Think Bigger: The Future of Unmanned Systems and the Next Major Shift in Aviation

The rise of unmanned aircraft is steadily changing U.S. business, society and government and the next 20 years will be even more consequential as larger and larger autonomous aircraft fill the skies. Today’s quadcopters carry cameras, but tomorrow’s pilotless jetliners will carry our families.

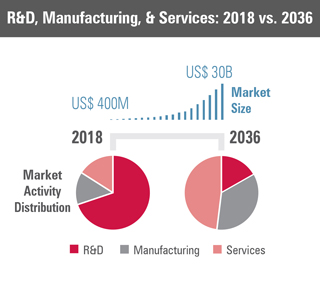

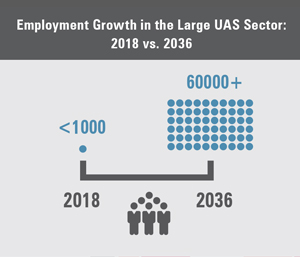

Through 2036, large unmanned aircraft are expected to drive nearly $150 billion in total spending and sustain up to 60,000 R&D, manufacturing, and services jobs annually, according to Avascent and AIA analysis.

As more and more large commercial unmanned aircraft – also known as unmanned aerial systems (UAS) – enter service, they will drive economic activity that easily eclipses the contributions made so far by smaller consumer-origin unmanned systems.

As more and more large commercial unmanned aircraft – also known as unmanned aerial systems (UAS) – enter service, they will drive economic activity that easily eclipses the contributions made so far by smaller consumer-origin unmanned systems.

Through 2036, large unmanned aircraft are expected to drive nearly $150 billion in total spending and sustain up to 60,000 R&D, manufacturing, and services jobs annually, according to Avascent and AIA analysis.

A combination of technological advances and growing consumer comfort – enabled by sound policy decisions and a supportive regulatory environment – will ultimately fuel dramatic economic growth and job creation in the future of unmanned systems.

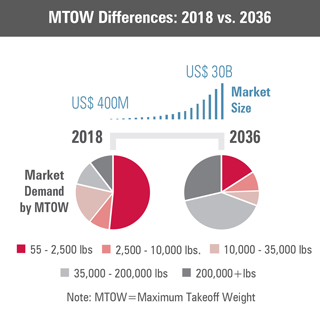

Current spending on large commercial UAS stands in the low hundreds of millions of dollars and is largely focused on research and development activities, with manufacturing and services focused on the industrial and public safety sectors.

Yet within a decade, this figure is poised for breakout growth. By 2028, spending is expected to reach $4 billion and by 2036 that number – driven by manufacturing and services for long-haul cargo and passenger aircraft – rises to nearly $30 billion.

To be sure, this is not going to be an overnight transformation. There will be distinct stages that reflect varied phases of adoption across aircraft weight classes, economic sectors and business models.

Yet the future of unmanned systems is moving from the theoretical to the practical faster than most anticipate. Remember that autonomy in the cockpit already plays a central role in everyday aviation: autopilot use on commercial passenger jets and automation-driven reduced crew on many long-haul flights.

Domestic carriers, for instance, reduced flight crew size from three to two beginning in the 1980s.

Why Autonomy Matters for the Future of Unmanned Systems

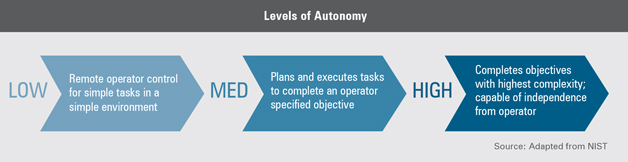

A closer look at the underlying capability of aircraft autonomy is central to understanding why the shift towards large unmanned systems is already underway. In its essence, autonomy is the ability of an aircraft to operate independently.

Today all unmanned aircraft are either remotely controlled or perform pre-programmed tasks such as those executed by autopilot functions. Over time, the level of autonomous capabilities will continue to grow, eventually leading to fully independent unmanned systems that can fly without human inputs or pre-programmed instructions.

Advances in machine-learning algorithms are central to this growth in capability, but other technologies are also critical. Communications, cybersecurity, avionics and sensors are among the crucial solutions that play a role in autonomy becoming central to aviation.

