The Startup Aerospace Company Landscape, Part 1: Introduction

This is Part 1 of a two part series focused on the startup ecosystem. A deep dive on the investor base is available in Part 2 here.

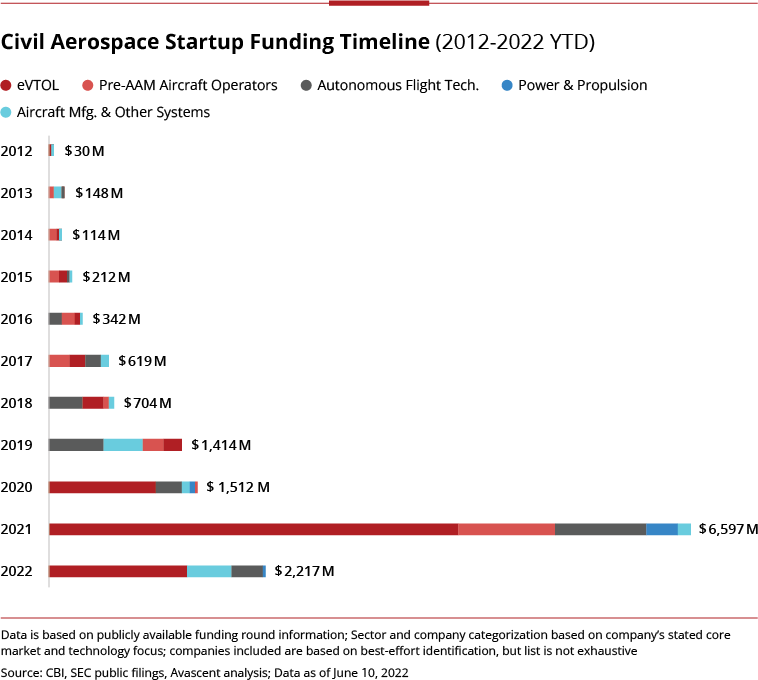

Startup aerospace companies seeking to disrupt existing aviation markets or establish revolutionary air mobility concepts have attracted over $14B worth of investment over the last decade.

Early momentum that was established by just a few pioneers looking to increase the efficiency of short-haul air transportation has since been accelerated by a newfound urgency to decarbonize the broader aviation ecosystem.

In 2021, the nearly $7B raised by startup aerospace companies was roughly equivalent with the total amount spent by today’s leading aircraft and engine manufacturers on commercial aircraft R&D.[1]

As multiple enabling technologies mature, including advanced manufacturing, materials sciences and machine learning, a wide array of entrepreneurs – and investors – are rushing in to help redefine air transportation.

There are of course plenty who have fallen by the wayside in this new civil aerospace “gold rush” and more will continue to do so, especially as we enter a more precarious macroeconomic environment in the second half of 2022.

But with a strong foundation in place across a range of key technology areas, the ecosystem for civil startup aerospace companies is poised to play an increasingly important role across the industry, necessitating more concerted engagement strategies from traditional aerospace suppliers.

The Startup Aerospace Company Landscape

Aircraft Manufacturing

Startup aircraft original equipment manufacturers (OEMs) have raised a combined $8.9B, 90% of which has been funneled to 17 leading OEMs.

Within this domain are numerous electric, supersonic, hypersonic, and even airship concepts that seek to disrupt everything from personal air mobility to commuter and regional air travel and eventually even long-range intercontinental flights.

Leading the investment pack, however, are electric vertical take-off and landing (eVTOL) vehicles within the Advanced Air Mobility (AAM) movement.

Special Purpose Acquisition Company (SPAC) transactions have helped drive this segment as of late, yet they have only generated $3B of the $7.6B total funds raised by eVTOL companies since 2012.

With $500M-$1B typically required to fund a new aircraft program through the onerous development process, the leading startup aerospace companies developing next-generation aircraft will likely undergo further consolidation.

But the relative diversity of market strategies in this field should still ensure 5-10 new aircraft enter service by the end of the decade.

Autonomous Flight Technologies

Approximately $2.8B has been invested in startup aerospace companies working to enable the safe operation and integration of increasingly automated and autonomous aircraft, allowing for more efficient, higher-volume operations.

Despite this common end-goal, regulatory immaturity and varied requirements across aircraft size classes and mission types have allowed a diverse playing field of 60+ companies to emerge and target unique market segments, including firms who want to not just build autonomous aircraft but operate them as well.

As the market evolves and technologies improve, there will inevitably be opportunity for a consolidated set of winners to build on successes in small aircraft applications and shift into larger, more complex aircraft use-cases.

Electric Power and Propulsion

The transition away from kerosene-based propulsion is a landmark moment in aviation’s history. Many new electric powertrain concepts aim to not only reduce aircraft operating costs, but also meaningfully decrease or eliminate emissions.

Over $500M has been directed to startup aerospace companies playing a discrete role in battery- or hydrogen-based powertrains, but this figure underestimates total startup-based development activities due to new OEMs’ in-house capabilities and unknown investments from private entities supporting leading startup aerospace companies like magniX.

Given the continued technical improvements needed across the electrification value chain and the scale of the market opportunity, startups still will continue to play a critical role moving forward and offer cooperative benefits to traditional aerospace propulsion providers.

Aircraft Operations

Although electric aircraft have yet to enter commercial service, a handful of “pre-AAM” operators who have committed to ordering eVTOLs and other disruptive air vehicles have raised nearly $2B.

These companies’ complex software solutions will be a critical enabler of next-gen aviation networks by optimizing aircraft supply and demand in high-volume urban and regional environments.

Final Thoughts on the Future of Startup Aerospace Companies

There were notable concerns at the beginning of the COVID-19 pandemic that hard-earned momentum supporting startup aerospace companies would fade amidst the worst downturn in aviation history.

Yet funding only accelerated during the pandemic, with approximately 75% of sector investments occurring since 2020.

This reflects an important silver lining of COVID-19, whereby industry stakeholders used this challenging period to seriously reflect on the need for more efficient and sustainable air transportation solutions.

Yet it also highlights how the surging interest in disruptive aviation technologies has coincided with – or is perhaps a function of – a period of unprecedented access to investment capital: as a point of fact, total venture capital investments across all industries exceeded $620B in 2021, nearly double that of 2020.[2]

As we now enter the second half of 2022 and a new world of declining liquidity and rising interest rates, a repeat of prior years’ performances appears unlikely in the immediate near-term as new unfamiliar investment hurdles emerge and startup aerospace companies continue to battle the technical, regulatory, and cultural challenges ahead.

Yet as Part 2 of this analysis will reveal, there is still plenty of room for continued progress and enthusiasm across the aerospace ecosystem, especially considering the strong baseline of earned investments thus far.

The shape, structure and volume of funding rounds may soon change, but the strong macro tailwinds and diversity of the investor base should help ensure that aerospace innovation remains well cultivated moving forward.

Subscribe to the Avascent Altimeter

We invite you to subscribe to the Avascent Altimeter – Insights delivered to your inbox on critical issues shaping the Commercial Aerospace industry’s future.