Space Market Disruption: The Smallsat Revolution

Across a number of market segments new smallsat constellations are being introduced that will have a transformative impact on the space industry. This is the second paper in Avascent’s series on space disruption and what it means for your business. For the first paper in the series, please click here.

For decades, the average mass of a spacecraft has steadily grown. Other than in a few niche applications, operators have sought more bandwidth, more power, and more robust and capable instruments. These demands have seen the mass of a typical satellite increase from about 120kg at the birth of the Space Age to more than 3,000kg today.

The boom in smallsats today is only the beginning of a new wave of technology that will transform the exploitation of space, well beyond imagery and communications.

Yet in the past few years there has been increased attention on small satellites, or smallsats as they are more often called. These spacecraft are less expensive, easier to upgrade, and disaggregate risk better than larger systems. Less capable individually, en masse they are often able to achieve results that provide complementary or substitute service to traditional systems. As new technologies and business models are introduced, smallsats will only become more prevalent, emerging as essential space assets.

The computer industry provides an example for how space platforms are changing; over the past several decades it moved from being centered on large mainframe computers to personal computers and then disaggregated personal devices. To this day supercomputers still fill a vital role, especially for analyzing highly complex scientific problems or developing and deciphering encryption systems. Yet it is clear that PCs have been an invaluable technological contribution—while no tablet or PC will ever match the computing power of mainframes or supercomputers, they provide tremendous capabilities and applications to people at an affordable price.

Now it is space’s turn to embrace disaggregation across a number of different applications, including imagery, communications, and weather. If these innovative experiments pay off, operators for other applications—such as positioning and navigation (GPS in the United States) and science—are also likely to embrace smallsat constellations an important part of their strategies.

Space Imagery

On the surface there is no comparison between big and small space platforms. New space imagery satellites, for example, offer anywhere from 4 to 20 times less resolution than the best commercial platforms in orbit. But their capabilities are good enough for most users. In agriculture, finance, logistics, and other industries resolution of 2, 3, or even 5 meters is often sufficient. The intelligence community, with its requirement for exquisite resolution, has previously driven demand for space imagery, as it is by far the greatest consumer of the product. However, this customer base has accounted for such a large share of demand because imagery has been prohibitively expensive for many commercial customers. If the cost can be reduced by an order of magnitude—or possibly even by three orders of magnitude, as some of these smallsat constellations promise—then there is room for value added services to develop useful applications and find lucrative distribution channels for their commercial products.