A high degree of autonomy – in which aircraft can operate independently – is a critical enabler for the widespread usage of large unmanned aircraft across a multitude of sectors. With crowded airspace and ever-changing conditions, highly autonomous aircraft must quickly sense and avoid potential hazards, circumvent deteriorating weather and deftly navigate airport taxiways.

The ability to make correct in-the-air decisions will no longer be based on a flight crew’s instincts and experience. Instead, autonomous flight systems will draw from the lessons learned by literally millions of hours of flight from aircraft and aircrews all over the world, as well as what increasingly connected aircraft themselves have to say.

This paradigm shift will, over time, instill confidence in air traffic controllers, operators and the public. Remotely piloted aircraft that are reliant on pre-programmed instructions simply move slower – or with imprecise and outdated information – when attempting to meet the multitude of challenges at hand.

While early versions of large unmanned aircraft will continue to rely on this lower level of autonomy, building scale in the market through confidence and performance necessitates real-time, automated decision-making.

Getting from Here to There: Market Timing and Adoption

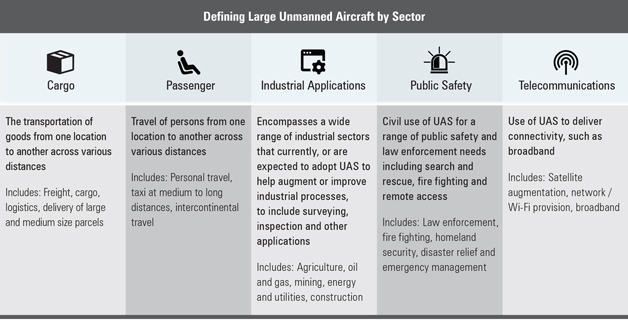

A diverse array of sectors stand to benefit from large unmanned aircraft, ranging from agriculture and firefighting to telecommunications and cargo shipping.

A diverse array of sectors stand to benefit from large unmanned aircraft, ranging from agriculture and firefighting to telecommunications and cargo shipping.

There are successful early adopters of small unmanned systems, while many continue to rely on large manned aircraft. Some are not yet operators.

But all of these sectors – and more – will eventually see autonomous large unmanned air vehicles become the dominant aircraft in the future of unmanned systems thanks to the economic benefits, safety advantages and consumer demand.

The timing of large unmanned-aircraft adoption and spending growth will lead to distinct stages of evolutionary expansion. Proving out relatively low-risk usage of autonomous aircraft – such as oil pipeline inspection or farm monitoring – can pave the way for large-scale unmanned air-freight transport.

In terms of pacing, the future of unmanned systems’ market expansion will be incremental, rather than a “big bang” that sees simultaneous peak demand across all aviation sectors.

Early Adopters (2018-2024)

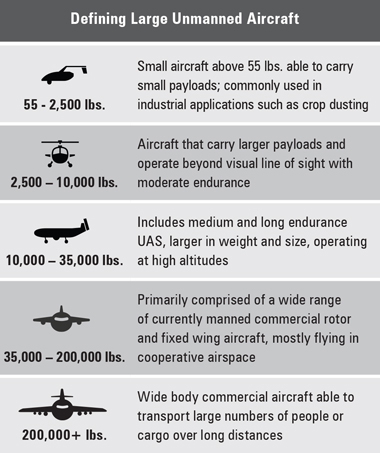

Many of the first users of large unmanned aircraft perform relatively low-risk sensor-focused roles such as ground surveillance. Early adopters include:

Many of the first users of large unmanned aircraft perform relatively low-risk sensor-focused roles such as ground surveillance. Early adopters include:

- energy companies,

- fire departments,

- farms,

- construction firms and

- insurance inspectors, among others.

While some of these users may currently fly small unmanned systems, a large unmanned aircraft’s dramatically improved endurance, more sophisticated sensor payloads and onboard data processing is transformational.

The aircraft in this early stage are familiar to today’s unmanned aircraft operators. At first, they generally are remotely piloted, but onboard autonomy steadily increases through the early 2020s.

During this period, research and development activity for cargo and passenger aircraft progresses, with early-stage prototype aircraft designed for low-altitude and relatively short-range flight.

