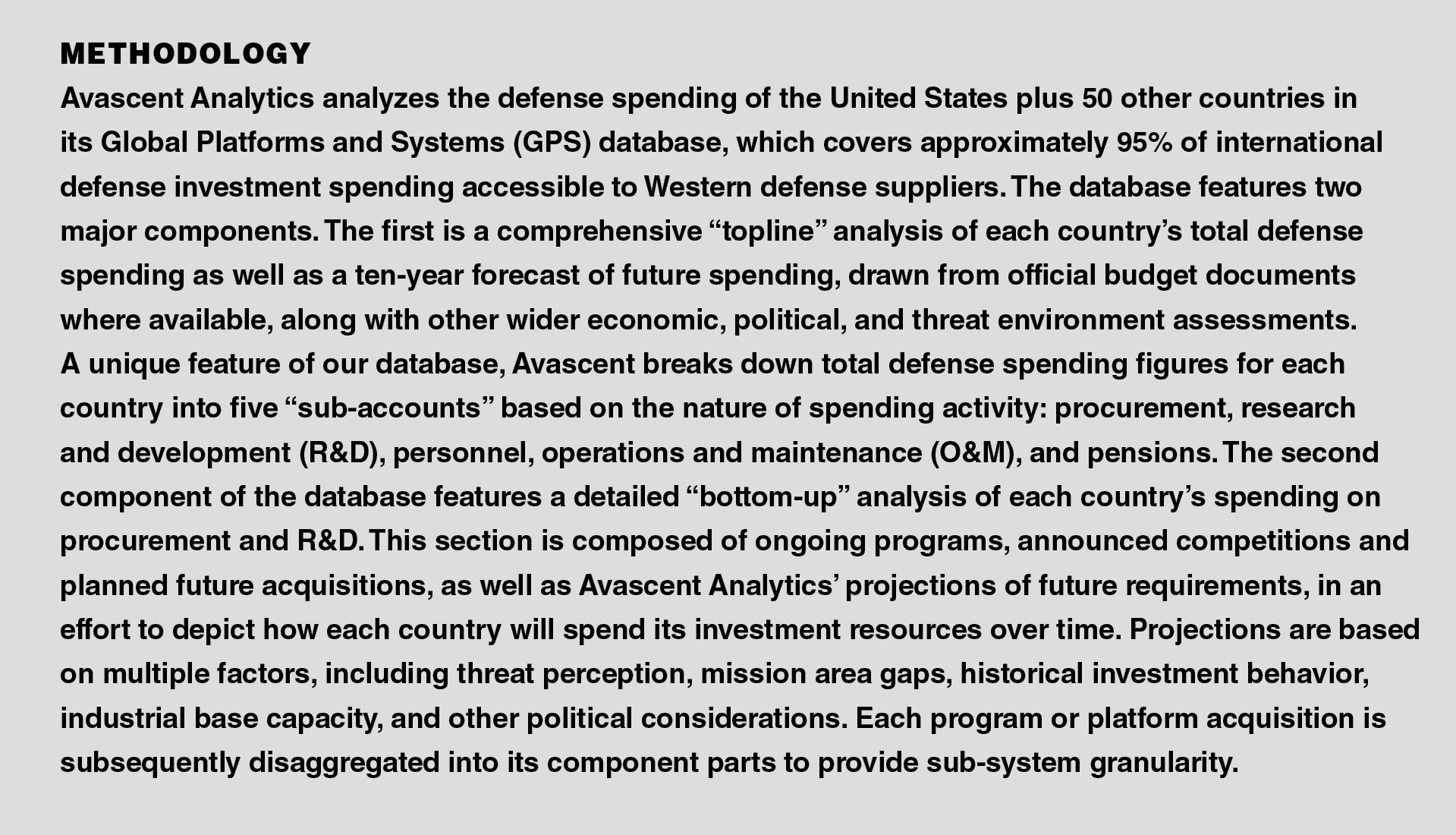

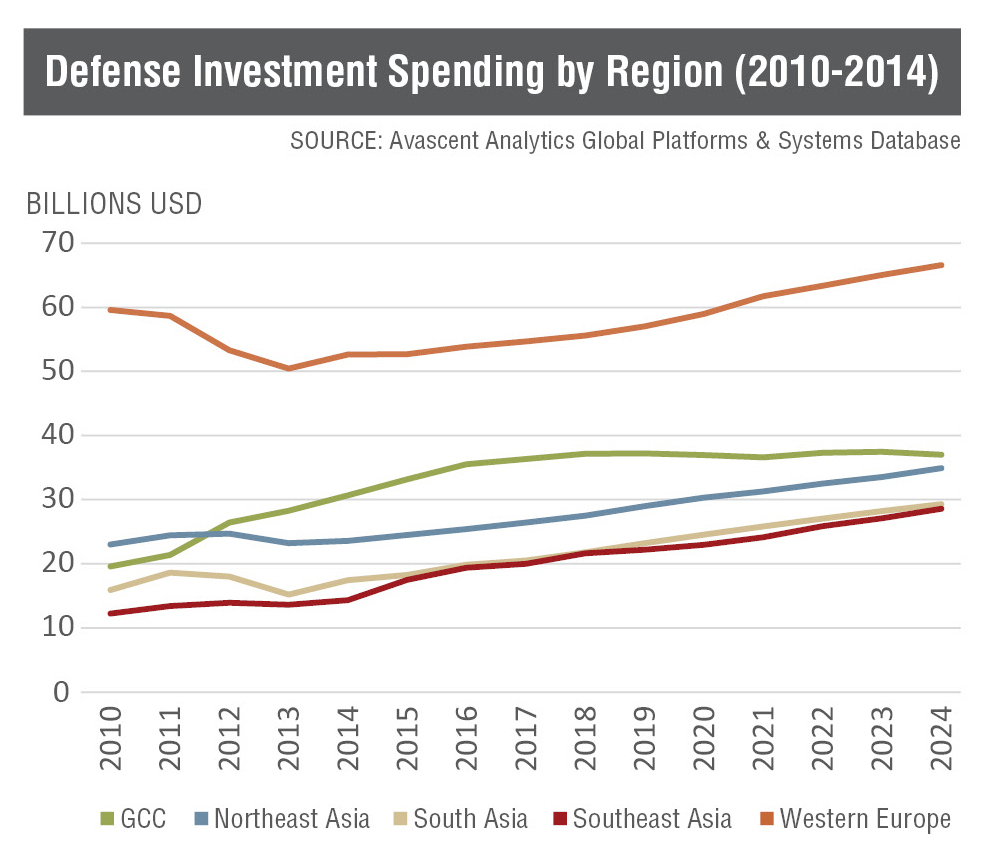

The pattern of international defense spending is rapidly changing as emerging defense markets in the developing world catch up with more mature, established markets. On one hand, large defense markets in Western Europe and Northeast Asia have cooled considerably over the past five years and, though expected to be stable, will experience low growth rates over the next ten years. On the other hand, emerging markets in the Middle East, South Asia and Southeast Asia have experienced impressive growth over the recent past and are expected to maintain strong defense spending over the coming decade. In particular, defense spending among countries comprising the Gulf Cooperation Council (GCC) have surpassed more mature markets in Northeast Asia to become the largest source of international defense spending1 accessible to Western suppliers outside Western Europe and the United States, a position it is expected to retain through Avascent’s ten-year forecast window.

