Redefining Asymmetric Warfare

The Defense Department seeks to revolutionize asymmetric warfare but offers few details about transforming the emerging Third Offset into reality.

Industry is positioned to lead R&D for disruptive technologies such as unmanned swarm systems. Not doing so risks industry’s competitive advantages and DoD’s technological edge.

Well after the Cold War ended, the Defense Department persisted in claiming that bigger is always better when it comes to new technology. What better way to gain asymmetric advantage over an adversary than by building something more imposing and more complex, not to mention more expensive?

But times are changing. Budgets are shrinking and the spectrum of 21st Century warfare favors innovation and agility.

Recognizing these changes, the Defense Department wants to revolutionize modern warfare to America’s advantage as it once did with nuclear weapons, GPS-guided munitions, and other military breakthroughs generated by previous “offset” strategies. While details are still materializing, a broader outline of capabilities and approaches has emerged about the new “Third Offset” strategy.

The Pentagon’s ambitions are to redefine asymmetric warfare using capabilities such as robotics, autonomous systems, miniaturization, big data, and advanced manufacturing. If enacted, these would continue a gradual shift away from relying primarily on time-tested industrial production models and large-scale platforms.

The next big thing in the Defense Department’s arsenal could be one of the smallest.

There is no single solution for what the Pentagon is seeking with the Third Offset. Taken together, however, the technologies outlined point to one thing that indeed may deliver the kind of paradigm shift sought by the Pentagon: autonomous, swarming unmanned systems.

Think of a swarm of tens, hundreds or even thousands of small and intelligent machines, manufactured at low cost, overwhelming or spying on underpowered enemies much like a networked pack. The next big thing in the Defense Department’s arsenal could be one of the smallest.

