Satellite Electric Propulsion: Key Questions for Satellite Operators and their Suppliers

Summary

- Electric Propulsion technology offers potentially disruptive cost savings that have implications across the satellite value chain

- Over the next three to five years, use of EP for satellite orbit-insertion is likely to see rapid growth; ABS and SATMEX are early adopters of the technology, but larger operators such as SES, Telesat, and others are likely to follow soon

- Expanded use of EP will offer satellite operators the opportunity to reduce mission costs and increase revenue, but will also present tough strategic questions

- Even before EP reaches its full market potential, satellite operators need to make critical business decisions regarding EP: When is the time to incorporate the technology? What types of satellites are most attractive? What are the risks of adopting? How can other customers be engaged to support R&D efforts?

Introduction

One year after Boeing’s announcement of the sale of two all-electric propulsion GEO communications satellites at the Satellite 2012 conference, the industry is again focused on satellite electric propulsion. This is not without good reason: Boeing’s 702 SP design, which uses electric propulsion (EP) to perform all of its orbit-raising maneuvers, boasts a dry mass percentage of 80%, far higher than typical industry ranges of 40-60%. That high dry mass ratio will enable the lightweight 702 SP to dual-launch onboard a Falcon 9 v1.1 without sacrificing payload capability (thereby cutting launch costs nearly in half). Its mission and financial parameters – which would be impossible without EP technology – sent shockwaves through the global commercial space industry. At the Satellite 2013 conference, several major operators indicated they expected to be purchasing their own “all-electric” satellites in the near future. Likewise several satellite manufacturers stated that they would soon introduce their own designs for an EP satellite.

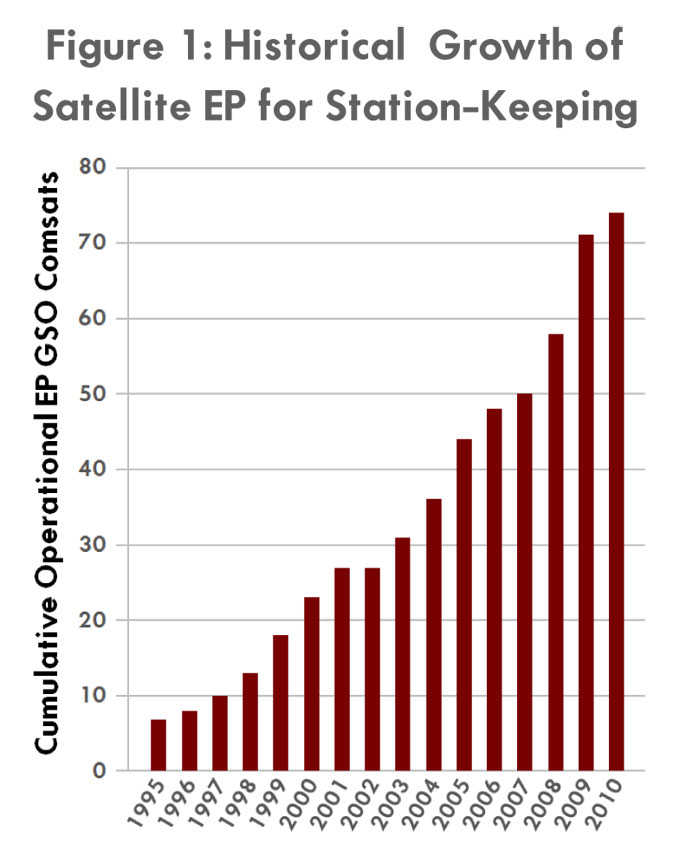

Though many were surprised by Boeing’s novel use of EP, the technology has been used on commercial satellites since the 1980s. Between 1995 and 2010 the cumulative number of operating geostationary communications satellites that utilize EP for station-keeping increased more than ten-fold to over 70 spacecraft (Figure 1). The technology’s widespread adoption has brought with it a number of benefits, including longer operational life and increased satellite dry mass for a given launch mass (and conversely decreased launch mass for a given payload mass). For commercial satellite operators, these effects directly translate into the ability to decrease costs for equivalent satellite capability and increase the amount of total life revenue generated by satellites.

