A First Look at the Next-Gen Regional Aircraft Industry Landscape

![]()

“That we are demonstrating the practicability of aerial transport is due to the courage and the patience, the vision and the persistence of those who designed and built and flew the craft which have startled and inspired.”

– 1920 Aircraft Year Book, Issued by Manufacturers Aircraft Association, Inc.

Off to the side of the urban air mobility (UAM) spotlight, momentum has been building behind a set of nearly 60 aircraft manufacturers (OEMs) targeting regional missions over 100 miles.

This influx of competitors underscores the fortuitous timing of disruptive new propulsion technologies that can revive a troubled regional aircraft industry.

Will these new aircraft arrive quickly enough?

Prominent OEMs that once hoped for a mid-2020s service entry are facing longer, costlier development timelines, and aircraft range and capacity targets are falling below those first proposed on paper.

Despite these setbacks, many of today’s OEMs possess “vision and persistence” much like the innovators from the 1920s who founded the powered aircraft industry.

These early entrants are establishing a much-needed foundation for a new regional air travel ecosystem that can cultivate continued innovation well into the future.

Governments, investors, and existing industry stakeholders should continue to explore how this playing field will evolve and the myriad of ways in which their support can accelerate development timelines and yield rewarding results.

The Early Shape of the Next-Generation Regional Aircraft Industry

Much like UAM competitors, new regional aircraft OEMs recognize the transformative opportunity afforded by new technologies.

As introduced in the Avascent Altimeter in November 2021, the economic and environmental benefits offered by battery, hydrogen, or hybrid propulsion concepts – as well as autonomous flight technologies – can reinvigorate the regional aircraft industry that has been plagued by rising fuel and labor costs.

With this market potential in mind, the next-generation regional aircraft industry is getting crowded.

Nearly all concepts are fixed-wing, conventional or short take-off designs that provide greater range, reduce or eliminate emissions, use existing infrastructure, and should be easier to certify relative to typically more complex eVTOLs.

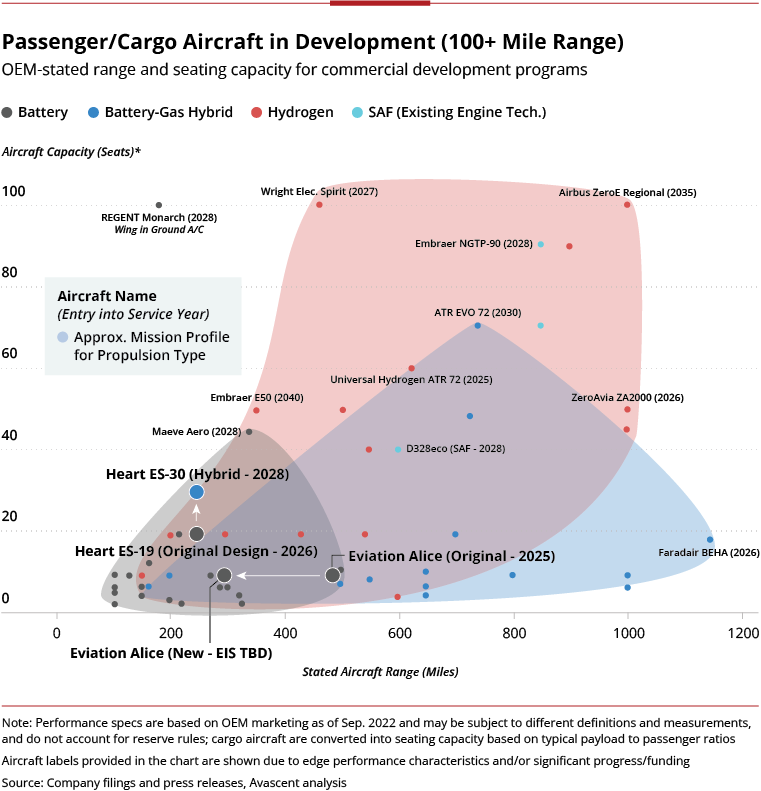

Given the immaturity of various propulsion concepts and other enabling technologies, the current aircraft performance “trade space” – defined by the OEMs themselves – is very broad, and not necessarily a realistic view of the future industry’s end state.

Nonetheless, there are still useful early implications for regional aircraft industry stakeholders as initial performance, economic, operational, and environmental tradeoffs come into view.

Battery-gas Hybrid

The graphic illustrates the notable design freedom afforded by hybrid concepts, due to various degrees of hybridization available for implementation.

New materials, more efficient power electronics, power-dense motors and advanced flight control solutions are examples of important inputs needed to mitigate weight penalties that are typical for more complex hybrid architectures.

Hydrogen

Hydrogen appears to offer even greater flexibility. Both fuel cells and hydrogen combustion should each have a role to play and sustain a relatively broad hydrogen trade space.

But identifying the most effective balance between range, capacity, and economics will depend on many new innovations – especially those that can minimize onboard hydrogen fuel storage systems that threaten seating capacity and unit costs.

Battery

Two of the more prominent entrants in the regional aircraft industry are now also some of the first to publicly acknowledge the stark realities of battery-powered flight.

- Swedish startup Heart Aerospace unveiled its 19-passenger ES-19 concept at the company’s launch in 2018, offering a 250-mile maximum range on battery power. As of September 2022, it has abandoned the ES-19 in favor of a larger 30-seat design with a hybrid architecture to ensure better usable range. Development costs for this new ES-30 concept will likely balloon significantly, and service entry is now delayed two years behind the ES-19’s original 2026 estimate.

- Eviation made history with its impressive first flight of its 9-seater battery-electric Alice aircraft on September 27, 2022. Yet it has backed away from previous targets of an approximately 500-mile max range and a 2025 service entry. Following its first flight, Alice’s publicized range was nearly cut in half to just under 300 miles, and the EIS is now undetermined and dependent on the pace of battery technology improvements.

Establishing a Vision for the Next-Generation Regional Aircraft Industry

As the regional aircraft industry matures and select “first generation” aircraft move from paper designs to the hangar floor, the landscape and propulsion trade spaces will contract and evolve – especially once airlines begin placing stronger financial commitments and more seriously weigh

- Performance,

- Cost,

- Operational, and

- Environmental issues

Nonetheless, greater technical clarity will support the effective development of a wide range of specialized, purpose-built aircraft that can serve a myriad of meaningful regional missions.

Subscribe to the Avascent Altimeter

We invite you to subscribe to the Avascent Altimeter – Insights delivered to your inbox on critical issues shaping the Commercial Aerospace industry’s future.