Private Equity Investing in Government Services: Bridge Opportunities in the Small Business Segment

Summary

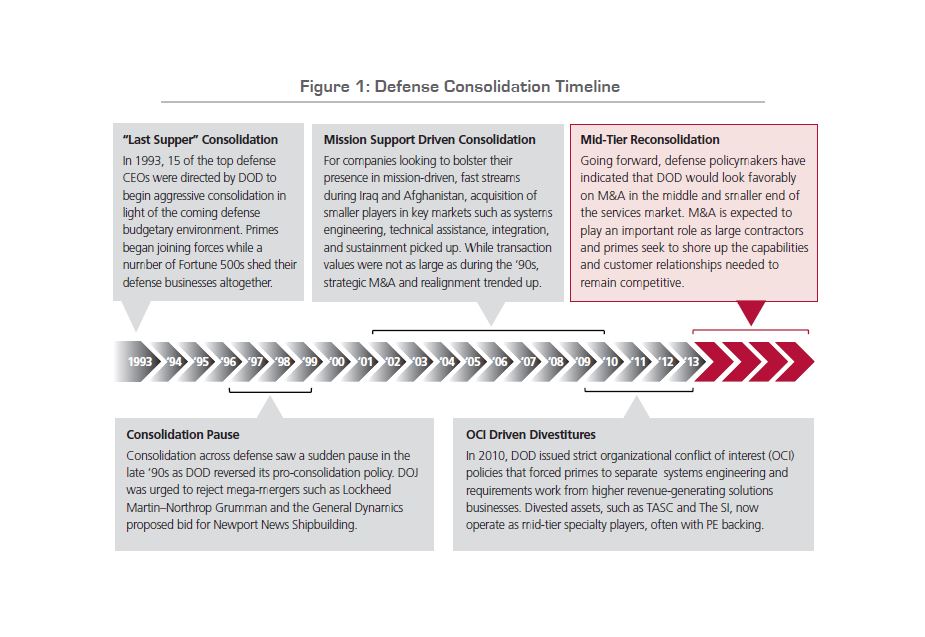

The budget-driven reorganization now underway in the defense services industry presents an interesting investment opportunity in the small businesses end of the market. Key dynamics (see Figure 1) have created opportunities for private equity to play a “bridge investor” role in the realignment process:

- Large services contractors and defense primes will seek to acquire customer relationships and other capabilities as they readjust their portfolios to remain competitive.

- As aging founders of small businesses with quality relationships and capabilities evaluate exit alternatives, the supply of potential acquisition targets in this space will grow.

- Large contractors, however, have had historically low success integrating smaller services businesses into their enterprises, and are therefore wary of transactions at the small end of the market.

- Opportunities now exist for PE buyers to acquire quality assets at attractive multiples, unlock value through asset rollup and increased cost-competitiveness, and position for a future exit to defense primes at higher “strategic multiples.”

- However, the small business end of the defense services market remains highly complex, requiring a strong diligence process to vet the business characteristics and market dynamics that will determine success or failure.