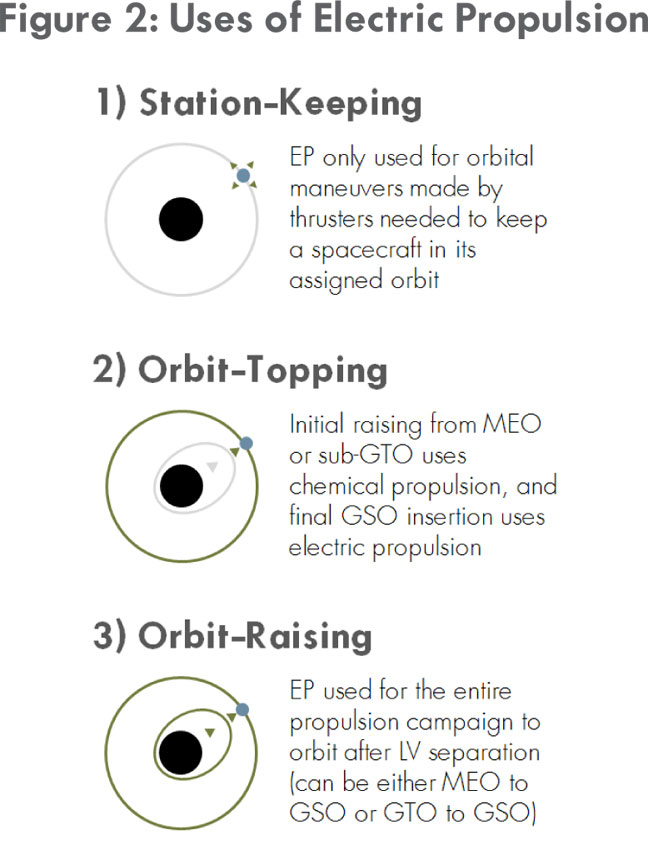

While the benefits of using EP for station-keeping have been significant, traditional chemical propulsion systems are still the main workhorses for more heavy-duty in-space propulsion tasks such as orbit-insertion. However, as early as 1999, satellite manufacturers saw success with EP “orbit-topping.” In orbit-topping, chemical propulsion provides the first series of orbit-raising maneuvers and afterward the orbit-raising campaign is completed using EP. Satellites that use EP for orbit-topping are said to have “hybrid” chemical/electric propulsion systems. The benefits of using electric propulsion for orbit-topping are the same as those for station-keeping, but with even greater financial and operational payoff.

With the introduction of the Boeing 702 SP, Boeing has done away with chemical propulsion altogether: when launched in 2014, the 702 SP will be the first spacecraft designed to use electric propulsion for the full orbit-raising campaign (though others have done so following failure of chemical systems).

Benefits and Drawbacks for Satellite Operators

All space stakeholders are familiar with the competing pressures in choosing a satellite’s design mass: on the one hand, larger satellites allow for larger payloads and higher power levels and accordingly, more revenue generating capability. On the other, heavier satellites cost more and require more powerful and more expensive launch vehicles. For many missions, launch costs range between one-fourth and one-half of total mission costs, so reducing these costs can make a substantive impact on the overall satellite return on investment. EP’s ability to reduce or eliminate the weight of a satellite’s chemical propulsion fuel and hardware allows satellite operators to select a less costly launch vehicle or make more efficient use of a given launch vehicle’s capability. In both cases, the real savings benefits of EP are from its impact on launch costs, which can be dramatic.

However, these savings come at a cost. Compared with chemical alternatives, EP provides significantly lower levels of total thrust. As a result, first generation all-EP satellites are expected to take between four and six months to reach their operational GSO orbit. From a satellite operator’s perspective, this can be a significant period of time to defer a satellite’s revenue generating potential.

Of course, financial considerations are not the only factors that matter in determining whether or not to opt for an EP satellite design. Satellite operators must also weigh the risks inherent in introducing relatively new technologies. Most of the EP thrusters and power processing units (PPUs) being considered today for EP orbit-insertion have at least some heritage from earlier models used for station-keeping, but the challenges associated with scaling up EP power and thrust levels are significant, especially for power processing units.

Key Questions for Operators

These conflicting considerations raise three primary questions for operators:

1. All-electric, hybrid chemical/EP, or neither?

While all-electric satellites have garnered most of the headlines over the past year, it may be enhanced hybrid chemical/EP satellites the have the most significant effect on reshaping satellite fleet architectures, launch vehicle designs, and the EP thruster and PPU provider base over the next five years. As of February 2013, only three major commercial satellite manufacturers were offering GEO communications satellites that use EP for the full orbit-raising campaign, while at least five were offering hybrid chemical/EP satellites. Operators must carefully evaluate where tradeoffs exist.

2. Which mission profiles? Which customers? How many and how soon?

While some government and commercial organizations have come out as champions of EP for orbit-insertion, others maintain that the technology is not a good fit for their missions, at least not yet. Operators must determine which of their new satellites are a good fit for EP – depending on customer preferences, replacement schedules, size and health of the overall fleet, regional considerations, and risk tolerance. Likewise, launch services providers and satellite manufacturers, for their part, must maintain an intimate awareness of their customers’ changing preferences and make sure their offerings are competitive and in-sync with market requirements.

3. New purchasing models?

Because EP satellites can be significantly smaller and lighter, they may also enable new purchasing arrangements or models. For example, ABS and SATMEX jointly purchased four EP satellites and two launch vehicles in a single contract. The companies got access to bulk-buy pricing efficiencies that are typically difficult for regional operators to capture, and the deal could signal a new trend of joint purchasing of multiple small all-EP satellites.

Conclusions and Recommendations

Use of electric propulsion for satellite station-keeping has already changed the global satellite industry, and now, with orbit-topping and orbit-raising, it is poised to transform it. Organizations may or may not best serve their stakeholders by being early-adopters of EP, but the inevitable growth in the technology’s use means they cannot ignore it in their strategic planning. Satellite operators should take the following steps in developing their strategy for electric propulsion:

- Assess financial attractiveness of existing and likely future electric propulsion offerings for the range of mission types, geographies, and customers served: The total financial impact of lower launch costs and greater revenue potential must be weighed against the premium cost of electric propulsion systems, deferred revenue during orbit-insertion campaigns, and financial risk implications of new technology introductions. Operators should study a diverse set of financial scenarios in order to understand when, how, and for whom they should procure EP satellites instead of traditional satellites.

- Clearly communicate technological, financial and schedule requirements to satellite and launch vehicle providers: Most satellite manufacturers have yet to introduce their all-EP offering, and even those that have are likely to introduce new or upgraded models over the next five to ten years. Different offerings will be attractive to different communities and will in turn influence the design of new launch vehicles, so it is crucial for operators to have the relevant analysis supporting their most preferred performance specifications and price points for manufacturers to target.

- Engage government stakeholders to invest: Government agencies have always played a key role in the development of satellite EP technologies. Now that the technology is achieving new heights, there is significant opportunity for commercial space leaders to engage with governments around the world in order to make sure that government investment in satellite EP technology both leverages the commercial sector’s capabilities and serves their mutual interests.