This trend will provide new challenges and opportunities for Western defense firms. It will demand deeper understanding of specific market dynamics and customer requirements in order to remain internationally competitive. Markets in South and Southeast Asia (and, to some extent, the GCC) are characterized by a sustained effort to develop a domestic defense industry capable of indigenously satisfying growing defense needs. However, the sustained demand for complex defense systems and platforms will require close collaboration with foreign firms. These market dynamics will present Western defense suppliers with significant opportunities for expansion, especially if co-operation with local defense industry is strategically pursued to gain better access to emerging defense markets.

Introduction

This paper is divided into three sections below. First, we discuss the overall defense spending patterns by region and offer forecasts for each of those regions over the next ten years2. Additionally in this section, we analyze trends in the allocation of defense budgets to investment, operations, personnel and other costs3. These proportions tend to differ widely between mature and developing markets. From there, the paper explores specific trends in investment-related categories. We provide an overview of how trends in supplier relationships in each region are likely to change in the coming years, considering projected requirements and shifts in geopolitical landscape. Finally, we examine market trends for specific platform categories and project growth opportunities for each category over the next ten years. It should be noted that, for the sake of brevity, this paper provides analysis primarily for Western Europe, Northeast Asia, the GCC (distinct from the broader Middle East region), Southeast Asia, and South Asia, which we consider the major, trend-setting accessible international defense markets in the world4. It should also be noted that this paper focuses primarily on analyzing accessible defense investment spending in each region (namely, procurement spending), at the expense of equally significant accessible spending on sustainment and other outsourced services. Avascent will address these areas in a future white paper.

Regional Topline Trends

Western Europe and Northeast Asia experience modest growth, lose ground to emerging markets

Despite a long period of stagnation in European defense spending, Western Europe5 will remain the largest accessible market outside the United States for the foreseeable future. However, the region has been and will remain one of the slowest growing markets through Avascent’s ten-year forecast window. Over the past five years, total defense spending in the region shrank by 2.7%. Defense investment accounts were hit even harder by austerity measures, declining by 11.7% since 2010. The IMF projects a long, but subdued recovery over the next ten years as negative fiscal and economic pressures persist in the region. As a result, over the 2015-2024 period, we forecast defense spending to grow by no more than 2% per year, and defense investment by 2.4% per year. Over the same period, the proportion of defense spending allocated to personnel is expected to decline from 39% to 37% as end-strength shrinks, while O&M is likely to grow from 28% to 29% of total defense spending, reflecting the increasing costs of even a smaller force. While it is possible that the increase in Russian assertiveness could prompt higher levels of spending in the future, Avascent does not believe it will have a noticeable effect on spending patterns in the near-term unless tensions escalate significantly and force the region into a longer-term military build-up.

The trajectory of defense spending in Northeast Asia6 is similar to that of Western Europe. Despite China’s military rise, the combined defense spending of Japan, South Korea, and Taiwan has experienced a decline of 4.2% over the past five years. However, we expect recovery in the near future as regional threat perceptions and budgetary allocations begin to align; Avascent projects defense spending in Northeast Asia to grow by 3.4% per year over the next ten years. Most of the recovery will come from defense investment accounts, which will grow by 3.6% over 2015-2024, while the share of defense spending allocated to non-investment activities will slightly decrease: spending on personnel will shrink from 42% to 40% and O&M will remain steady.

Much of the recent decline in regional spending can be attributed to lackluster Japanese performance, a consequence of the country’s protracted economic woes. Strong rhetoric from the country’s new political leadership notwithstanding, defense spending in Japan will remain subdued over the next decade and will grow by 1.6% a year over the period. Considerable publicity has been given to Japan’s supposed “largest ever defense budget” in 2015, but this headline must be taken in context. Between 2005 and 2012, Japan decreased its defense spending each year. Tokyo approved a JPY 4.9 trillion defense budget for the fiscal year 2015, only fractionally larger than the “trough” of JPY 4.6 trillion in 2012 and the “peak” of JPY 4.83 trillion in 2005. Additionally, significant exchange rate fluctuations between the Japanese Yen and US Dollar over the past five years have eroded the JSDF’s purchasing power, particularly for foreign equipment. Japan’s defense budget for 2015 is the equivalent to USD 48 billion at current-year exchange rates. Even in 2012, however, more favorable rates meant that Japan could spend USD 58 billion on defense despite its “smallest” defense budget in ten years.

In contrast, defense spending in Taiwan and South Korea has increased over the past five years, and is expected to continue steadily growing. South Korea in particular, given its relatively healthy economy and persistent North Korean belligerence, will drive the region’s defense spending over the next ten years at a 4.9% average annual growth rate.

Defense spending in the Gulf countries overtakes that of Northeast Asia; growth to slow after procurement spurt

Over the past five years, the GCC surpassed Northeast Asia as the largest accessible defense market outside Western Europe and the United States.

One of the most noteworthy international topline trends is the rise of defense spending among the member countries of the Gulf Cooperation Council (GCC).7 The aggregate defense spending in the GCC has grown at a conspicuous 8.8% yearly rate over the past five years. This has propelled the GCC past Northeast Asia as the largest accessible defense market outside Western Europe and the United State. However, Avascent expects the growth of defense investment to cool to a 1.1% annual rate over the next ten years, given the cyclical nature of procurement spurts in the region. Simultaneously, we expect regional allocation to O&M accounts to increase steadily, as newly acquired systems come online and the cost of maintaining them increases. On average, GCC countries allocated just 27% of defense spending to O&M in 2014; Avascent forecasts this number to grow to 36% of by 2024.

These trends largely pre-date the outbreak of conflict in Iraq and Syria and subsequent rise of ISIS, as well as the decline in oil prices in the latter half of 2014. Neither factor is likely to significantly alter current spending levels in the near-term . However, the persistence of low oil prices will inevitably result in longer-term pressure on budgets. Conversely, an escalation of regional or international involvement in Iraq and Syria will probably further stimulate spending in the out-years.

Defense spending in Southeast Asia grows at a steady rate, eclipses South Asia

Southeast Asia8 will likely experience the strongest growth in accessible defense spending over the 2015-2024 period. In 2010, the region trailed Western Europe, Northeast Asia, the GCC, and South Asia in total defense spending. By 2011, however, its collective expenditures had surpassed South Asia’s, and growth is expected to continue at a 5.7% annual rate over the next ten years. This projected increase will take it closer to spending levels in Northeast Asia. Significantly, Southeast Asia’s higher-than-average allocation for personnel and O&M accounts (close to 70% of total defense spending) will continue to crowd out outlays on procurement and R&D. Ballooning operating costs and salaries notwithstanding, we still expect defense investment in Southeast Asia to increase by 5% per year over the next ten years, the fastest growth rate among accessible international defense markets.

Defense spending in South Asia9 grew at a lackluster 1.2% annual rate over the past five years. However, recent spending figures for India, the region’s defense and economic powerhouse, can be somewhat misleading. Like Japan, India also experienced significant exchange rate fluctuations over the past ten years – the Rupee (INR) depreciated 40% against the US Dollar (USD) between 2005 and 2014. Between 2010 and 2014, Delhi actually increased defense spending by 7.5% per year when measured by local currency. Nevertheless, because of India’s still-substantial dependence on foreign defense imports, the rupee’s precipitous decline undermined much of that country’s purchasing power. This weakening, combined with the country’s bureaucratic indecisiveness and high-profile industry limitations, further hamstrung the Indian armed forces’ ability to fully equip and modernize its forces in recent years.

