The Aerospace Startup Landscape, Part 2: Funding “Recalibration”

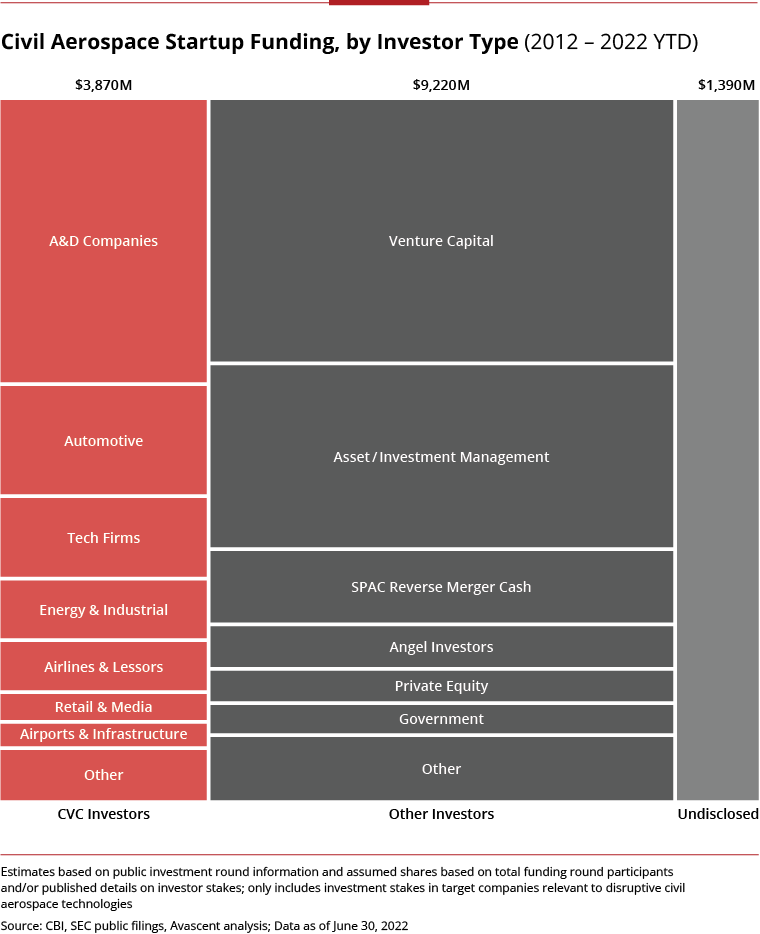

Over $14B has been funneled into a range of disruptive aerospace startups poised to reshape aviation, cultivated by an increasingly diverse set of committed investors, as analyzed in Part One of this two-part series on the Aerospace Startup Landscape.

Corporate venture capital (CVC) entities are now a notable driving force, alongside an array of venture capitalists, government affiliates, angel investors and institutional funds.

Despite a worsening economic environment, there is sufficient momentum in place to ensure the lasting presence of aerospace startups in the future industrial base.

CVCs and other sector-specialized investors will find that the newly emerging “recalibration” phase is an ideal opportunity to establish or refine their strategic engagement plans with aerospace startups.

The civil aerospace startup ecosystem has expanded dramatically over the last decade and become a force to be reckoned with.

For an industry that is notoriously known for high entry barriers, the scale ($14B) and the pace of investment (75% raised since 2019) is as necessary as it is astounding.

Compelling technologies and greater urgency to deliver more efficient, sustainable air travel are at the heart of the aerospace startup boom, yet low interest rates and a strong economy have been also greasing the wheels.

As these macroeconomic conditions reverse course, however, investors are reevaluating their exposure to riskier startups relative to other safer investments.

Most startup founders that have only ever known a period of abundant, zero-cost capital are beginning to face a new reality.

Yet despite growing fears of a sharp, protracted downturn, a temperate “recalibration” period is instead the most likely outcome in the years ahead, whereby a smaller, yet still modest capital pool will be funneled more judiciously to aerospace startups with sound business plans and rational burn rates.

Productive consolidation and vertical integration opportunities will also emerge for leading startups and traditional suppliers alike, altogether helping ensure that transformative aviation technologies enter the market in a safe, timely, and impactful fashion.

Two key factors support the plausibility of this “recalibration” scenario.

For one, airline customer demand signals for transformative, sustainability-minded solutions have proven resilient amidst recent upheaval across the airline industry. These signals only continue to grow louder.

Just as important, however, is the growth in the investor base that is committed to fostering the technological transition.

The diversity of investors has grown as quickly as the industry itself, and now comprises Corporate Venture Capital (CVC), traditional VC funds, startup accelerators, government-affiliated entities, and numerous angel investors.

Although this includes many one-time investors, funding data indicates that there are expanding factions of committed, seasoned investors who are familiar with the long investment time horizons typical to aerospace innovation.

These investors will not only help promote a softer “recalibration” scenario ahead, but also discover that this period is an opportune moment to shape the outcome of the next aerospace revolution.

Newfound Opportunity for Corporate Venture Capital (CVC)

The investor base behind aerospace startups has grown more diverse in large part due to corporate venture capital (CVC).

CVC entities were barely involved in the aerospace startup ecosystem just five years ago, yet since that time they have invested nearly $4B.

By continuing to support aerospace startups – not just with capital but with their unique industry expertise, customer access, and engineering resources – CVCs will find this a uniquely advantageous time to bolster their technology roadmaps and accelerate their market strategies.

