Turbofan Engine Technology Upgrades — How Should Suppliers React?

Next-generation turbofan engines, due to arrive on new narrow-body aircraft by 2015, promise dramatic efficiency improvements thanks to the introduction of innovative new technologies.

Yet these sweeping changes to engine architectures are threatening traditional suppliers’ competitiveness and ultimately forcing them to reevaluate their position in the supply chain.

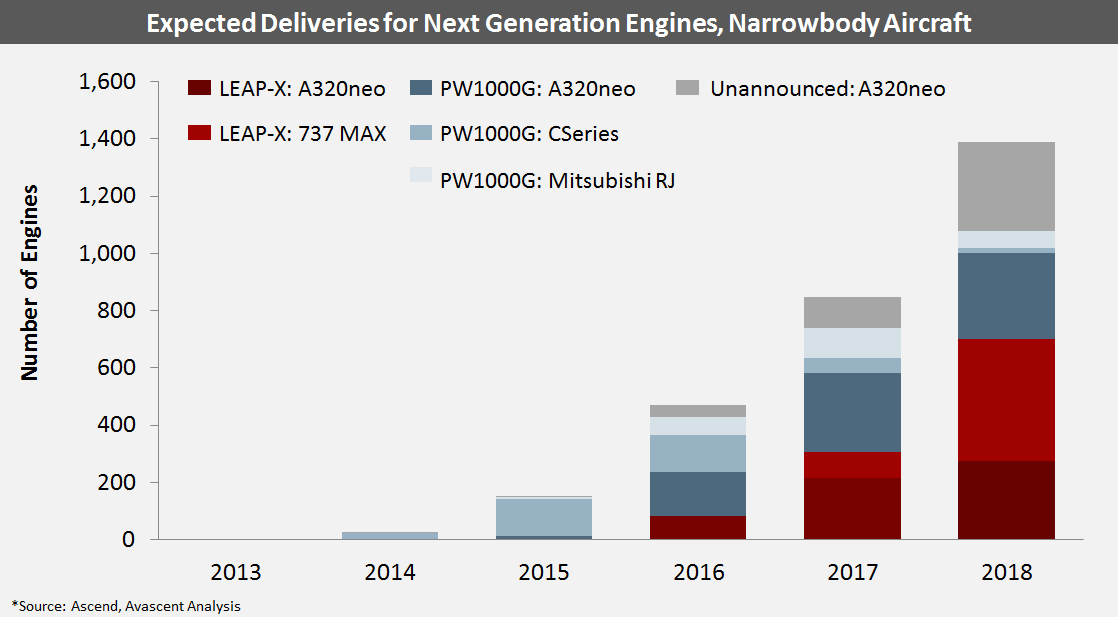

Over the last several years, major improvements in turbofan engine technology, along with sustained high fuel costs, have accelerated retirements of aging aircraft and helped drive order backlogs for new commercial aircraft to record-breaking levels. The average retirement age for commercial airline fleets has dropped from 30 to less than 25 years since 2008, and with fuel burn per flight mile estimated to be approximately 15% lower than current engines, new high-efficiency turbofans will begin replacing older, fuel-guzzling engines at a blistering pace over the next decade.

Nowhere is this transformation more evident than in the narrow-body segment, where substantial performance improvements by CFM’s LEAP-X and Pratt & Whitney’s (P&W) PW1000G Geared Turbo Fan (GTF) have led Airbus and Boeing to postpone major clean-sheet aircraft development projects in favor of re-engined A320 & 737 families.

The original equipment manufacturers (OEMs) may bicker over percentage point differences in operating metrics, however the performance improvements that both engines anticipate over current A320 and 737 power plants have driven over $400B in total new narrow-body orders. Two key technology breakthroughs have ultimately made these performance improvements possible:

- New materials and coatings

- Optimized 3D manufacturing processes

While these technological advances create exciting opportunities for both engine manufacturers and their customers, they have important ramifications for current players across the supply chain. Specifically, these developments threaten the competitiveness of raw materials providers, Tier I, and Tier II parts manufacturers, and could reduce their addressable markets dramatically. The introduction of next generation engines poses critical strategic questions for suppliers, forcing them to reposition themselves in terms of their customer mix, platform exposure, and the products and services they provide.

New Materials and Coatings

Cutting fuel burn is the primary objective for engine manufacturers, especially as fuel prices continue to account for over 30% of airlines’ operating costs. New durable, lightweight materials are helping curtail fuel consumption by improving engine performance in two key areas: thermodynamic and propulsive efficiency. These enhancements also help reduce emissions, noise, and maintenance costs, providing airlines further incentives to accelerate retirement of last generation engines in favor of newer turbofans.

Thermodynamic Efficiency

With engine thermodynamics, maximizing the temperature at which the engine core operates directly translates to greater engine efficiency. The most advanced metal alloys available to date for critical items like high-pressure turbine shrouds have melting points below the temperatures at which jet fuel burns, limiting the temperature at which the core can operate. However, with the introduction of highly advanced materials like Ceramic Matrix Composites (CMC) on LEAP-X shrouds, the engine core can now approach temperatures up to 2,400°F, nearly 500°F hotter than previously possible. This means that inefficient bleed air systems once needed to cool the hot section of the engine are now no longer required, simplifying the design and reducing the number of components in the high-pressure turbine.