Avascent expects the sub-continent’s defense spending to accelerate over the next ten years, expanding at an average 5.2% per year through 2024, on the basis of a relatively stable exchange rate. Defense investment in the region, after growing just 1.9% per year over the past five years, will also be on the uptick and increase 4.8% per year through the remainder of our forecast window. Allocation to personnel accounts will remain steady at around 29% of total defense spending, while O&M’s share of defense dollars will grow over time from 29% in 2014 to 33% in 2024. Should exchange rates fail to stabilize, however, this forecast will naturally require adjustment.

Defense Suppliers in Emerging Markets

Demand for complex platforms in emerging markets creates opportunities for Western defense suppliers despite push for indigenization

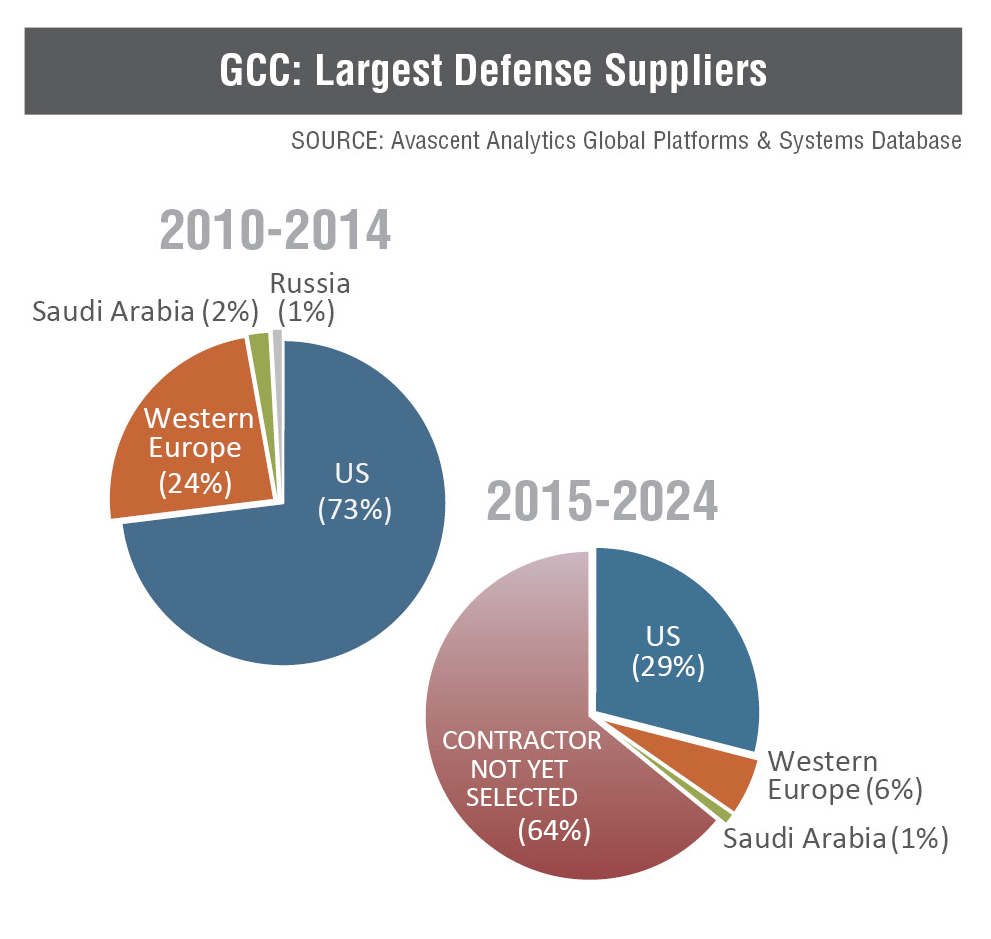

Foreign suppliers will remain dominant players in the GCC as countries seek increasingly sophisticated platforms that domestic industry cannot provide.

International defense markets are a complex and competitive landscape composed of many private firms and governmental players. US firms have the leading position in this market, especially among emerging markets. However, US-based defense suppliers are experiencing increasing competition from European, Israeli, Russian, and Chinese defense firms. Suppliers from these countries have sophisticated and competitive offerings to match growing demand among modernizing militaries. They are also well positioned to take advantage of shifting political dynamics, including friction between the United States and some of its allies and partners, increased importance of sensitive technology transfers, and China’s emergence as a competitive international defense supplier.

Mature markets in Western Europe and Northeast Asia have tended to be served by established, locally entrenched domestic defense suppliers that generally capture a large portion of available defense investment. While these mature markets will continue to offer major competitive opportunities over the next ten years, many opportunities will be found in fast-growing emerging markets which have less well-developed industrial capacity to fulfill the requirements of rapidly expanding militaries. A growing share of revenues for most Western defense suppliers will come from these emerging markets.

For example, the GCC overwhelmingly imports its defense systems from abroad: 95% of all known awarded contracts for defense systems between 2010 and 2014 were awarded to foreign companies. US-based defense firms won about 59% of those competitions. Foreign suppliers will remain dominant players in this region as GCC countries look to acquire increasingly sophisticated platforms that domestic industry cannot provide. And while some countries in the region have been sponsoring the development of domestic defense industrial capabilities, these will remain largely unable to play a decisive role in high-end systems, like combat aircraft, missile defense, and naval systems.

Southeast Asia also derived much of its defense hardware from imports over the past five years (88% of new acquisitions between 2010 and 2014). US-based defense manufacturers were again the leading suppliers in the region, with Russia a distant second (43.5% and 13% of all known awarded contracts, respectively). In the out-years, South Korean companies will become a sizeable source of defense materiel for Southeast Asian militaries, as the Korean defense industry matures and economic and diplomatic ties with the region increase. Avascent similarly expects Indonesia’s defense industry to develop reasonably quickly over the next ten years and bolster the region’s nascent indigenous production capacity. While the share of foreign-supplied defense systems in the region will likely decline as a result of government emphasis on localizing production, opportunities for defense-industrial cooperation are also bound to increase in this fast-growing market in the coming years. China, currently a negligible factor in Southeast Asian defense markets, may also become an increasingly competitive player as well, as Beijing’s state-financed defense industry becomes internationally competitive and capable of offering viable alternatives to more established foreign suppliers in the region.