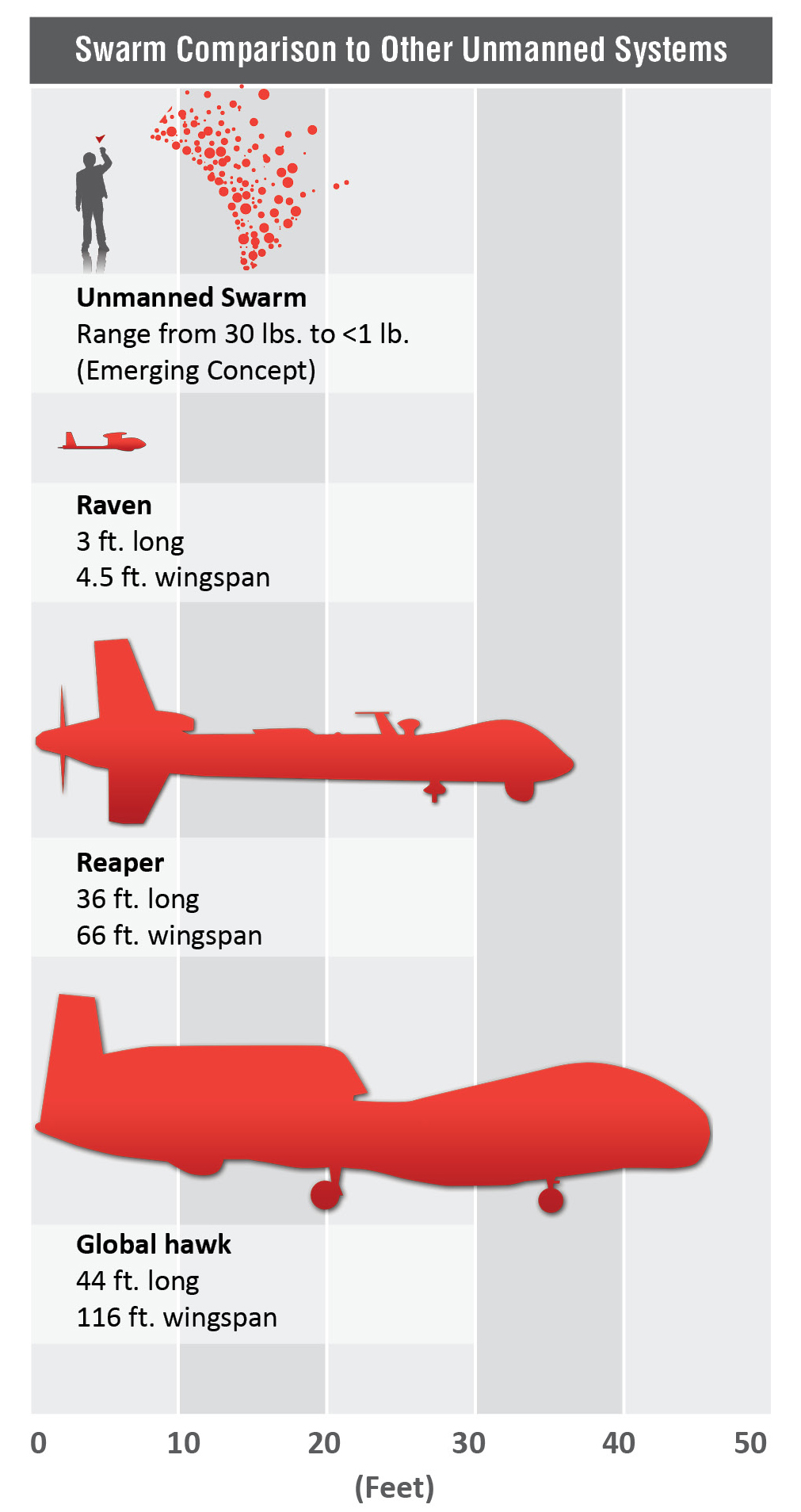

So far, unmanned military aircraft like the 10,500 pound MQ-9 Reaper, which has flown over 942,000 flight hours since it was first introduced, have mostly been used like manned aircraft: directed or flown by humans.

They surreptitiously loiter above the battlefield for a little over a day with the capability to attack ground targets with missiles. Advances in software, sensors and aircraft design have rendered some unmanned aerial systems able to fly “on their own,” but they still require significant human intervention.

That may change sooner than expected if the Third Offset works as advertised. But this is no guarantee, especially if the defense industry does not take a more active role in envisioning the future. How the swarm ultimately develops will say as much about the Pentagon’s new plan as it will about the way the industry approaches highly disruptive and revolutionary technologies.

Sound of the Swarm

Unmanned swarm systems are by no means the only disruptive technology that can answer the call of the Third Offset. However, the broad-brush policy outlines indicate that what the government seeks sounds a lot like the unmanned swarm, or the combined capability of collaborating as a group – whether they are in the air, on the ground or at sea.

Moving ahead with game-changing swarm technology would mean going forward with the strategy itself in a significant way. The ultimate operational capability of unmanned swarm systems can in fact be viewed as a test case for the broader paradigm shift envisioned by the Pentagon.

While still an emerging concept, there are some things that can be said about how swarm systems might operate. For starters, unmanned vehicles in the swarm would function quite differently than those of today. The airborne varieties would be able to communicate with each other and might range anywhere from 30 pounds to less than one.

Flight time – powered by fuel cells or solar panels – could last days, if not weeks, on end. And, thanks to advances in autonomy and artificial intelligence, they may be able to operate largely on their own with limited human intervention.

Unlike most aircraft of today, the swarm’s missions would be numerous and varied. The swarm might act as a new generation of precision guided munitions, overpowering enemy units who are helpless to do anything but try and dodge the lethal swarm. They could move en masse deep into enemy territory and collect intelligence, too small to be detected by radar systems. Or they could surround potential threats, thereby acting as a blockade for higher value assets.

But like many advanced concepts in the national security realm, the swarm’s value to the US is in the eye of the beholder. This is in part because government has been slow to figure out its vision for the future of unmanned systems and because no single program of record is driving forward development. The reality is that a multi-billion dollar development RFP with clear requirements is not coming anytime soon. However, this should not be equated with a lack of opportunity.

