Hydrogen on the Rise

“Why are we doing this now in a crisis? We do not have a choice.”

– Grazia Vittadini, Airbus CTO at Airbus ZEROe Announcement

The August 2020 unveiling of Airbus’s zero-emission “ZEROe” hydrogen powered aircraft concepts was a defining moment for commercial aerospace.

For one, ZEROe legitimizes an important potential pathway to reducing aviation’s environmental impact. At the same time, it underscores how R&D initiatives will help the industry withstand and recover from the worst crisis in its history.

Although hydrogen’s future role is anything but certain, its momentum is helping unlock new funding to advance key enabling technologies — many of which will also help advance other competing “next-gen” aircraft architectures like battery or hybrid-electric.

Therefore, it is important to begin assessing hydrogen’s potential future impact on aviation, including its:

- Viability,

- Value proposition,

- Barriers, and

- Strategic opportunities

Hydrogen as an aircraft fuel source is not a novel concept; its three times higher energy density relative to kerosene incentivized its use in the first ever turbojet test engine in the 1930s.

Yet despite this advantage, hydrogen has not advanced past occasional studies and demonstrators over the last century due to significant economic and operational challenges.

Even now, a European Union Clean Sky report from May 2020 estimates that the earliest short-range hydrogen aircraft will likely be at least 20-30% more expensive per seat relative to traditional aircraft.[1]

The use of smaller aircraft and the abundance of non-passenger, lower-risk transport missions is well suited to the current maturities of autonomous flight control and clean propulsion technologies.

Additionally, a sizeable fleet of in-service turboprops provides opportunity for retrofit technology implementations that can materialize faster than clean-sheet aircraft designs.

Furthermore, few, if any changes to existing airport and ground infrastructure are required.

Why could things be different now, even with this cost disadvantage?

For one, hydrogen increasingly appears to be the most viable solution to dramatically reduce emissions for large aircraft flying over 100 mile trips, unless there is an unexpected dramatic improvement in battery technology.[2]

Furthermore, with this increasing government, industry, and public interest in “green” aircraft, it seems likely that new policies could offset hydrogen’s early cost penalties for airlines, allowing new concepts to at least get off the ground.

What Innovation Is Needed for Hydrogen-powered Aircraft?

Numerous innovations will still be needed in several areas to ensure that the business case for hydrogen-powered aircraft can stand on its own in the long run.

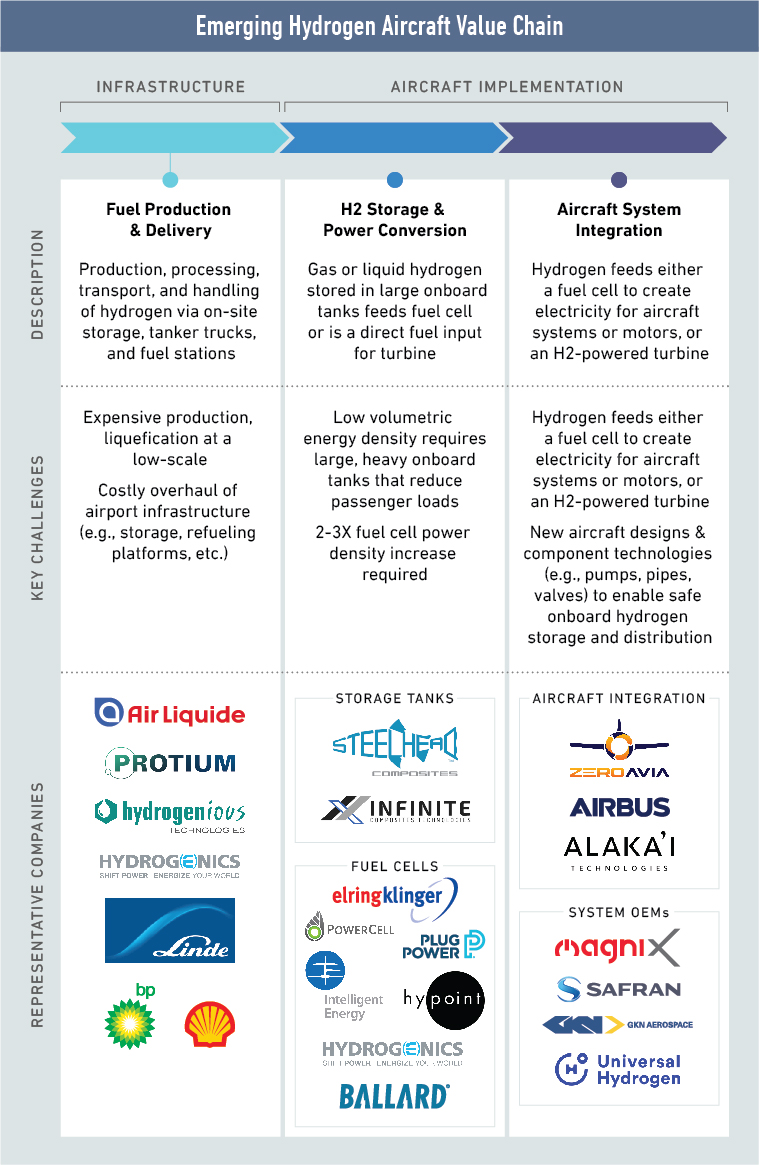

First, existing hydrogen production and delivery infrastructure must be improved. Adoption in other industrial sectors is underway, including in airport environments (e.g., hydrogen-powered ground equipment, catering trucks, etc.), but more is needed to generate sufficient scale that can drive down input costs.

Another impediment is hydrogen’s volumetric energy density, which is four times worse than conventional fuel and necessitates oversized on-board storage tanks that displace seats and harm aircraft economics.

Innovative new materials and cryogenic components are necessary so that safe, lightweight, custom tank systems can be effectively integrated with the airframe.

In addition, higher power density fuel cells and new turbines tailored to hydrogen’s combustion properties are required to optimize energy demand and operational economics.

Finally, aircraft OEMs must evaluate architecture tradeoffs (e.g., direct combustion, turbine-fuel cell hybrid, etc.) and assess the impact on airframe designs and component requirements (e.g., pumps, pipes, valves, on-board power, etc.).

Although it may be ambitious to count on large commercial hydrogen-powered aircraft in service by the mid-2030s, Airbus is not alone in its pursuits.

Other traditional aerospace suppliers like GKN and Safran are exploring hydrogen’s viability, while start-up firms like Universal Hydrogen and ZeroAvia are looking at drop-in solutions or smaller clean-sheet aircraft.

Recognizing the budding opportunity space, hydrogen specialists such as ElringKlinger and PlugPower are partnering to support aerospace OEMs with their initiatives. Further afield entities like Toyota even appear to be investigating how hydrogen can be applied to new eVTOLs.

Hydrogen now joins an array of other exciting new electric architectures seeking to revolutionize aviation’s next century, and this momentum offers external R&D opportunities for suppliers to help mitigate near-term losses and enhance long-term competitiveness.

[1] Clean Sky 2 Joint Undertaking, “Hydrogen-powered aviation: A fact-based study of hydrogen technology, economics, and climate impact by 2050,” May 2020.

[2] Ibid. “Hydrogen-powered aviation.”

Subscribe to the Avascent Altimeter

We invite you to subscribe to the Avascent Altimeter – Insights delivered to your inbox on critical issues shaping the Commercial Aerospace industry’s future.