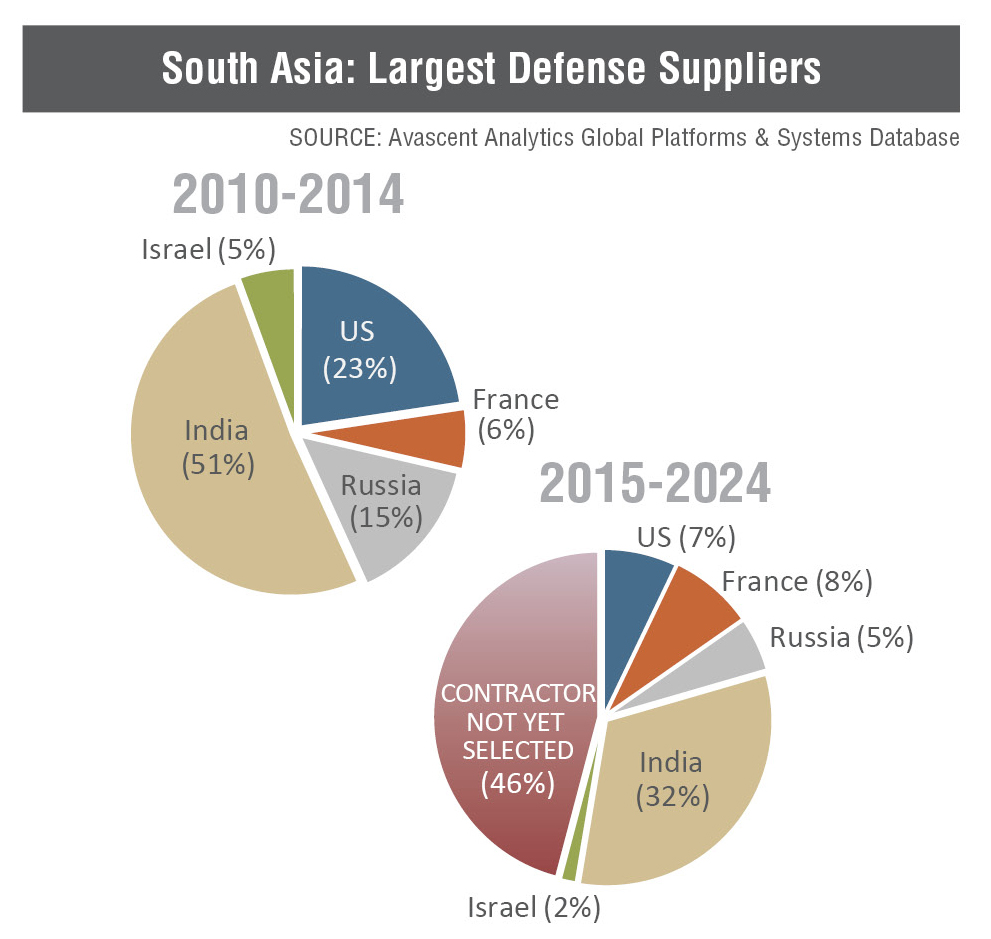

In South Asia, regional tensions with broad geopolitical underpinnings will continue to dictate the dynamics of defense procurement. Pakistan and Afghanistan will both continue to draw US military aid. Islamabad will also seek to deepen its strategic partnership with China, a relationship that has already delivered such high-profile platforms as the JF-17 fighters and attack submarines. India’s emphasis on developing an indigenous defense industry will naturally squeeze foreign suppliers’ market share over the next ten years. Delhi, however, will still depend heavily on cooperation with foreign contractors to support this effort. As a result, India will continue to solicit international competitions for its major acquisition programs, with increasingly stringent technology transfer and other offsets requirements. India has diversified its source of weapons imports over the past ten years, shifting gradually from its near-total reliance on Russian suppliers to a mixed portfolio including major US, Israeli, and Western European firms. Given the scope and size of many of India’s acquisition programs, however, any single procurement competition carries with it the potential to alter market share. For instance, if India goes forward with its currently stalled Sukhoi/HAL Fifth-Generation Fighter Aircraft (FGFA) program, Russia’s share of the Indian defense market would be revived. Likewise, Europe’s share of India’s defense market would also experience a boost if France’s deal to provide 126 Rafale fighter aircraft from Dassault Aviation succeeds. In other words, India’s defense investment accounts will likely remain open for Western suppliers in the years to come. Yet while patience is a virtue in virtually all international defense markets, it will be even more so in India given that country’s history of squeezing maximum concessions from foreign suppliers and notoriously slow acquisition process.

Shifts in Capability Requirements

Strong international demand for maritime platforms

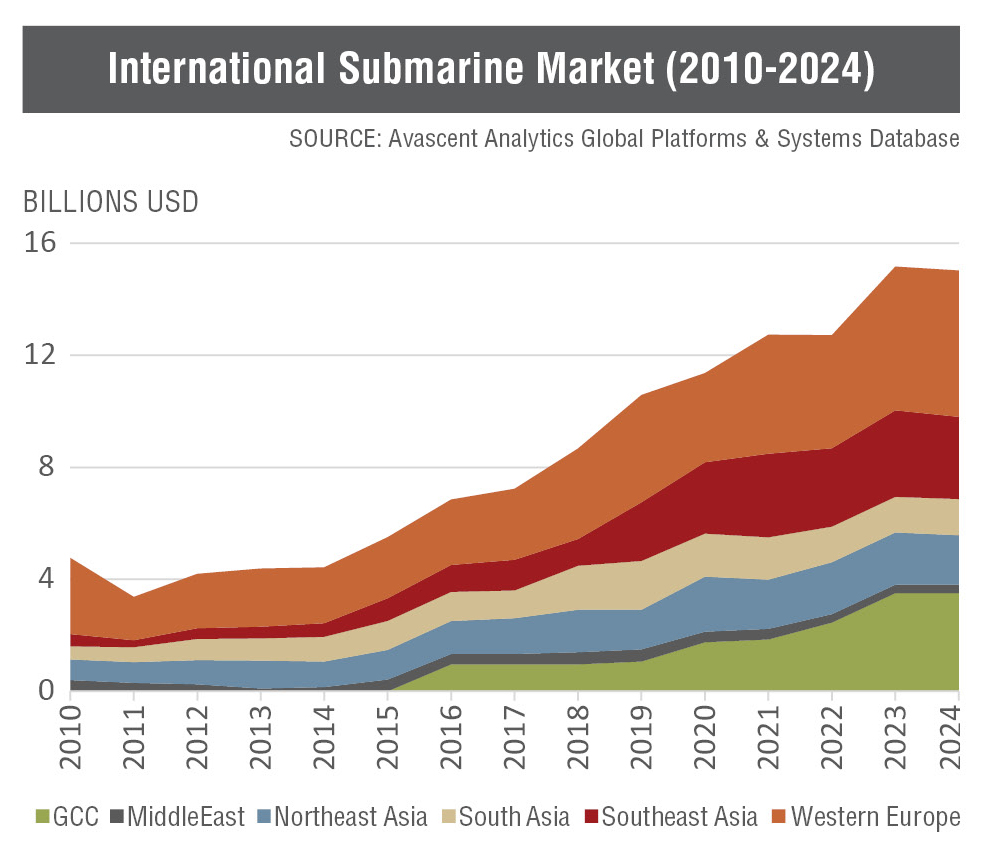

Avascent anticipates the demand for maritime platforms and systems to increase considerably over the next ten years. We expect the market for submarines and related systems to be especially strong in the coming decade, growing at a 10.5% annual rate through 2024. After collectively spending $24 billion over the past five years on submarines, international customers will likely allocate an additional $44 billion over the next five years, and $118.5 billion over the next ten years. Western Europe, despite looming fiscal constraints, is expected to drive demand in the market, doubling its annual spending on submarines between 2015 and 2024. Many European countries have chosen to prioritize undersea warfare for another generation even in the face of shrinking budgets, providing funding for a new series of submarines at the expense of other capabilities. France (Barracuda-class), Britain (Astute-class and Vanguard-class replacement), and a coalition of Northern European countries (pooled together to reduce individual participants’ development and production costs) will each invest in a new class of attack submarines over the next ten years.

