Six Ways that ESG Drives Value

Historically, environmental, social, and governance (ESG) considerations have been under the purview of compliance departments, often viewed as a “check-the-box exercise.” Yet, increasingly, forward-leaning companies are raising ESG concerns in their executive committee meetings and board discussions.

These firms understand that ESG is more than just a matter of risk management, but instead offers significant opportunities for value creation and competitive differentiation.

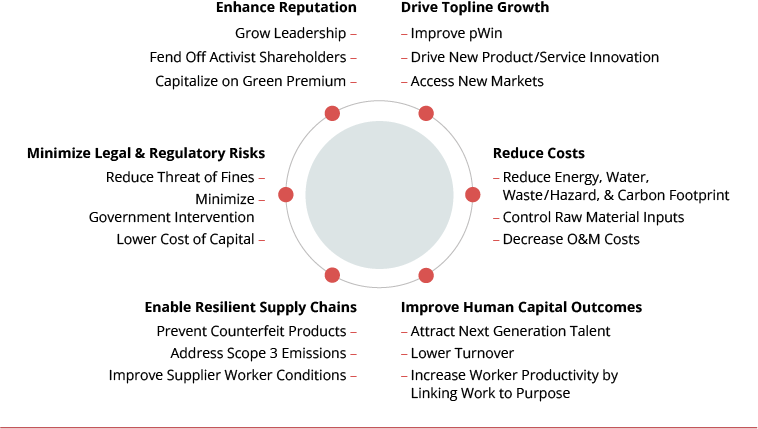

When corporations embed ESG considerations into their core strategy and set pragmatic, actionable ESG goals with clear metrics, they can create value in six significant ways:

- Driving topline growth

- Reducing costs

- Improving human capital outcomes

- Enabling more resilient supply chains

- Minimizing legal and regulatory risks

- Enhancing a company’s reputation among investors, employees, and customers

![]()

How Can ESG Drive Value?

The 6 Ways ESG Drives Value

1. Drive topline growth

In today’s environment, a strong ESG value proposition allows a company to defend and grow its market footprint. Whether in North America, Europe, or Asian markets, evidence suggests that government and other public sector customers will increasingly use their procurement power to select green suppliers and solutions that align with their policy priorities.

For example, while the United States already has rules in place to encourage selection of eco-efficient solutions, the Biden Administration is now pushing for greater transparency around supplier emissions disclosures.[1]

As a result, a company can improve its odds of winning new business by demonstrating progress in reducing its environmental footprint. At the same time, firms can grow their top lines by investing in new products or services that help its green-conscious customers meet their objectives.

For companies looking for new market opportunities, next generation climate technologies represent a fast-growing investment opportunity. Technologies or services to support development or deployment industry electrification, carbon capture, hydrogen development, or next generation power grid represent significant opportunity.

Moreover, public R&D funding is often available to support such technology development. For example, the 2021 Infrastructure Investment and Jobs Act included $3.5B for carbon capture and removal technology pilot projects.[2] The objective of these public investments is to accelerate private sector investments which will further stimulate demand in the years ahead.

2. Reduce costs

As many have recognized, a robust ESG strategy can also help a company reduce operating costs through improved internal resource management. Indeed, many firms have recognized that they can find cost savings by lowering its energy consumption, reducing water intake, building more efficient hazard/waste processes, and/or decreasing greenhouse gas emissions.

All this directly contributes to their bottom line while burnishing their ESG profile. Conversely, firms that ignore these cost-saving opportunities are undermining their value. A 2014 study conducted by Matsumura, Prakash, and Vera-Muñoz found that firm value decreased by $212K for every additional 1,000 metric tons of carbon emissions.[3] In short, better resource management will cut costs and increase firm-value in the long-run.

While projects to reduce operating costs may require up-front investment, they lead to long-term savings that more than offsets the initial cost. For example, choosing solar panels for a new commercial production facility may have higher upfront costs than sticking with legacy energy options, but will lead to lower raw material input costs and operations and maintenance expenses over time.

Moreover, firms that defer such investments will find themselves at disadvantage as their peers move to embrace these opportunities.

3. Improve human capital outcomes

In today’s highly competitive labor market, a robust ESG strategy can help attract and retain top talent. In a survey completed in 2021, 86 percent of employees responded that they preferred to support or work for companies that care about the same issues they do.[4]

This is especially true among Millennials and Gen Z employees. A proactive ESG strategy and communication campaign can also help retain the talent a firm already has onboard. A study by the Harvard Business School Impact Weighted Accounts team found that strong employment impact scores (strong ‘S’ practices) are associated with lower employee turnover and higher firm valuation.[5]

Likewise, a robust ESG strategy can also enhance employee motivation and increase worker productivity. Marsh McLennan in 2020 found that employers with highly satisfied employees also scored an average of 14 percentage points higher on ESG performance relative to peers.[6]

Forward leaning leaders have long recognized that satisfied employees tend to stay longer and be more productive, driving firm long-term value. Pursuit of ESG initiatives provide a new avenue to engage employees and foster loyalty.