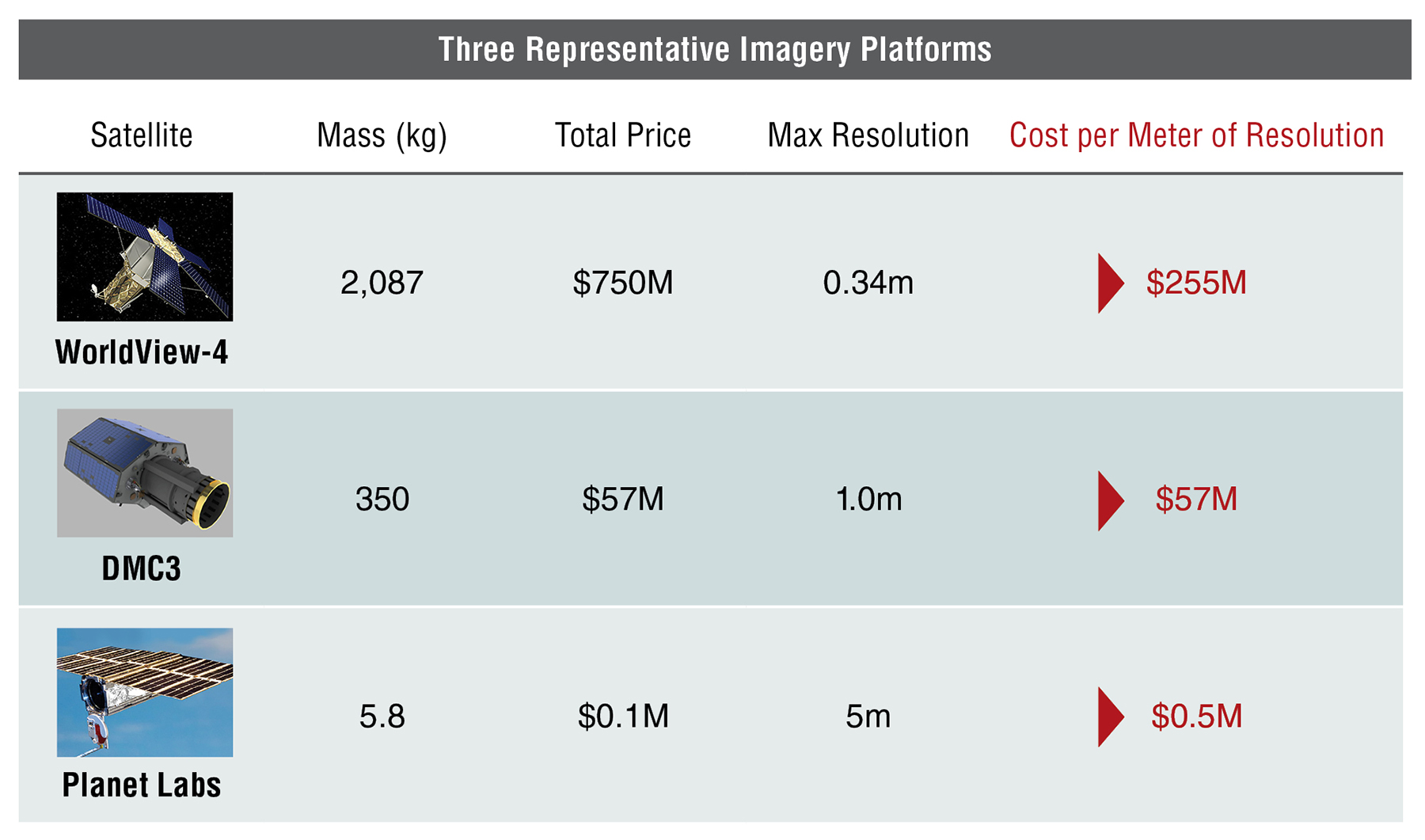

The figure below depicts the difference among three current-generation space imagery platforms: WorldView-4 built by Lockheed Martin for Digital Globe; DMC3 built by Surrey Satellite Technology for DMC International Imaging; and the Flock 1 spacecraft built by Planet Labs. As the data show, the WorldView spacecraft provides much more exquisite resolution than the others. In fact, for classified customers the spacecraft can even provide better than 0.34-meter resolution (rumored to be 0.25m). But when you compare the resolution to the cost of the platform, it becomes clear that customers have to pay a significant premium to achieve that quality. If you happen to be a customer for whom a high level of resolution is not required, then perhaps the smaller systems will suffice. And at the price level of the Planet Labs platform, there is an opportunity to attract a far greater customer base.

Business models are also readjusting, as emerging space imagery companies are focused on developing and selling “solutions” to customers rather than providing raw imagery. While the intelligence community can work with raw imagery, because it has the resources to develop custom software tools and train specialized analysts, most commercial customers need to be told what the imagery shows and what the data means for their business. This is where change detection software and data analytics comes in, and it will be the true discriminator among the emerging imagery companies. Even at a resolution of two or three meters, analysts can learn a great deal by identifying where and how situations on the ground are changing over time. The imagery companies—or resellers, in many cases—will package the analysis in actionable intelligence products for customers.

While large platforms will still be lucrative, the customer base will become ever narrower.

One other benefit of smallsat systems is the ability to regularly update capabilities as new technologies come online. Higher resolution cameras or new imagery wavelengths (hyperspectral, infra-red, etc.) can be added to subsequent generations of satellites to continuously improve the constellations. Large platforms can also be replaced with upgraded versions, but they are certainly not on the same rapid refresh cycle when each platform costs hundreds of millions of dollars.

Still, this new technology does not mean the end of traditional platforms, as exquisite systems are still necessary. Just as the National Security Agency, the Department of Energy, hedge funds, and other specialty users still make valuable use of supercomputers, the intelligence community will still value the 0.25 meter (or better) resolution it can gain from much larger space platforms. Yet as smallsat constellations are fielded and companies develop sophisticated applications, even the smaller platforms will be increasingly attractive to the intelligence community, serving an expanding fraction of its needs. So while the large platforms will still be lucrative, the customer base will become ever narrower.

Space Communications

The bigger market disruption will likely be in satellite communications, where companies such as OneWeb, SpaceX (teamed with Google), and possibly Samsung hope to introduce networks that transform how people communicate across the globe.

Smallsats are being applied to communications to enable low-priced applications that are impractical using traditional systems. Geostationary spacecraft are invaluable for providing guaranteed bandwidth for much of the globe, but their extreme distance from the surface of the planet (~36,000km) creates a latency that makes them unsuitable for many applications that require real-time connectivity. Smallsats in low Earth orbit, by contrast, eliminate the latency problems. The purpose of the proposed constellations is to offer high-throughput bandwidth in real time. The new proposed LEO satellites also have the added benefit of being global, delivering coverage that cannot be achieved through GEO satellites and throughput not provided by legacy LEO constellations. For government customers, large smallsat constellations can enable a significant boost in resiliency, minimizing the risk of jamming or physical attacks on a relatively small number of GEO satellites.