Second Stage Adopters (2025-2031)

Following research and development activities during the previous period, cargo aircraft for short-haul flights at relatively low altitude debut for use. It is not uncommon for these aircraft to fly over rural areas or regions with few inhabitants.

Following research and development activities during the previous period, cargo aircraft for short-haul flights at relatively low altitude debut for use. It is not uncommon for these aircraft to fly over rural areas or regions with few inhabitants.

At the same time, intra-city passenger aircraft fly at low altitudes, frequently serving as a taxi or shuttle service. While these passenger aircraft can fly without an operator onboard, early iterations commonly have a pilot onboard as both a backup for the automated system and to mollify passengers who are not yet fully accustomed to this new experience.

By the end of this period, research spending increases on high altitude aircraft that provide telecommunication services to rural areas lacking connectivity.

Research and development activities focused on increasingly autonomous long-haul passenger and cargo aircraft (35,000 lbs. and above max takeoff weight) drive overall spending during this time and set the stage for growth in manufacturing and services such as operations, maintenance and repair.

Later Adopters (2032 and beyond)

Early prototypes of long-haul passenger and cargo aircraft roll out during the early years of this decade, leading to increasing levels of production by 2036. During this period, early adopters fly unmanned cargo aircraft on long-haul domestic and international flights.

As with earlier iterations of unmanned passenger aircraft, many of the jets still have a pilot onboard even though the aircraft conducts the trip as a fully autonomous flight. These aircraft account for an increasing – although still relatively small – share of passenger jets produced during this decade, signaling strong upside growth in the 2040s and beyond.

Adoption Headwinds

Aided by strong market momentum during the 2030s, advocates for autonomy face diminishing headwinds around large unmanned aircraft.

- Acceptance from some consumers – particularly for passenger aircraft –take time to fully develop. Optionally piloted aircraft help to mitigate concerns

- Liability and insurance issues need to be considered and resolved where appropriate

- Infrastructure (e.g., airports) require updates to account for growth in large unmanned aircraft. This is an opportunity for job creation, but any delays in funding pose a risk to market development

By recognizing and addressing these variables now, the future of unmanned systems will be better positioned for the aviation community to mitigate any possible delays and risks – and possibly even accelerate expansion.

The Nature of Adoption: Substitution, Incremental Growth, New Applications

To make sense of the technological and commercial pathways toward large-scale autonomous aircraft becoming relevant and ubiquitous, it is helpful to think of three adoption categories: substitution, incremental growth, and new applications.

To make sense of the technological and commercial pathways toward large-scale autonomous aircraft becoming relevant and ubiquitous, it is helpful to think of three adoption categories:

- substitution,

- incremental growth, and

- new applications

Substitution: The future of unmanned systems lies in autonomous unmanned aerial vehicles. They will replace aircraft in mature aviation sectors such as agriculture, cargo and passenger travel. These market segments, at present served by manned offerings, are well established: aircraft manufacturers and services firms, as well as business and consumers, thrive today.

The Substitution segment rests on three pillars:

- Manned aircraft have been operating for decades in this market segment (from crop dusters to the most advanced wide-body passenger jets)

- Autonomy will evolve current aircraft (e.g. removing the cockpit and life support systems from fully unmanned aircraft or providing rudimentary emergency controls only for a single operator)

- These innovations will make aircraft more efficient and cost effective; despite their evolutionary nature, the knock-on effects may be powerful, allowing savings to be reinvested in related areas, such as propulsion or materials advances

Incremental Growth: Other segments of the newly emerging autonomous aircraft market will straddle the middle ground between established economic sectors and truly disruptive applications. Incremental Growth will occur in those segments where airborne applications are not as firmly established due to existing economics or manned-aircraft limitations.

Therefore, this segment will be poised for more profound change and benefit from steady improvements in autonomy and the erosion between the categories of manned and unmanned. Various large-scale surveillance or public safety systems fit best in this category.

Incremental Growth can be characterized by the following themes:

- Some of these sectors are already served by unmanned (but remotely piloted) aircraft of various weight classes and capabilities

- In this category of aircraft, there are few remaining efficiencies to be derived from onboard-control reductions

- The likely bridge between the two segments will be severing the tether between these legacy systems and their remote pilots; increased flight duration, unencumbered by shift changes of pilots, is a natural follow-on

New Applications: Large unmanned aircraft also offer a dramatic change for industry and consumers in new market segments.