Southeast Asia will likely be the next biggest submarine market – we expect the region’s allocation for sub-surface vessels to grow by 13.7% per year over the 2015-2024 period. Indonesia’s procurement of Chang Bogo-class submarines and Australia’s eventual Collins-class replacements will be the most prominent programs. The GCC is expected to increase spending on submarines in the out-years, as several countries have expressed interest in the platforms as part of a major regional naval expansion effort in the region. It should be noted, however, that GCC spending on submarines is very much notional, given the limited capacity of countries in the region to absorb and operate such platforms.

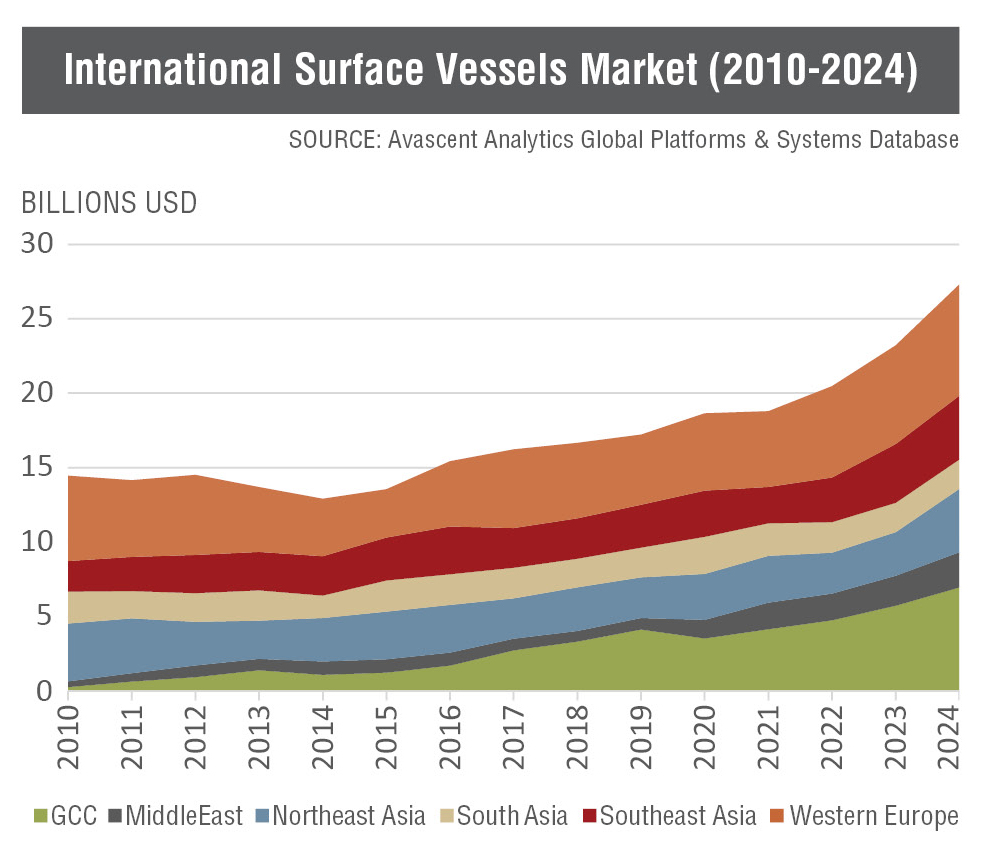

The accessible international surface vessels market struggled over the past five years, as the traditional big spenders in Western Europe (-8% per year), Northeast Asia (-5.5% per year) and South Asia (-7% per year) reduced spending on surface combatants and support vessels between 2010 and 2014. However, Avascent anticipates the market to rebound strongly over the next ten years, growing by 7.4% per year. In particular, Avascent expects the GCC to triple their annual allocation for surface vessels and associated equipment between 2015 and 2019, fulfilling regional ambitions for naval expansion.

Western Europe, after a brief hiatus following the conclusion of its most recent fleet modernization projects, could also embark on major surface vessel acquisitions programs in the near future. If the British and French carry out their plans to construct new aircraft carriers within Avascent’s forecast window, region-wide expenditures on surface vessels could grow by 8.7% per year over the next ten years.

Surface vessel spending in Asia is also expected to rise over the next ten years, though it will likely come in spurts and differ from country to country. Japan and Australia will both reduce spending on surface vessels until the middle of the next decade, as both countries have recently completed major naval acquisition programs (the Akizuki-class and Atago-class destroyer projects, and the Hobart-class destroyer and second Canberra-class LHD projects).

On the other hand, spending on surface vessels in South Korea and in Southeast Asia as whole will increase markedly through the next ten years. For Southeast Asia in particular, much of the growth will be driven by persistent piracy threats to commercial sea lanes as well as assertive Chinese maritime territorial claims. Over the next ten years, the navies (and coast guards) of Indonesia, Malaysia, Singapore, Thailand, and Vietnam will each induct large numbers of small surface combatants (e.g., frigates and corvettes) and patrol vessels (both littoral and ocean-going) to enhance maritime presence and control capabilities. Avascent expects Southeast Asia to overtake Northeast Asia in surface vessel spending by 2019.

Southeast Asian countries are expected to induct large numbers of frigates, corvettes, and patrol vessels over the next ten years.

Likewise, South Asia is also expected to maintain a high, steady level of spending on surface vessels over the next ten years. India especially will continue to spend on upgrades to its blue-water maritime capabilities, in particular through an ambitious (though likely protracted) aircraft carrier acquisition program, as it seeks to assert its presence in the Indian Ocean in the face of growing Chinese encroachment.