The use of massive smallsat communications constellations enables substantial economies of scale in manufacturing. Indeed, the OneWeb satellites will be manufactured for $500,000 or less per platform, lowering the cost of entire constellation construction below the cost of two or three GEO satellites. At this affordable cost, broadband service can be delivered that rivals terrestrial alternatives in price. In addition, for developing country consumers without access to fiber networks, these new satellites could be priced at a level that meets their more modest budgets.

While economies of scale can be attained on satellite construction, the overall costs of constellations do not come cheap. OneWeb will spend over $1 billion to launch its satellites and will need to invest upward of another $1 billion on a ground network and hardware. The SpaceX-Google venture publicly acknowledges that it will cost “billions,” and sources indicate that Google anticipates spending as much as $15 billion on its new global connectivity initiative. And although ground segment capital expenditures (CAPEX) will be lower for follow-on satellites, the high cost of launch for constellations with hundreds or thousands of satellites creates an ongoing challenge to overcome.

In spite of the high CAPEX requirements, the use of smallsats for communications constellations has tremendous disruption potential across the value chain. Legacy satellite manufacturers have thrived on selling and manufacturing massive bespoke GEO satellites costing hundreds of millions of dollars. They will now being forced to compete for several-hundred kg platforms that are being manufactured hundreds or thousands of times and are expected to cost several hundreds of thousands of dollars. Launch providers will likely see many new opportunities to launch the new constellations of smallsats. These opportunities will extend to medium-class launch providers, which will carry many smallsats per launch, and small vehicles, which will compete for targeted launches of replacement and test satellites.

These satcom constellations will not replace the high-end GEO platforms that currently exist. Those systems will still generally be the best options for wide area broadcast of television and radio signals and for provision of data backhaul for global telecom companies. Rather than being directly competitive, the new services open up the satcom industry to users that have previously been off limits due to price and technical issues. That said, the tremendous amount of capacity provided by the new constellations could lead to significant price pressures on the services for GEO satellites, hurting profitability.

The Implications of the Smallsat Revolution

The boom in smallsats today is only the beginning of a new wave of technology that will transform the exploitation of space, well beyond imagery and communications. PlanetiQ, Spire, GeoMetWatch, and GeoOptics are developing a commercial weather constellations, and Orbcomm, Spire, and ExactEarth are delivering satellite-Automatic Identification Systems for tracking ships at sea. These satellites are enabling new market applications that heretofore did not exist due to technical and budgetary challenges. As technologies mature, governments will also turn to smallsats to provide advanced applications or complement systems already in place.

A crucial question that many traditional aerospace manufacturers are asking is how to make money in an environment where satellites cost so much less. These new smallsats are far less expensive than the typical platforms that cost hundreds of millions of dollars. As mentioned above, the OneWeb satellites are being built by Airbus for $500,000 a copy, including the up-front, non-recurring engineering costs. For an old-school company like Airbus to be able to make a profit will require a drastic change in its internal operations and approach to manufacturing. Avascent’s next two space white papers in this series will look at some of the processes manufacturers are adopting to be successful.

Meanwhile, the incipient space operators need to build successful businesses. This is not a foregone conclusion, as the largest and most lucrative addressable customers could be the least familiar with space applications and how they can benefit business operations. Operators will not only have to design specialized applications that show measurable impact, but they will also have to develop marketing tools that educate these consumers. It’s a slow process that will benefit from a coherent strategy that prioritizes among potential customer segments and identifies their most pressing data needs.

Given the time it will take to attract unsophisticated customers to their services, new space operators will be keen to target traditional customers—government and commercial—who are already familiar with space products. This field—whether in imagery, satcom, weather, or other markets—is highly competitive, however, with many entrenched players. Many of these customers will also be wary about new suppliers and services; it’s not just a reluctance to try new ideas, but also a concern about adopting new data and processes that may not be available if the upstart companies disappear.

Consequently, operators should consider innovative partnerships that leverage the networks, sales channels, and reputation of the larger aerospace primes. Again, it will be crucial to prioritize among potential partners and be tactical about setting up appropriate relationships. To return to the computer example from the beginning of this paper, the partnership between IBM and Microsoft to install MS DOS on all of the manufacturer’s PCs was a huge win for both companies. Similar partnerships are achievable in space. A future Avascent white paper will dive deeper into some of these issues.

The smallsat revolution is creating disruption across the space value chain and beyond. Combined with other major trends, such as new manufacturing processes and operational models, smallsats will challenge companies throughout the industry to adapt to changing dynamics. In the coming weeks, Avascent will release additional white papers discussing a range of disruptive trends and the implications for business.

Please click here for Avascent’s companion paper on growth projections for the smallsat market, developed in conjunction with Avascent Analytics.