4. Enable more resilient supply chains

The chaos caused by the COVID-19 pandemic demonstrated the importance of visibility into one’s supply chain. Beyond traditional supply chain concerns, leaders are coming to realize that supply chains can also hold ESG risks that can significantly disrupt operations.

As consumer brand leaders such as Nike and Apple have long realized, worker health and safety practices among lower-tier suppliers can be difficult to monitor yet pose serious reputational risks.

As concerns about ESG issues permeate the broader landscape, unmonitored practices across supply chains have the potential to disrupt operations and undermine a firm’s other ESG advances. By incorporating robust processes to evaluate supplier ESG practices, a company can build more resilient supply chains, reducing disruption and associated costs or missed revenue.

Many public sector agencies are increasingly demanding that corporations consider ESG across the value chain. For example, the United States and United Kingdom have robust regulations in place that put contractors on the hook for monitoring their sub-contractors for potential human trafficking violations.

More recently, in June 2021, the German Parliament passed the Supply Chain Due Diligence Act (effective 2023) in which large companies will be responsible for ESG issues arising from their global supply chains or risk fines of up to 2% of annual revenues.[7]

These penalties are only likely to grow as regulators seek to promote a more comprehensive approach to environmental and social concerns across global supply chains.

5. Minimize legal and regulatory risks

More broadly, failure to address ESG issues will increasingly lead to legal or regulatory risks. For example, under current US laws, government contractors can be fined for not properly citing its environmental liabilities or disregarding government-mandated data security compliance measures.

In contrast, a robust ESG framework can help build productive relationships with government regulators and avoid costly penalties or enforcement actions.

Minimizing legal and regulatory risks through robust ESG framework may also have the added benefit of helping lower a company’s cost of capital. A Deutsche Bank review of 19 academic studies showed that strong corporate commitment to ESG is positively correlated with lower cost of capital.[8]

While it is challenging to prove causation, initial evidence does seem to suggest that strong ESG practices reduces risk and thus supports lower costs of capital. And, of course, lower capital costs enable other value creating initiatives including market expansion, R&D, and M&A.

6. Enhance reputation

While all firms have a variety of stakeholders, government contractors, in particular, must answer to a diverse set of stakeholders pursuing both private and public priorities.

Shareholders, government agencies, customers, boards, lawmakers, regulators, employees, and the public are all demanding that companies build and execute robust ESG and sustainability programs.

A well-executed ESG strategy that is regularly and consistently communicated to various stakeholder groups can enhance a firm’s reputation and ensure that it gets credit for proactive ESG initiatives.

While often viewed as laggards to the ESG agenda, the reality is that shareholders are increasingly on the leading edge of those seeking proactive strategies. Evidence suggests that shareholder groups are growing more concerned about ESG topics, with the number of proposals filed on sustainability issues doubling from 1999 to 2013[9].

Sustainability-focused activist shareholders have even replaced board directors that were not moving fast enough to address the climate crisis (e.g., Engine No.1 was able to replace three new directors on Exxon Mobile during a proxy fight). A proactive ESG strategy can help companies get ahead of shareholder ESG concerns.

Conclusion on Ways ESG Drives Value

The six avenues identified above represent the most direct paths by which ESG efforts help drive value creation. Companies that fail to embed ESG considerations into their operating and market strategies will increasingly find themselves losing share and relevance.

However, leaders who recognize that ESG represents an opportunity for long-term gain will find they are more resilient, relevant, and prepared to meet the market and environmental challenges to come.

Footnotes:

[1] US – The Federal Sustainability Plan; US EO14057 – “Catalyzing Clean Energy Industries and Jobs through Federal Sustainability”

[2] Congress.gov. “H.R.3684 – 117th Congress (2021-2022): Infrastructure Investment and Jobs Act.” November 15, 2021.

[3] Matsumura; Prakash; Vera-Muñoz. “Firm-value effects of carbon emissions and carbon disclosures.” The Accounting Review (2014/3).

[4] PwC – ESG Consumer Intelligence – 2021.

[5] Panella; Rousen; Serafeim. “Accounting for Employment Impact at Scale.” Harvard Business School (2021).

[6] Marsh & McLennan – ESG as a Workforce Strategy – 2020.

[7] Loc.gov. “Germany: New Law Obligates Companies to Establish Due Diligence Procedures in Global Supply Chains to Safeguard Human Rights and the Environment.” July 22, 2021.

[8] Deutsche Bank – Sustainable Investing: Establishing Long-Term Value and Performance-2012.

[9] Grewal; Serafeim; Yoon. “Shareholder Activism on Sustainability Issues.” September 2016.