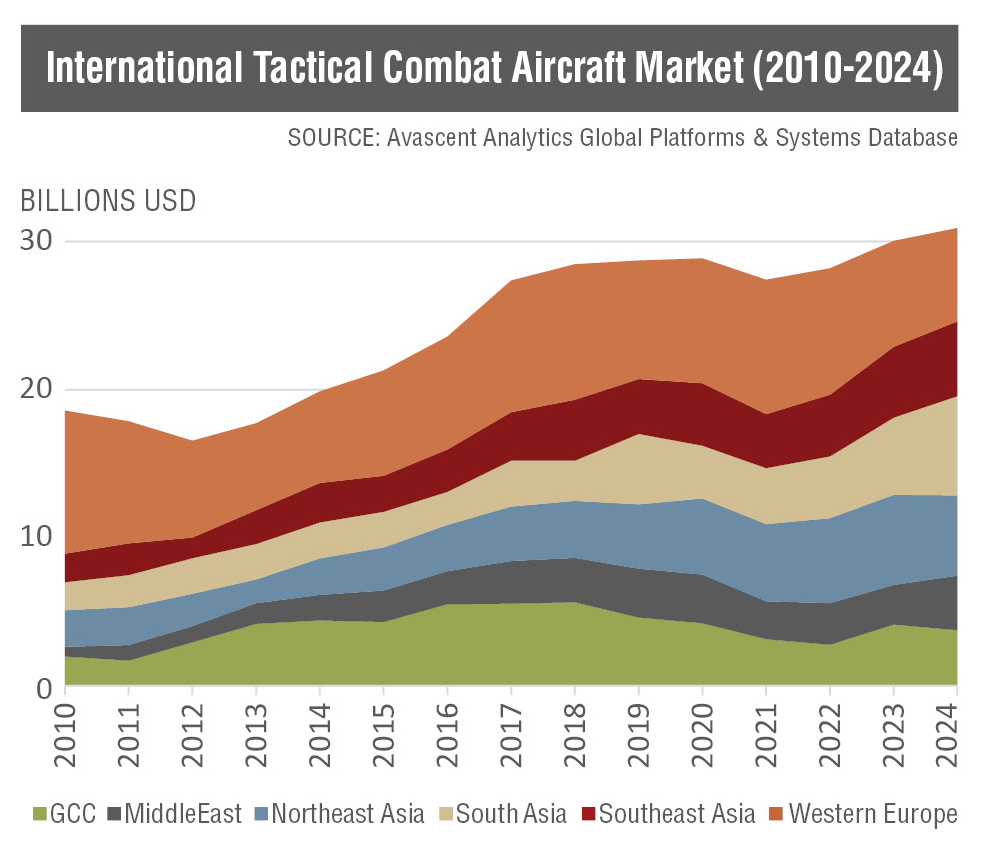

Airborne platforms command the lion’s share of defense investment with fixed-wing and UAS platforms growing; utility rotorcraft to underpin cyclical attack helicopter market

The GCC and Southeast Asia leapfrogged Northeast Asia over the past five years to become the biggest spenders on combat aircraft outside Western Europe and the United States. Saudi Arabia drove much of that spending, including both a Eurofighter acquisition, as well as an ambitious F-15SA acquisition and upgrade program. By 2018, however, the Royal Saudi Air Force will have fully inducted all of its Eurofighter purchases and also be near the conclusion of its F-15SA acquisitions and upgrades. Saudi spending on combat aircraft is thereafter expected to drop through the remainder of the forecast window, while the costs of operating and maintaining such an advanced fleet will rise.

By contrast, Southeast Asia will likely continue to increase spending on combat aircraft over the next ten years. Both Australia and Singapore, which respectively made F/A-18E/F and F-15SG purchases over the past five years, are also expected to begin inducting F-35A Joint Strike Fighter in the near future. Likewise, Indonesia has stated its intention to launch the production phase of the KF-X fighter aircraft program in 2018. Such aggressive timing may be optimistic, but Avascent does forecast that Southeast Asia will overtake the GCC in fighter and attack aircraft spending in the early 2020s.

South Asia’s spending over the next ten years will be of particularly significant note. By 2019, the sub-continent is expected to overtake the GCC and Southeast Asia to become the biggest spenders on combat aircraft outside Western Europe and the United States. By 2024, the region may surpass Western Europe as well. India will likely drive the region’s purchases as it keeps pace with regional rivals as well as retirements en masse of its current-serving aircraft. The future Fifth-Generation Fighter Aircraft (FGFA), medium multi-role combat aircraft (M-MRCA), and other multi-billion dollar programs will all drive heavy investment spending over the next ten years, notwithstanding the country’s history of delayed procurement and slow-moving defense bureaucracy. India will also drive international demand for fixed-wing mobility aircraft outside Western Europe and the United States, having recently begun inducting Boeing’s C-17 Globemaster and Lockheed Martin’s C-130J Super Hercules transport aircraft.

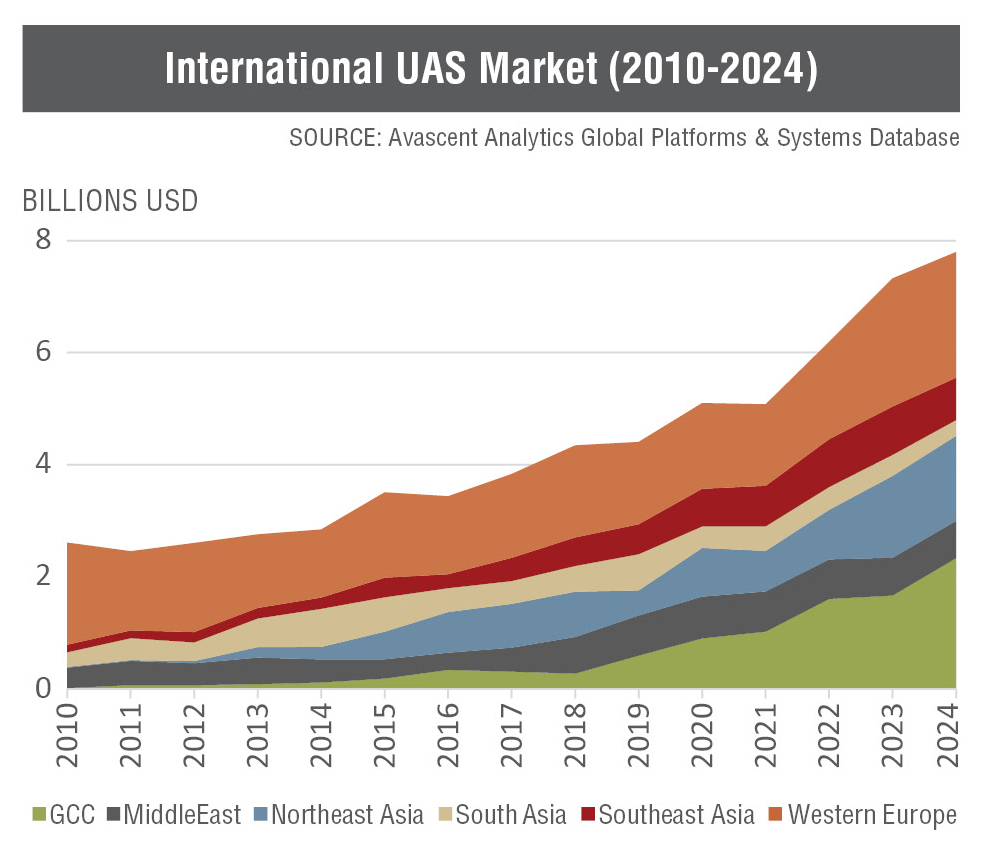

Avascent expects the unmanned aerial systems market to continue growing over the next ten years. Most of the future spending will be concentrated outside Western Europe and the United States. The UAS market – particularly those segments that do not demand low observable airframes or highly autonomous control systems – will increasingly be served by a more diverse supplier base, including indigenous providers. While US and Israeli firms have led the global market for years, the technology to field “entry level” UAS is within reach of a much wider supplier base. As such, we have seen Western Europe’s share of the accessible international UAS market shrink from 66% in 2010 to 39% in 2014, while South Asia’s share rose from 9.5% to 21%, serviced primarily by indigenous industry with Israeli assistance10. In the out-years, we expect the countries of the broader Middle East and North Africa region, including GCC members, to become strong UAS growth markets.

Finally, the accessible military rotorcraft market appears set to contract after peaking in 2016. Avascent does not expect it to rebound again until the mid-2020s. Both Western Europe and the GCC, which in 2014 overtook Western Europe as the world’s largest accessible spender on rotorcraft outside the United States, are expected to spend half as much on rotorcraft in 2019 as they did in 2015; Northeast Asia is also expected to spend only $1.5 billion in 2024 compared to the $2.5 billion in 2015.