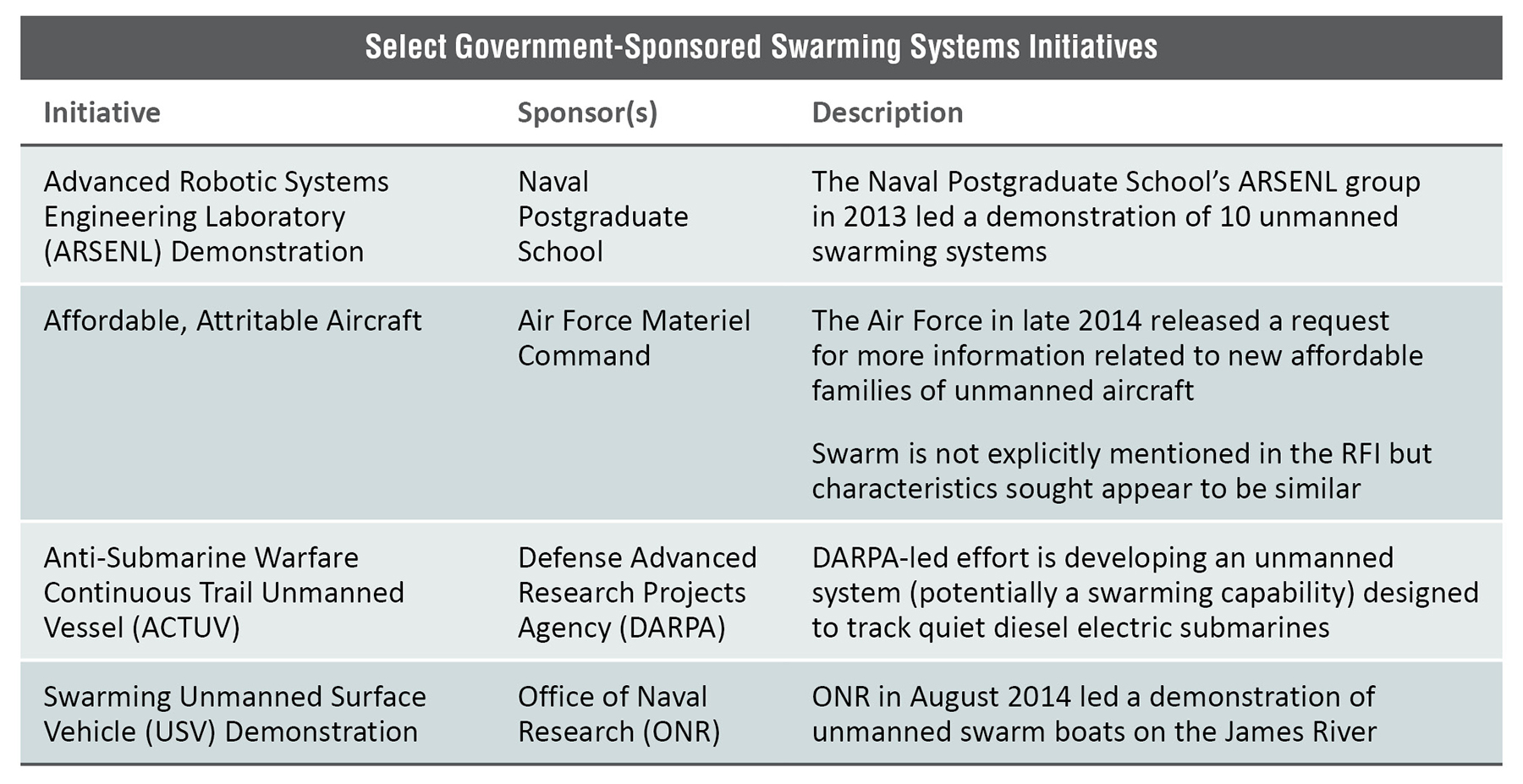

The Defense Department’s interest in swarming systems is clear, but how that transitions from exploration to implementation remains to be seen. One official avenue is a Defense Science Board study of autonomous technology this year.

Among other areas, it will explore “the use of large numbers of simple, low cost (i.e. “disposable”) objects vs. small numbers of complex (multi-functional) objects,” according to a November 2014 memo from Frank Kendall, Under Secretary of Defense for Acquisition, Technology and Logistics.

As autonomy is an inherent characteristic of swarming, this study is worth watching for industry, particularly as it is focused on the barriers to the use of autonomous systems — and removing those very roadblocks.

Unlike many defense innovations of the past, the Third Offset is to a significant extent about commercially-driven technologies that require industry-led solutions.

At the policy level, recommendations and guidelines are emerging, such as recent reports on battlefield robots and autonomous weapons systems from think tanks including the Center for a New American Security and the New America Foundation.