In some cases, these will be highly visible consumer-oriented solutions such as airborne taxi and short-haul delivery or passenger services. Others may have industrial impact such as heavy-lift UAS at worksites, replacing massive and costly cranes that are ubiquitous at building sites.

- While these aircraft may not be that revolutionary mechanically, their avionics and software “brains” will be notably different

- During the early years, an operator may remain in-the-loop during high-consequence and one-off assignments such as heavy-lift UAS at a building site

- Many, however, will have a high degree of autonomy, providing complex, but perhaps more repeatable and long-duration tasks

While segmentations can make analytical sense of these emerging tech developments, reality always intervenes. There is the potential for substantial overlap between the sectors and their impact on both consumers and business in the future of unmanned systems.

Large unmanned cargo aircraft operating in dense urban zones may largely manifest as a substitution effect, due to their size and cost as well as the risk they could pose to people and assets on the ground; thus, they may only gradually replace manned aircraft.

On the other hand, cargo aircraft operating over remote airspace or large bodies of water may become fully unmanned and autonomous in the not too distant future, operating in a conveyor belt like fashion that is hard to imagine today. Such revolutionary aircraft are best described as a “new build” phenomena.

Cargo aircraft operating over remote airspace or large bodies of water may become fully unmanned and autonomous in the not too distant future, operating in a conveyor belt fashion that is hard to imagine today.

Finally, flight altitude may be another notable determinant of how unmanned aircraft operate during the coming decades. Most New Applications aircraft will likely operate at low altitude (air taxis, heavy-lift UAS, surveillance systems, etc.).

These solutions will be highly visible to the public and may operate in densely populated areas requiring significant regulations and safeguards. Substitution and Incremental Growth systems will be more prevalent in higher altitudes, to include cruising altitudes and beyond.

Large cargo and multi-passenger aircraft are the most obvious examples. Some solutions are sure to defy easy definition, reflecting a unique confluence of ambition and imagination.

High-altitude telecommunications unmanned aircraft providing broadband to underserved areas, essentially playing the role of ultra-low orbit satellites, could easily be categorized as New Application systems. Yet in form they are better classified as a Substitution solution.

The future of unmanned systems’ adoption timing for these systems is likely to be counterintuitive as well. Some New Application systems, such as large unmanned aircraft designed for industrials-sector missions, are on the cusp of wider adoption.

Yet Substitution systems, for instance pilot-less widebody passenger aircraft are still many years in the future. Indeed, the public and regulators are more likely to accept a new tool or development than a major modification of a well-established and understood way of accomplishing tasks.

When coupled with cost, and human and financial risks, progress for such systems will be slow and sporadic in the early years.

Economic and Societal Transformation

The economic impact of unmanned and autonomous aircraft is complex, in part because business and consumer adoption is tied up with how society embraces other daily technologies that make decisions for themselves. Analysis suggests that tens of thousands of high-value jobs could be sustained by large unmanned aircraft production and operation.

The knock-on economic effects, largely jobs created around or in support of aerospace-sector commercial activity, are likely to be many multiples of this number.

While driving overall growth in the aerospace sector, the future of unmanned systems is a shift toward autonomous aircraft that will drive lower labor costs and other efficiencies.

While driving overall growth in the aerospace sector, the future of unmanned systems is a shift toward autonomous aircraft that will drive lower labor costs and other efficiencies.

The public may associate this with a declining need for pilots but that need not be the case, particularly if the overall number of aircraft in service grows due to lower operating economics. Indeed, in the early stages, unmanned but only lightly autonomous large aircraft will drive a countervailing demand for remote pilots, as experienced in dramatic fashion by the U.S. Air Force.

The near-certain intensification of air traffic in many new aircraft-type categories driven by increased autonomy will also counter-balance this trend by driving growth in other high-skill areas.

For instance, the need for air traffic management staffing will grow at traditional airports but also within the commercial sector as companies, new to airborne operations, begin operating fleets of aircraft for the first time.

There are additional factors when considering how savings in one aspect of the aerospace sector can lead to growth and investment in another. More efficient aircraft logistics management will lead to lower per-hour flight costs, reduced airport fees and lower support expenses. In turn, this will drive greater demand for prized aircraft manufacturing and maintenance jobs.