Many CVCs will face funding challenges as their own corporate entities navigate market pressures, but they can benefit from an expected near-term pullback from some larger institutional funds that are not typical venture participants.

Having become overexposed to startups as their public stock portfolio values plummet, the exit of some large funds from venture investing will support more palatable future funding terms for CVCs and other committed investors.

Proper investigation into the growing role of CVC in aerospace warrants separate, dedicated analysis, but these investors are commonly motivated to:

- Build awareness of new disruptive technologies

- Shape external innovation activities to complement and advance internal technology roadmaps and business plans (and vice versa)

- Establish in-kind supply chain contribution opportunities to kickstart new revenue streams

- Promote the overall maturation of new advantageous market opportunities

- Enhance a company’s corporate brand and attract new talent

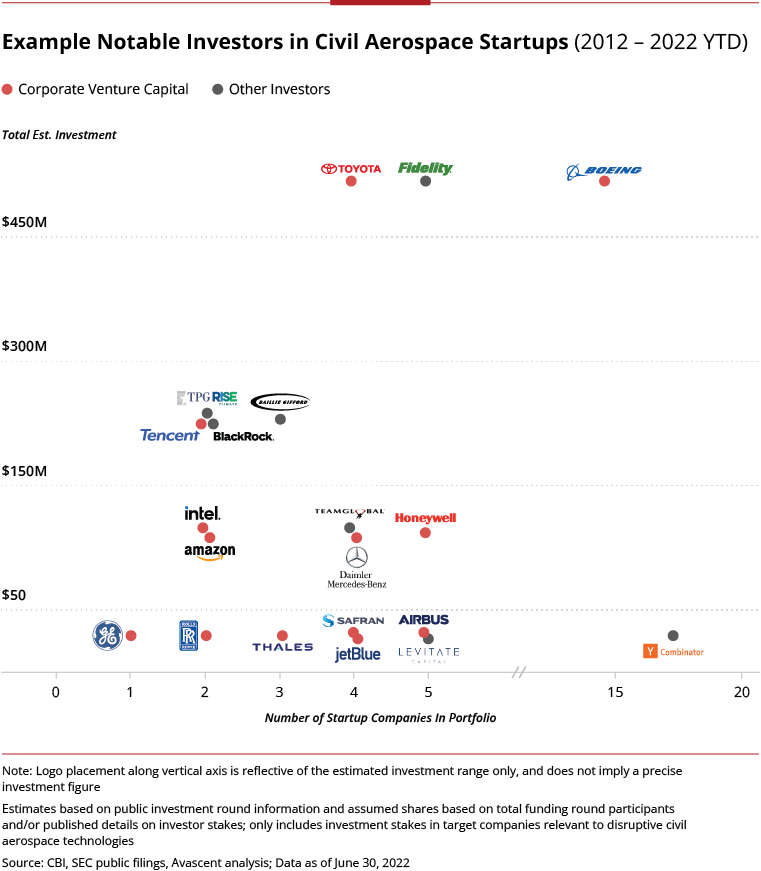

As one might expect, aerospace and defense (A&D) and airline CVCs have been the most prominent investors. Boeing’s $450M investment in eVTOL company Wisk (2022) and its HorizonX venture activities have set it apart[1], but other major aerospace OEMs such as Honeywell, Safran, and Thales are taking early stakes in areas relevant to their portfolios (e.g., avionics, autonomy, power systems, etc.).

Airlines such as JetBlue and United Airlines, meanwhile, are investing in novel aircraft concepts that have the potential to unlock new market opportunities in a sustainable fashion.

CVCs outside of aerospace have been surprisingly active. Whether driven by competitive threats or sensing new market opportunity, leaders in mobility markets (e.g., Toyota, Daimler), IT (e.g., Tencent, Intel), retail (e.g., Amazon), energy (e.g., Shell, Air Liquide), and other verticals are becoming a powerful investment force shaping the aerospace startup ecosystem.

Mission-driven Venture Capital Funds

Venture Capital (VC) has of course also been instrumental in advancing aerospace startups.

Two-thirds of the estimated $3.5B contributed by VC firms can be tied to more than 125 entities that have participated in multiple startup funding rounds. Their patience and understanding of long aerospace investment timelines should help keep credible startup companies moving forward.

Such specialists include aerospace industry experts (e.g., Levitate Capital, Team Global) as well as broader climate technology funds focused on zero-emission solutions (e.g., TPG Rise Climate and Breakthrough Energy Ventures).

Esteemed seed stage venture accelerators like Y Combinator, meanwhile, have helped launch nearly 20 aerospace startups, including many who have subsequently raised large funding rounds (e.g., Boom Supersonic, Volansi, Iris Automation, and REGENT).

The Next Chapter for Aerospace Startups

The “recalibration” that lies ahead for the civil aerospace startup ecosystem will unfortunately drive out good ideas and capable founders whose main shortcoming is just poor timing.

But in an industry where aerospace startups had perhaps started to climb too fast, a more measured investment period supported by seasoned industry investors will allow healthier, better prepared companies to drive a more impactful transformation of the aviation landscape.

Continued funding will obviously be essential, but in a more difficult operating environment, trusted advisor relationships will become the next most valued currency for the most promising aerospace startups.

Footnotes:

[1] HorizonX investments include relevant activities during Boeing’s direct ownership period through 2021, as well as those that have occurred with Boeing as a partner to AE Industrial Partners

Subscribe to the Avascent Altimeter

We invite you to subscribe to the Avascent Altimeter – Insights delivered to your inbox on critical issues shaping the Commercial Aerospace industry’s future.