At the industry level, no such guidance exists even though awareness is building that swarm system technology will be part of the next generation of warfare. Accordingly, no company has the lead in developing, let alone defining, the technology.

Government funding and programs may eventually materialize, but it is still industry that must take a lead role in defining the swarm and other technologies of the Third Offset. Unlike many defense innovations of the past, the Third Offset is to a significant extent about commercially-driven technologies that require industry-led solutions.

What industry and government alike must understand is that the technology underpinning swarm systems may be early stage but is not quite as far off as it may seem. Examples such as the Navy’s swarm boat test in late 2014 and a recent Air Force simulation show the potential in a variety of military and civilian missions.

Now is the time to accelerate development efforts, at the very least because not doing so may mean adversaries will gain ground on – or surpass – the US. Ensuring that doesn’t happen is what the Third Offset is all about.

To create real-world operational relevance, the defense industry has a unique opportunity now to get out in front and gain enduring competitive advantage – but only if it is willing to take on more investment and development risk than it is accustomed to.

At the same time, the Defense Department must be able to ensure intellectual property (IP) protections for industry and provide meaningful input throughout the development process. Industry innovation related to a matter this strategically important cannot and should not take place in a vacuum.

Setting Expectations and Building Acceptance

Despite the promise of swarms, there are clear challenges that must be weighed by the defense industry before committing investment to the technology. Like the Third Offset itself, swarming technology represents a true paradigm shift that that will undoubtedly leave some people blinded by risk.

Indeed, past experience with adoption and acceptance of new technologies, such as GPS, shows that such advances can be slow to manifest their full military relevance. Typically, it is conflict that reveals their game changing attributes and contributes to their broad adoption.

Satellite-guided munitions may offer a parallel. The laser-guided smart bomb, predecessor to today’s JDAM, emerged during the first Gulf War and put the world on notice that American forces could fight more effectively and efficiently than any other military.

When the GPS constellation came online a few years later, the US military understood well the modern relevance of truly “smart” bombs and aggressively pushed the advantage of satellite-guided weapons in the coming decades before being normalized within America’s way of war, and also among allies and adversaries alike.

Such potentially disruptive technology will cause tensions within the defense industry. The first reaction may come when those who are involved in such a breakthrough have an opportunity to shape a new market with their most important DoD and intelligence community customers.

The response to this competitive threat may be increased support for status-quo approaches to missions that swarm technologies would address in new ways. Tactics that check such progress undercut the armed forces, and undermine the Third Offset’s necessary boldness in applying company resources to developing game-changing technologies.

Succeeding with swarm technology means making informed engineering and internal investment bets. However, these investments will not amount to much if there are not open lines of communication with DoD, intellectual property (IP) rights remain unreformed, and the government’s acquisitions cadre is not prepared to buy game-changing technologies that do not fit into conventional procurement models.

However, alongside these perils are benefits beyond the immediate technology at hand. The know-how relevant for swarming systems is applicable for a broad array of strategically important applications. Indeed, swarm technology allows companies to experiment with post-industrial production models, 3D printing, and next-generation aeronautical software and systems on a potentially more affordable scale than say 6th Generation fighters.

There are other new dynamics, to be sure. A “cheap, simple, and disposable” mantra is likely to develop as the dominant paradigm for swarm systems, which has profound implications for the innovation cycle and the business model. Swarm-related technology is likely to change so quickly that a traditional DoD five-year development program simply does not make sense; five months may be more appropriate in some cases. For most of the aerospace and defense industry, this is an entirely new way of doing business.

Swarm technology will be fundamentally disruptive to some systems integrators and companies whose programs are tied to legacy industrial production models and conventional software builds.

By operational necessity, swarm platforms will need to be inexpensive – though they may not immediately reach an economy of scale. Production facilities may mirror their products by shrinking in size (or be rendered fundamentally different if 3D printing is involved) owing to the nature of diminutive platforms that may be no bigger than a briefcase.

For some industry players, this would mean a shift in the way that they conduct business.

Given these elements, swarm technology will be fundamentally disruptive to some systems integrators and companies whose programs are tied to legacy industrial production models and conventional software builds. Yet at the same time, these dynamics create an opportunity for long-time competitors to re-invent themselves and for upstarts to seize part of the still sizable DoD budget.