Introduction

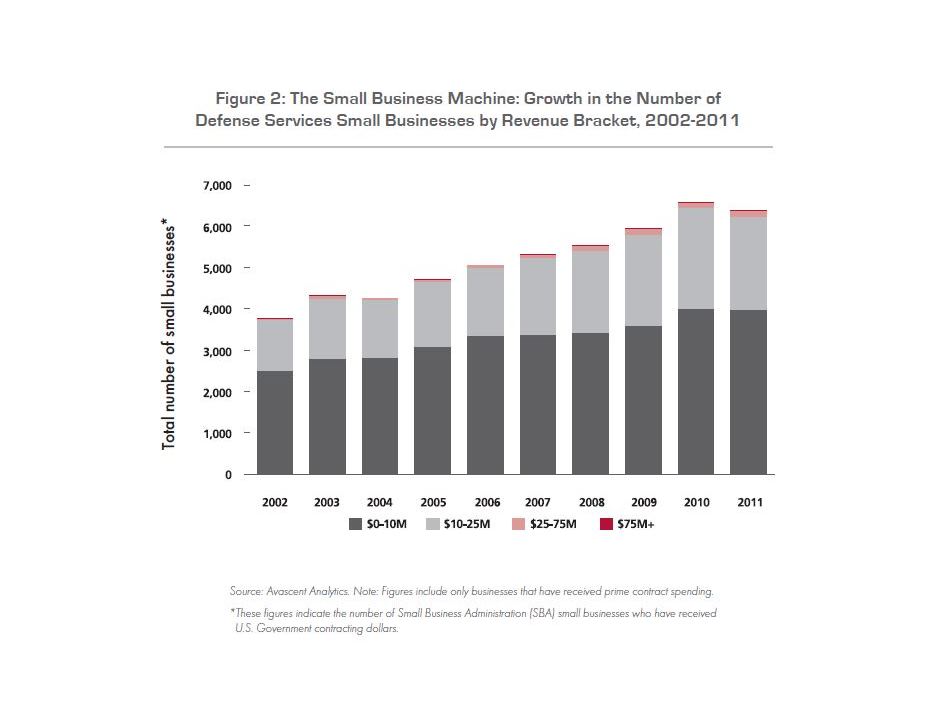

Budget uncertainty has created planning and execution challenges for federal agencies and the contractors that serve them. At one end of the market, large services contractors and defense primes are actively seeking to rebalance their portfolios to meet changing requirements. To do so requires bolstering capabilities that will survive and flourish beyond the budget shakeout, and building relationships at customers that will continue to spend. M&A will play a critical role in resolving capability and customer gaps, as well as adding “intelligent scale” to compete more effectively on consolidating contract vehicles. Meanwhile, at the other end of the market lies a well-populated universe of small defense services businesses (see Figure 2), many of which can also address these customer and capability gaps. As aging small business owners look to exit, a growing sell-side inventory of small firms is expected to drive a range of potential acquisition opportunities.

Understanding and Exploiting the Opportunity Space

Because management teams at small businesses tend not to optimize their operations as their businesses grow, the relationships and capabilities that large contractors crave often come burdened with inefficiencies that negatively impact cost structure and cost-competitiveness. Defense primes, meanwhile, are by definition strategic buyers, not operational turnaround specialists. Ill-equipped to drive efficiency gains at acquired assets and wary of integrating sub-optimized organizations into their enterprise structure, large contractors often require a “bridge investor” to make target assets integration-ready. Therefore, at the heart of the bridge strategy, is cutting the fat out of quality companies to create lean, integration-ready entities for eventual exit to strategic buyers.

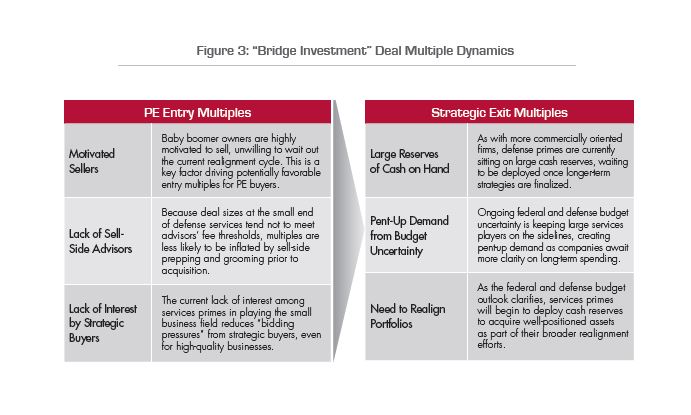

A key driver of the bridge strategy’s immediate appeal is the compelling valuations environment that currently exists around small defense services businesses – namely, the opportunity to acquire quality assets now at “PE” multiples versus potential exits at higher “strategic” multiples later. As Figure 3 demonstrates, the defense services market looks poised to reward those who position early to gain from pent-up demand among services primes.