Utility rotorcraft acquisitions will drive spending on helicopters over the next five to ten years.

However, much of this decrease can be attributed to the cyclical nature of the attack helicopter market. Procurements of attack helicopters tend to be periodic, rather than sustained over time. This stands in contrast to what is expected to be a relatively robust utility helicopter market. For example, the bulk of the 2016 peak will be driven by Saudi Arabia’s behemoth $6.55 billion purchase of 70 AH-64D Apache attack helicopters. The attack helicopter market thereafter will likely not see another purchase of such grand scale until a new generation of attack helicopters becomes available – something that we do not expect will happen within our current forecast window. In the meantime, utility rotorcraft acquisitions will drive spending on helicopters over the next five to ten years.

Of particular interest in this market will be India’s pending light utility helicopter (LUH) and reconnaissance and surveillance helicopter (RSH) competitions. India will continue to seek foreign partnerships to fulfill these requirements even with its emphasis on indigenization. Should these competitions come to fruition, they alone could significantly boost the market’s numbers for the near future. It should also be noted that this analysis is necessarily limited to spending on “new” acquisitions – opportunities for after-market support activities will almost certainly increase over the next ten years, especially given the recent surge in rotorcraft acquisition around the world.

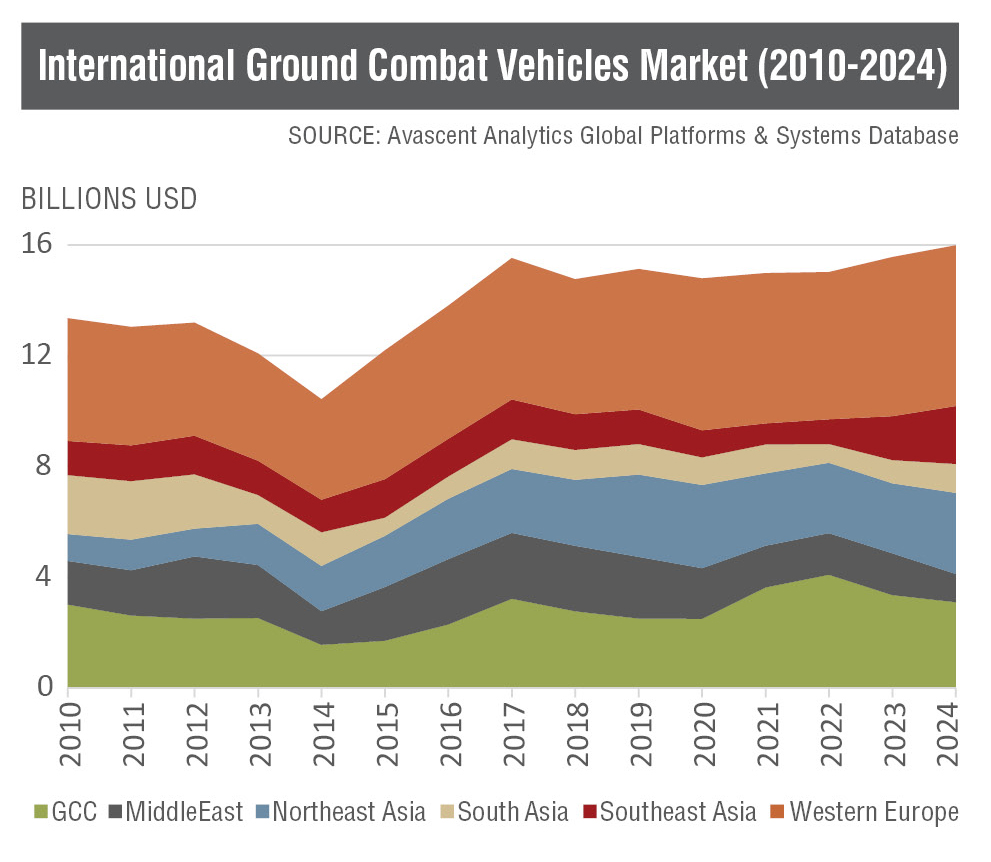

Steady growth of demand for Ground Combat Vehicles, mostly from “mature” markets

While the United States has seen a marked decline in spending on ground vehicles from peak levels in 2008, Avascent does not expect the international ground combat vehicles market to be affected for the foreseeable future. A strong, steady stream of funding for combat vehicles is likely to persist through the next ten years, primarily among Western European and Northeast Asian countries which feature large indigenous military vehicle producers. Following a 3.9% decline in spending each year since 2010, Western Europe’s demand for combat vehicles is expected to increase again over the next ten years, surpassing its pre-financial crisis level of spending in 2016. The UK (Future Rapid Effect System vehicles), France (Heavy Vehicule Blinde Multi-role troop carriers), and Germany (Schutzenpanzer Puma armored infantry fighting vehicles) will constitute the bulk of that demand. Likewise, Northeast Asia’s demand for ground combat vehicles will likely double over the next ten years and drive international demand outside the United States and Western Europe. South Korea is expected to spend an average of $1.5b per year over the next ten years in inducting a new generation of K2 Black Panther main battle tanks (MBT) and K21 infantry fighting vehicles (IFV).

International demand for combat vehicles will likely persist in emerging markets as well, given the presence of indigenous military vehicle production bases among many of those countries. While such countries will have no practical alternative to importing high-end systems like combat aircraft and submarines for the foreseeable future, their indigenous industrial bases will be more capable of sustaining demand for combat and combat support vehicles. This situation increasingly obtains among the GCC and a few other non-GCC Middle East countries.

A strong, steady stream of funding for combat vehicles is likely to persist through the next ten years, particularly in Western Europe and Northeast Asia.

Avascent expects the GCC to undergo major combat vehicle acquisition programs in the out-years, beginning with a GDLS-Canada deal for armored vehicles in Saudi Arabia, followed by main battle tank acquisitions in the UAE and others. Many of the electronics components and other high-tech content of combat vehicles will still need to be sourced via imports, and some of these marquis programs will consequently rely on foreign prime contractors. However, GCC countries Saudi Arabia and UAE and other Middle East countries like Egypt and Israel feature well-established or growing capacity to produce and modify a range of military vehicles. As such, Gulf countries are not only expected to maintain high spending levels on military vehicles, but they are also expected to overtake Northeast Asia as the largest spenders outside the United States and Western Europe by 2024.