These differences will be difficult to accept for many in today’s acquisition cadre, as well as internal corporate committees guarding company coffers. Fully understanding and accepting these new dynamics will be key to growth – as well as comprehending how they can lead to potentially significant payoffs for the military and industry even in unrelated areas.

As much as anything else, it will take leadership from the government and the industry community to drive forward swarm technology and other new, revolutionary capabilities.

Envisioning The Swarm in Action

If how the swarm will be built at the industrial level is unclear, understanding how it might be used is equally hazy. More broadly, if the Third Offset strategy is to bear out as military and civilian planners hope, keeping an open-mind in defining concepts of operations may be the most crucial step.

Popular culture, interestingly, offers some of the most fully formed and accessible views of swarm technology.

A conversation about future concepts of operations needs a common frame of reference, of which there are few. Popular culture, interestingly, offers some of the most fully formed and accessible views of swarm technology. In Dan Suarez’s book Kill Decision, swarm aircraft guided by a software algorithm derived from the insect world are deployed by the thousands to nefarious ends.

Humans play no perceptible role in their operation, only their creation. In the Call of Duty video game series, the latest version Advanced Warfare features an urban combat scenario very early in the game requiring a player to navigate a swarm attack, before defeating it with an electromagnetic pulse weapon.

Throughout the confines of Seoul’s urban canyons depicted in Advanced Warfare, the swarm’s ability to overwhelm a military force is amplified.Outside of entertainment, video from research labs working on swarm systems can be found online, which offers a less dramatic but a more grounded view of where the technology is today.

The US Navy recently released video of swarming rigid-hull inflatable boats, as well. Each of these visions is important, yet none is a definitive depiction of what the future may hold.

A conventional taxonomy of swarm technology might include categories according to domain: land, air and water. This lends itself to following the core competencies and customer familiarity for most defense companies. Yet this may sell short the ability to use technology in new ways if engineers and designers hew to traditional approaches. Instead, firms would be well served by asking and answering:

What missions and capabilities will these new technologies be required to perform? Doing so may offer a superior framework for imagining, designing and building the next generation of swarm technology. Already, DARPA is seeking funding for the Multi-Domain Unmanned System program (UxS) and is considering whether a single class of unmanned systems can operate on land, air and sea.1 While not necessarily a swarm approach, it reveals the interest in exploring this dynamic capability.

A swarm military mission categorization could include strike, surveillance and reconnaissance, support, or tandem manned-unmanned operations. Domain relevance matters for practical purposes, but it should not be a limiting factor in the conversation about potential missions. In the civilian realm, logistics, maintenance and search and rescue operations also hold promise and could be equally game changing as their military counterparts.

Given the possibilities, envisioning the swarm and defining military and civilian opportunities in a mission context is an essential first step for industry. This is a change from the past, when the Defense Department often drove the vision for new capabilities. But in a world of rapidly evolving capabilities and shorter innovation cycles, it is industry that must define the art of the possible for customers who are sometimes too far removed from the technology to see its potential.

Taking the Next Steps

Now that the defense sector is starting to see more certainty, the Third Offset adds more unknowns. As much as the new strategy can be a pole star around which a company might orient its internal investment and allocate its engineering talent, disrupting existing and legacy businesses with new technologies when defense budgets are politically unstable makes for an uncertain future.

When it comes to the ability to develop game-changing technologies, what sounds great in an E-ring briefing room may not resonate in a corporate boardroom.

Indeed, developing a swarm capability carries inherent risk and there is a real possibility that some efforts will not pan out as planned. It is worth remembering disruption is not supposed to be easy, nor comfortable. For some firms, the potential reward will be worth the risk – for others it will not.

But avoiding risks, whether for the swarm or other disruptive technologies, could ultimately mean missing out on new revenue and contributing to the next generation of defense capabilities.

For those companies considering R&D funding for swarm programs, and similarly disruptive technologies, careful steps must be taken and key questions addressed:

- Have customer technology advocates been identified?

- What are their unmet needs and highest priorities?

- How well does our portfolio of technologies align to these needs?

- Where should we focus investment within the portfolio?

- In what ways can commercial technology be leveraged?

- Who are potential technology development partners?

