2020 Civil Helicopter Market Retrospective

The year started on a shiny note in January 2020 at Heli-Expo, with buzz around Clean Sky projects, next generation aircraft, and Advanced Air Mobility (AAM) initiatives such as the Bell Nexus and City Airbus.

However, it of course goes without saying that by the end of 2020, much has changed, with some long-lasting implications. Was 2020 the worst year for the helicopter industry?

Another Black Monday for the Helicopter Market

On Monday 8th March, crude oil fell by 26% and the WTI [1] price reached $20.48 a barrel. The helicopter market is used to volatility, having been severely impacted by the 2015 crisis (with barrels below $40); yet it was certainly not ready to face negative trading prices (-$37 per barrel) in April 2020.

The Covid-19 pandemic has accentuated the devastating impact of the oil plunge with extremely low consumption for several months.

With virtually no improvements since 2016, OEMs increasingly anticipate that the Oil & Gas (O&G) market may no longer drive meaningful demand, and they are considering different options to repurpose their backlogs of mostly medium-sized rotorcraft.

2020 Welcomes fewer models

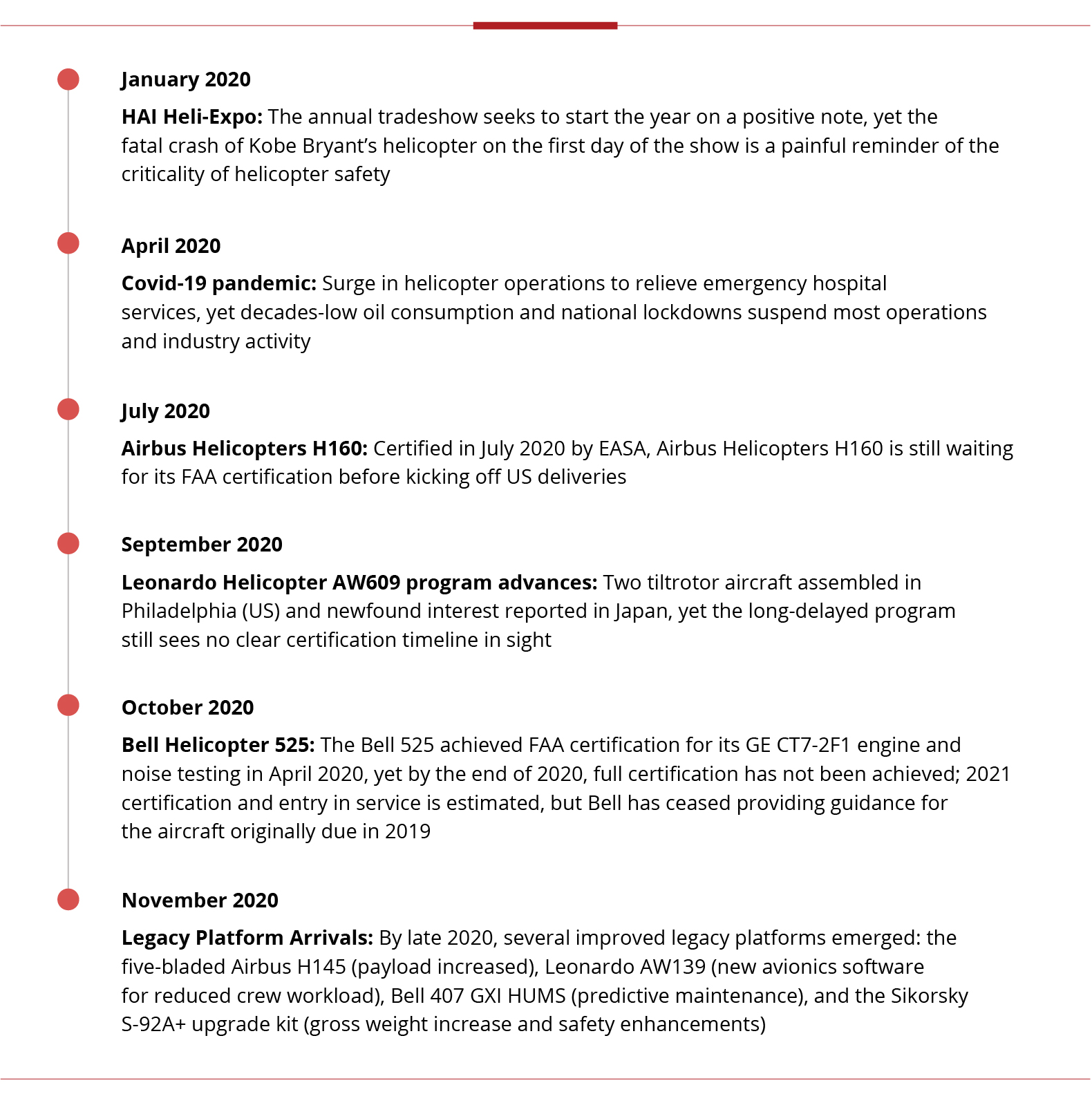

The Bell 525, Airbus H160, Leonardo AW609 and the Russian Ka-62 are from the same design generation and were expected to enter service by 2020. However, the pandemic has delayed usual testing and manufacturing activities.

Once certifications are eventually granted, this does not mean a complete victory. Given the downward pressure on the O&G market, sustained sales will likely be affected by downward pricing pressure in other customer segments.

Furthermore, ongoing customer preference for second-hand rotorcraft, due to well-established OEM support networks, adds further tensions to the helicopter market.