Establishing An Execution Model

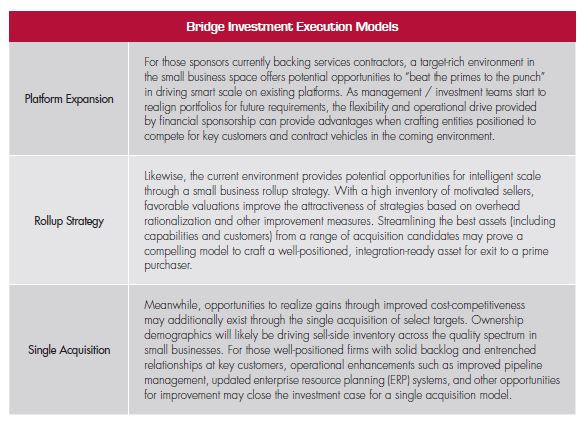

This opportunity landscape accommodates a number of execution options. Depending on a given sponsor’s goals, existing portfolio assets and other factors, three primary models exist to profit through bridge investment in defense services.

BRIDGE INVESTMENT EXECUTION MODELS

Platform Expansion: For those sponsors currently backing services contractors, a target-rich environment in the small business space offers potential opportunities to “beat the primes to the punch” in driving smart scale on existing platforms. As management / investment teams start to realign portfolios for future requirements, the flexibility and operational drive provided by financial sponsorship can provide advantages when crafting entities positioned to compete for key customers and contract vehicles in the coming environment.

Rollup Strategy: Likewise, the current environment provides potential opportunities for intelligent scale through a small business rollup strategy. With a high inventory of motivated sellers, favorable valuations improve the attractiveness of strategies based on overhead rationalization and other improvement measures. Streamlining the best assets (including capabilities and customers) from a range of acquisition candidates may prove a compelling model to craft a well-positioned, integration-ready asset for exit to a prime purchaser.

Single Acquisition: Meanwhile, opportunities to realize gains through improved cost-competitiveness may additionally exist through the single acquisition of select targets. Ownership demographics will likely be driving sell-side inventory across the quality spectrum in small businesses. For those well-positioned firms with solid backlog and entrenched relationships at key customers, operational enhancements such as improved pipeline management, updated enterprise resource planning (ERP) systems, and other opportunities for improvement may close the investment case for a single acquisition model.

Risk Mitigation Through Due Diligence

Not all small businesses are created equal; therefore, target selection and a well-informed diligence process remain critical elements of a successful strategy. Screening processes will vary from deal to deal, as each small business comes with its own set of advantages and challenges, which must be thoroughly understood. Below is a sampling of key high-level diligence items that should be considered as part of an acquisition process.

MARKETS: What market segments does the company operate in? What are the macro and micro budgetary factors that are likely to impact the company’s outlook?

CUSTOMERS: Does the company have relationships at desired customer sets? What is the tenure of key customer relationships? Any potential threats? What are the current trends at key customers with respect to the services that the company provides?

COMPETITORS: Who else is competing to provide similar services to existing or target customers? How do the company’s offerings and relationships compare to those at competitors?

SERVICES: Is the company highly specialized or does it offer a range of services? How well does the company’s service mix fit with (a) the overall market and customer strategy (b) the acquisition strategy?

CONTRACTS: Is the company performing work primarily as a prime or subcontractor? How secure is subcontract work? Does the company perform any work as small business set-aside? How might set-aside work be impacted by acquisition? Is the customer sole-sourced on any awards, or is work primarily competed on a task-order or other competitive basis?

FINANCIALS: How has the company performed historically in terms of revenue and EBITDA? Has performance exceeded or lagged the market? Why? What is the company’s backlog position? How robust are the company’s pipeline and new business capture processes?

Conclusions

- As the federal and defense budget outlook clarifies, services primes will begin to deploy cash reserves to acquire well-positioned assets as part of their broader realignment efforts.

- Private equity buyers now have the opportunity to make acquisitions at the small end of the defense services space at potentially compelling multiples to position for eventual exit to primes at higher “strategic” multiples at a later date.

- While this “bridge strategy” can accommodate a number of execution models, unlocking value by driving cost-competitiveness will be the key to a successful strategy.

- However, the small business end of the defense services market remains highly complex, requiring a strong diligence process to vet the business characteristics and market dynamics that will determine success or failure.