Just as swarming systems operate in coordination, industry should be open to civilian and defense industry alliances to develop this next-generation technology. Both domestic and international technology partnerships should be considered as a means to bring the most capable technology forward to customers.

Commercial technology firms in particular are uniquely positioned to provide rapidly evolving capabilities essential for success, e.g., software for autonomous flight. Engaging these firms is potentially a way to manage risk and investment exposure for capital-conscious defense and aerospace companies.

Teaming is important for other reasons as well, that reflect the potential downside of this new technology. Just as unmanned aircraft systems today – while still relatively inexpensive – are not as cheap as commonly believed when total operating costs are factored in, the economics of swarming systems may not follow today’s assumptions.

Most importantly, it is critical for industry executives to engage Pentagon decision-makers in a different kind of conversation compared to those surrounding a typical, more linear acquisition process. This means listening for unmet needs first and foremost, but then responding with a vision, while working in tandem with customer advocates.

All of this should take place before significant investment dollars are committed. Government stakeholders must be willing and able to engage in this new kind of cooperative dialogue, while still ensuring corporate IP rights are protected.

Identifying government partners who can advocate for this disruptive technology and provide input to the development process is essential. Customers have to know how to use the swarming systems to get the most out of them, which puts a greater burden on defense firms to set realistic near-term expectations while not limiting the discussion of the strategic context.

Culturally as well as legally, autonomous weapons frameworks are unformed and need to be developed concurrently with the technology, while retaining the ability to change with it.

Revisiting the Third Offset Strategy

The Defense Department is counting on a new wave of technologies to help secure America’s military advantage, and ultimately its ability to project power well into the 21st Century. The unmanned swarm represents one way of fulfilling the Third Offset, and there are undoubtedly many others. But as much as anything, it is a leading candidate to fulfill the Pentagon’s vision.

The costs of waiting are high: The defense industry may miss out on breakthroughs and the Defense Department could cede its technological edge.

As with other cutting-edge developments, unmanned systems offer yet another opportunity that the defense industry cannot afford to ignore until receiving a contract or even clear direction. If there were ever a moment to define the industry’s future, by getting out in front of government customers as well as competitors, it is now.

The costs of waiting are high: The defense industry may miss out on breakthroughs and the Defense Department could cede its technological edge. The capabilities outlined in the Third Offset – like robotics, 3D printing, and miniaturization – are advancing daily whether the Pentagon is part of the process or not.

Ultimately, it will be up to the industry to take the reins and work closely with the Defense Department and allied defense ministries to define a technological future that is moving faster and becoming more complex than ever before. However, the old ways of only allocating internal R&D funding tied to programs of record and pursuing procedural government awards is not a winning proposition in the long run.

Relying solely on these approaches will mean falling behind the pack when it comes to the Third Offset.

For these disruptive technologies, commercial software development schedules must be the norm more than they are today. In many ways swarming systems – with their primary reliance on software – have more in common with the iPad than with manned aircraft. So why try and shoehorn them into legacy development models that are often too slow, bureaucratic, and expensive?

New kinds of conversations and approaches must be considered. For example, government and industry should consider investing in broad portfolios of early-stage technologies that have the potential to be disruptive. Some investments will pay off and others will not. Much like a venture capital firm, wins offset losses with this portfolio approach.

For industry, it will be critical to engage customers early and often to ensure investments are not misaligned with priorities. Likewise, government must offer incentives to industry. This could include providing seed funding to these nascent development efforts in a way that promotes innovative solutions outside the framework of the traditional defense development process.

For those looking to take initiative and lead the way, it is imperative to start thinking broadly about new models for making informed investments in the technologies, like swarm systems, that will enable transformational military capabilities and enduring competitive advantage.

This means looking internally, but also externally to partners and customers who are willing to take chances. Indeed, government and industry must work closely together on multiple levels to begin a dialogue and develop shared visions of disruptive technologies.

There are bound to be pitfalls along the way. But innovation has never resulted from succeeding 100% of the time, even in the defense industry. The question now is whether industry and government acknowledge this before R&D begins, rather than when it is too late to take the lead. The course of the Third Offset – and the Defense Department’s future technological advantages – may just depend on it.

Footnotes

1. “Unmanned Allies.” Aviation Week. March 2-15. 48.