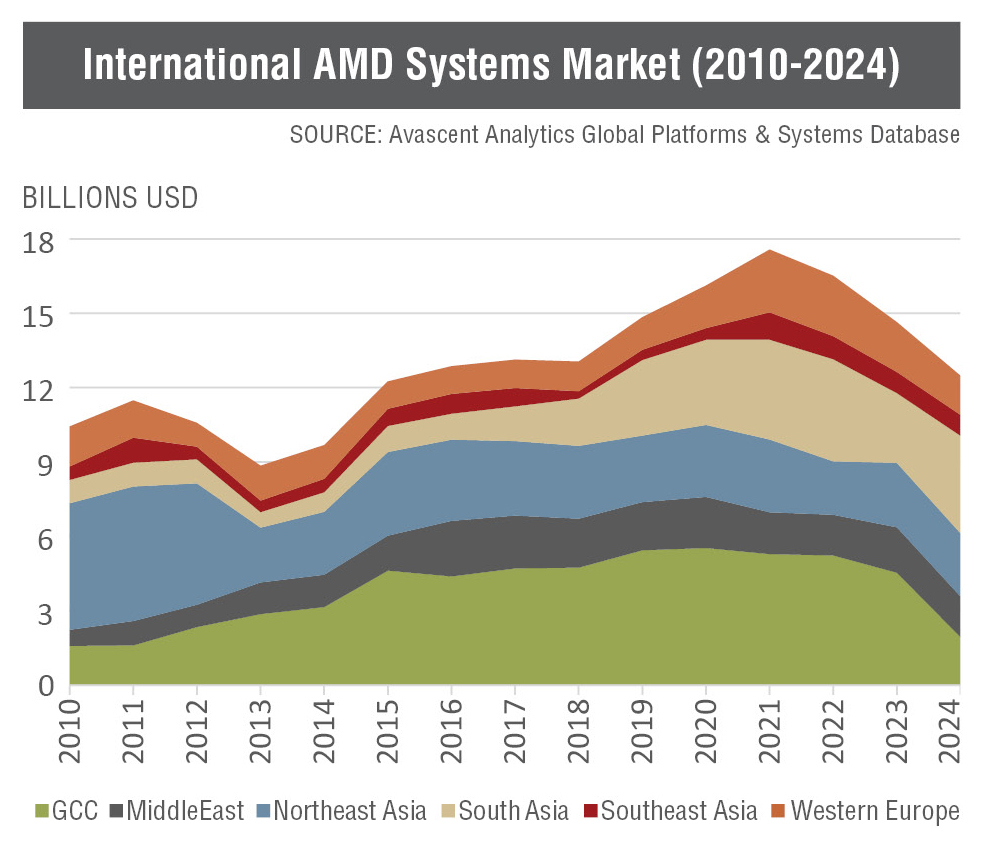

After a decline, demand for Air and Missile Defense Systems will experience modest growth

The proliferation of relatively capable ballistic missiles and unmanned aerial systems will continue to spur investment in both high-end missile defense and more traditional air defense capabilities. While the former has largely been the preserve of US firms, which can market products developed with heavy investment from the US Government, the latter has featured a much broader competitive field. The higher-end missile defense systems have tended to skew overall dollar figures for sales of air and missile defense (AMD) systems. Systems geared toward more limited air defense roles (often with at least limited missile defense capability), by contrast, have been far more affordable than true missile defense systems. Between 2010 and 2013, Northeast Asia led international spending on high-end air and missile defense systems, driven by Japan’s acquisition of an Aegis BMD-capable Atago-class guided missile destroyer fleet, and its purchase of Patriot missile defense systems, to be assembled locally under license from Raytheon. South Korea has also been investing in the Aegis system as part of its fleet modernization program. Given the proximity North Korea’s burgeoning ballistic missile capability, Avascent expects Seoul to continue its ADM modernization efforts, building on their ongoing Aegis investment.

More recently, a number of GCC countries have surged to the front of the market, propelled by UAE spending on the Theater High-Altitude Area Defense (THAAD) system, and Saudi Arabia’s purchase of the Patriot PAC-3 system. Avascent expects GCC demand for relatively high-end AMD capabilities to increase over the next five to ten years and lead international demand in the market, particularly in anticipation of further missile defense requirements in Saudi Arabia. Qatar, Kuwait, and Oman could also to invest in some mode of missile defense capabilities as the threat of a nuclear-tipped Iran lingers.

Final Considerations

An important caveat is that the forecast and analysis presented in this paper are predicated upon a relatively stable and peaceful international system over the next ten years. Any major armed conflict directly or indirectly involving any one of the countries covered in our database would naturally alter our forecasts. Similarly, a new or protracted global or regional financial crisis could also scuttle anticipated trend lines. Taking those assumptions in consideration, Avascent expects the shifting dynamics in accessible international defense markets to present new challenges and opportunities for Western defense firms. Mature defense markets in Western Europe and Northeast Asia are experiencing modest growth amidst strong competition between international suppliers and well-entrenched domestic firms. However, emerging markets in South and Southeast Asia, as well as in the Middle East are experiencing strong growth and are providing many opportunities for expansion. The rapidly modernizing militaries in these emerging markets foster strong demand for complex defense platforms and systems that cannot be domestically sourced, despite a growing priority to develop indigenous defense industrial capacity. Western defense firms are well-positioned to take advantage of these rapidly expanding and relatively open defense markets, especially if they pursue strategic cooperation with local defense firms.

Footnotes

1. The term accessible spending and accessible markets refers to defense spending by countries where Western defense firms can do business and compete for contracts. Avascent Analytics’ Global Platforms and Systems (GPS) database covers 50 such countries (in addition to the United States), which accounts for 95% of defense investment accessible to Western defense suppliers. Note that major defense spenders such as China, Russia, and Iran are not included because they

are not accessible to Western defense suppliers.

2. Defense spending refers to the overall allocation for military-related activities in the country. It is composed of the country’s official defense budget, along with other funds that might contribute to total spending. For example, funds from a non-Ministry of Defense government entity (the Ministry of Foreign Affairs and the Ministry of Interior being the two most common) might be used for defense-related activities and would count toward total defense spending. Likewise, some countries also depend on foreign aid (e.g., US Foreign Military Funding) to boost their purchasing power.

3. Generally, Avascent breaks each country’s official defense budget down into five accounts, generally modeled on the US DoD’s appropriations titles: procurement, research and development (R&D), personnel, operations and maintenance (O&M), and pensions where applicable. The first two, procurement and R&D, are collectively referred to in this paper as defense investment. Avascent Analytics maintains a detailed bottom-up depiction of programs that comprise defense investment activities for the United States and 50 other countries.

4. Further quantitative and qualitative analysis on defense markets in the Americas, the broader (non-GCC) Middle East, Eastern Europe, and Sub-Saharan Africa is offered in Avascent Analytics’ Global Platforms and Systems (GPS) database.

5. Avascent’s estimates for Western Europe include the following countries: Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the UK.

6. Avascent’s estimates for Northeast Asia include the following countries: Japan, South Korea, and Taiwan (China and North Korea are excluded because Western countries cannot export defense technology to those countries).

7. Avascent’s estimates for GCC include the following countries: Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE. By assessing defense spending trends among the GCC countries, we do not intend to imply that this regional political association exercises any decisive influence over the foreign and defense policies of its member states. While the GCC is nominally intended to support collective defense, it has largely failed to channel the independent national instincts of its member states. Nevertheless, the member countries of the GCC exhibit patterns that make them distinct from the broader Middle East region; faster growth rates, smaller personnel numbers, strong allocation of funds to defense investment accounts in order to sustain a very ambitious modernization effort, are some of the distinguishing features.

8. Avascent’s estimates for Southeast Asia include the following countries: Australia, Brunei, Indonesia, Malaysia, Philippines, Singapore, Thailand, and Vietnam.

9. Avascent’s estimates for South Asia include the following countries: Afghanistan, India, and Pakistan.

10. Trends in European UAS markets can be affected by whether or not Europeans can align a coherent strategy for investing in advanced UAV and unmanned combat aerial system (UCAS) designs. To date, work in these areas has been fragmented and without a long-term commitment.