Similarly, autonomy will also support the development and growth of many value-added services (data analysis from surveillance aircraft, premium transport of goods/people, greater demand for airborne shipping or telecommunications connectivity to name a few). Carefully crafting labor and other policies will both maximize the positive economic impact of growth in unmanned and autonomous systems, and smooth out difficult employment transitions.

There are societal and humanitarian benefits beyond economics that must also be considered, particularly when weighing these technological advances and how policy or regulations may need to accommodate them. As an example, how long until large firefighting UAS led by military-grade swarm algorithms, systematically douse forest fires?

Advances on the ground are also likely to drive significant economic activity. Infrastructure investments at existing and new airports and terminals will be needed to accommodate dramatic increases in around-the-clock traffic.

This will require regular assessments of everything from zoning to ensuring environmental considerations are heard, similar processes to today’s challenges but on a far larger and more consequential scale that stays a step ahead of the steady adoption of large autonomous commercial aircraft and the future of unmanned systems.

Conclusions & Recommendations

The biggest barrier in the way toward this future of unmanned systems is a status quo mindset. The small UAS segment offers indications of the challenges ahead for the future of unmanned systems.

First, rulemaking that cannot anticipate innovation will clearly hamper the development of emerging unmanned aircraft technologies.

Second, industry and operators cannot flourish while domestic and international regulatory bodies struggle with unclear and/or overlapping roles.

Finally, commercial unmanned aircraft must emerge from the shadow of an outdated military export control regime that could classify a civilian unmanned aircraft as a cruise missile. Such overly restrictive rulesets curtail exports and risk spoiling U.S. leadership in this emerging global market.

To that end, the following recommendations prioritize aviation safety while encouraging commercial innovation and fostering a leading U.S. market position:

- Regulators must anticipate the near-term arrival of technology that allows unprecedented UAS density and flight persistence

- Regulators should codify the near-term needs for detect-and-avoid operations, autonomous certification and spectrum allocation.

- They should also focus increasingly on larger certifiable classes of aircraft operating in the global airspace system, including above Class E (according to the FAA, Class E includes airspace up to – but not inclusive of – 18,000 ft. mean sea level).

- This technology must be compatible with existing and future air traffic management systems and infrastructure.

- Autonomy, sensor technologies, and spectrum are the enablers for this integration and are on their way to allowing beyond visual line of sight operations; a critical capability for certified UAS.

- Furthermore, regulators need to engage in near- and long-term application of this technology and partner with industry to develop performance-based standards as part of their rulemaking process.

- Regulators must work to harmonize international UAS regulations and ensure that performance-based consensus standards are developed in an orderly fashion

- Dedicated international regulatory efforts continue among entities such as the European Aviation Safety Agency, which in 2009 established a technical framework for all UAS operations regardless of their weight in the European Union (EU).

- EU rules will likely treat unmanned systems as a new type of aircraft, with “proportionate rules based on risk of operation.”

- To achieve UAS integration into the global airspace system, there should be increased regulatory reliance on performance-based international consensus standards.

- There are myriad domestic and international committees, working groups and associations undertaking standards development.

- Yet they do so without clearly defined roles and responsibilities within the larger integration effort.

- This makes overlap likely between the numerous standards entities.

- Despite the laudable efforts of these organizations, and the incorporation of the American National Standards Institute, this work could result in regulatory regimes that are confusing, contrary and duplicative.

- The U.S. government must support modification of civilian UAS-related export and trade restrictions which unnecessarily constrain U.S. market leadership and influence on global standards

- The Missile Technology Control Regime framework must be reformed to distinguish between missiles and civilian UAS.

- The United States must ensure its application does not needlessly impinge upon the national security, foreign policy and economic benefits of American UAS exports.

The trajectory and speed of large unmanned aircraft market development is predicated on the establishment of a clear regulatory framework. Inaction in the U.S. would result in a redirection of growth to countries and regions that take the lead. U.S. industrial leadership, coupled with a supportive and robust regulatory environment, will drive substantial economic and societal benefits at home, to include job creation, improved consumer experiences and industrial efficiencies.

This study was prepared in partnership between Avascent and AIA.