Light EMS Helicopters to the Rescue

Despite challenges for medium-sized helicopters, the pandemic has highlighted the criticality of light helicopters (single/twin engine) to support MEDEVAC and pandemic relief efforts.

Largely unimpacted by the 2008 financial crisis or the 2015 oil plunge, the EMS[2] segment of the helicopter market remains the most robust and buoyant sector.

Despite tighter budgets due to pandemic-induced utilization increases and maintenance needs, as well as unplanned investments in additional protective equipment, a strong fleet modernization push is underway; appetite for light helicopters should not fade despite stretched liquidity.

Bold M&A

Leonardo’s $185M acquisition of Kopter was a major headline at Heli-Expo, though it was not a huge surprise: Leonardo has always been keen to stay relevant in the light single-engine segment relative to Airbus and Bell’s more advanced platform designs.

As of late 2020, Leonardo was considering possible production sites in Italy and in the US for the SH09.

The US is the biggest market for light helicopters, accounting for more than 40% of the new-build global civil helicopter market, and the emergence of a US-built disruptive Kopter SH09 could reshape regional competition.

Another light helicopter could appear in the coming years: the VRT500 from Russian Helicopters and Tawazun (UAE), equipped with a Pratt & Whitney PW207V engine and Thales FlytX avionics.

It registered several LoIs[3] in November 2019 at the Dubai Air Show. First prototypes were expected to be assembled in 2020 H2, however the pandemic delayed this optimistic timeframe.

Innovation Imperative

OEMs will need to consolidate their market shares and get fit for the coming “Helicopter Market 2.0.” Rethinking operating landscapes and envisioning new missions necessitates new concepts around unmanned systems and digitalization. Afterall, drones are not the only domain for start-up companies.

- Manned-Unmanned Teaming (MUM-T)

- Bristow Helicopters ran trials in the UK with a Schiebel S-100 Camcopter and a Sikorsky S-92 aircraft to improve Search-and-Rescue mission efficiency and response time.

- Unmanned

- OEMs are developing their own unmanned aircraft (e.g., Bell Autonomous Pod Transport-APT 70, Airbus Helicopters VR700), primarily to serve military missions, but paving the way for first responders’ types of role in the near term.

- Connectivity

- A new pre-requisite to improve engine and main systems support (e.g., rotor, landing gears) via real-time data analysis to optimize maintenance and parts management and reduce time on ground.

- Connectivity also becomes a game changer for life-critical missions, including the National Fire Agency of South Korea implementing voice and video real-time data transmission between rotorcraft and control rooms through IoT and LTE communications.

- Artificial Intelligence (AI)

- A key enabler to many initiatives above, contributing to detect and avoid sensors, reduced pilot workload avionics, maintenance optimization, and even proposed hybrid power plants.

2021 Big Predictions for the Helicopter Market

2020 was a difficult and peculiar year to say the least, but certainly not the worst. The immediate impact of the pandemic on helicopters has been diverse depending on sectors: many operations or development activities are on-hold, while in other areas there has been a surge in utilization (EMS, Firefighting, Disaster Relief).

Besides, market activity was showing recovery signs in late 2020, with leading lessors growing their order book.

However, the ripple effect on the helicopter ecosystem could be darker in the long term, with new-build helicopter pricing pressure and leaner operating margins potentially leading to more OEM consolidation.

However, innovation still creates room for new platforms, new markets, and even new players.

For instance, Hill Helicopters (UK) aims to introduce a revolutionary HX50 light single engine helicopter by 2025, which will make for interesting competition against existing popular offerings such as:

- Bell 505,

- Airbus H125,

- Leonardo SH09, and

- Russian VRT500

While these traditional light helicopters may find new success, OEMs will also be keeping a close eye on the arrival of new eVTOLs that are eager to soon disrupt this market.

References:

- https://www.eia.gov/todayinenergy/detail.php?id=24432

- https://www.ft.com/content/a5292644-958d-4065-92e8-ace55d766654

- https://www.airbus.com/newsroom/press-releases/en/2020/07/the-h160-receives-easa-approval.html

- https://www.flightglobal.com/helicopters/no-commitment-on-final-date-but-bell-525-certification-tests-finishing/140383.article

- https://www.avascent.com/news-insights/weekly-wire/the-weekly-wire-for-your-situational-awareness-8-6-20/

- http://koreabizwire.com/firefighting-helicopters-to-transmit-real-time-video-and-voice-data/175915

- https://tass.com/defense/1206787

- https://www.airbus.com/newsroom/press-releases/en/2020/10/milestone-becomes-first-leasing-customer-for-multimission-h160.html

- https://verticalmag.com/news/hill-helicopters-hx50-experimental-approval-strategy/

Alix Leboulanger was a Research Associate with Avascent before moving to Janes in January 2021 following its acquisition of Avascent’s defense market analytics business, otherwise known as Global Platforms & Systems (GPS).

As part of the Avascent Analytics team, Alix was a leading contributor to civil and military helicopter market analysis.

Prior to joining Avascent, Alix was an Industry Analyst with Frost & Sullivan, specializing in military, para-public and commercial helicopters, platform-related aftermarket support, helicopter systems, as well as military training and simulation.

Moving forward, Janes and Avascent are committed to ongoing collaboration to help aerospace and defense clients address pressing strategic challenges.

Subscribe to the Avascent Altimeter

We invite you to subscribe to the Avascent Altimeter – Insights delivered to your inbox on critical issues shaping the Commercial Aerospace industry’s future.