New coatings also contribute to optimized thermodynamic efficiency. While CMCs are critical for turbine shrouds, which direct hotter exhaust gases through the high-pressure turbine, other non-composite components in the hot section must still be able to withstand this harsh environment. CFM and P&W are both introducing proprietary coatings to ensure that metal temperatures remain low enough to inhibit unnecessary damage. With over 90% of engine maintenance costs originating from components in the core, ensuring low metal heat is highly advantageous.

Propulsive Efficiency

One of the critical differentiators driving improved propulsive efficiency for the GTF is the proprietary, light-weight metals used in the gearbox. Gearing systems are not new to aircraft engines; the ability to decouple the turbine from the fan and enable each component to turn at its optimum speed for greater efficiency has always made for an attractive engine architecture, but previous designs have been both unreliable and unable to generate proper thrust for large aircraft (e.g., Garret TFE731, Avco Lycoming LF502/507). The introduction of a low-weight, high-strength gear system with just seven moving parts provides the GTF engine with 40,000 pounds of thrust and has enabled dramatic design changes across the engine architecture to improve propulsive efficiency.

Not only does the slower-rotating fan enable a larger diameter, and in turn, the largest bypass ratio for a turbofan (12.2:1), but the gearbox allows the low-pressure turbine to run at its optimal high speed, eliminating the need for up to six low-pressure turbine (LPT) and low-pressure compressor stages (LPC). This translates into roughly 1,500 fewer blades across the LPC and LPT. CFM has also found ways to cut excess weight from the LEAP-X turbine, despite the absence of a gearbox.

It has incorporated light-weight, highly durable materials like titanium aluminide into its turbine blades to cut down on weight and the number of blades. The material is half as dense as traditional nickel superalloys yet equally durable, ultimately contributing to a 180 pound reduction in the weight of the turbine.

New 3D Manufacturing Processes

The improved reliability of 3D manufacturing and design tools also supports the major engine performance breakthroughs visible on the LEAP-X and GTF. Two key processes that leverage 3D technology are Direct Metal Laser Metaling (DMLM) and Resin Transfer Molding (RTM).

Direct Metal Laser Metaling

Instead of traditional machining that removes excess metal to create a desired component, Direct Metal Laser Metaling (DMLM) can “grow” parts from the ground up by melding together ultra-thin layers of powdered material with a laser welding machine. Components with complex geometries once thought impossible to produce can now be built organically in a single piece, with the help of 3D design software that plots individual blueprints of each ultra-thin layer. This freedom of design affords significant cost as well as performance improvements.

P&W, as well as GE, a CFM partner, have both refined DMLM capabilities for use on a variety of new components for the GTF and LEAP-X, including blades, tubing, and stators. P&W, in conjunction with the University of Connecticut, has developed an Additive Manufacturing Innovation Center, where engineers have been researching new applications for 3D-printed metal parts on the GTF engines. One of GE’s most transformative uses of DMLM has been in the design and manufacture of the LEAP-X’s fuel nozzles. Fuel nozzles are traditionally subject to coking, the build-up of carbon deposits from fuel that is sprayed at over 3,000°F into the combustion chamber. Over time, the residue alters the flow pattern of the fuel spray and adversely affects the overall efficiency of the engine. GE’s new additive fuel nozzle is “grown” with cooling pathways inside the nozzle to eliminate coking and improve durability; what was once an 18-part component now consists of just a single part, 25% lighter than the traditional nozzles it replaces.

3D-woven Resin Transfer Molding

An equally transformative manufacturing technique that contributes to engine performance improvements is 3D-woven Resin Transfer Molding (RTM) of composite materials.

Just as the GTF’s geared architecture enables P&W to incorporate a larger fan size and increase the bypass ratio, CFM’s patented 3D RTM allows for a dramatically lighter fan with fewer blades but greater overall durability. Instead of combining multiple layers of composite plies to form blades, LEAP blades are woven in three dimensions, shaped into a rigid mold and counter-mold, and then injected with liquid resin. These improved fan blades have a thinner, more geometrically curved design that uses less material and is more aerodynamic than titanium counterparts. They also have no life limitations and cut nearly 1,000 pounds off the fan section, enabling a larger fan size and a bypass ratio twice that of the CFM56.

Strategic Considerations for the Supply Chain

The range of technical innovations that CFM and P&W are incorporating into next-generation engines to improve fuel efficiency, cut emissions and noise, and reduce maintenance costs, are proving to be a boon for aircraft OEMs and, in turn, airline customers. At the same time, they jeopardize many firms’ positions in the supply chain. The alterations made by leading OEMs to traditional engine sub-systems are likely to have a profound impact on supplier shipset value and overall platform presence. Moreover, these changes will be far-reaching in their effects. Beyond the blade and nozzle changes described earlier, CMCs, for example, eliminate the need for valves, seals, and pneumatic ducting that provide bleed air into the engine core.

As these new engines grow rapidly in terms of their overall share of the market, firms up and down the supply chain are likely to experience substantial and sudden changes to their business prospects, particularly in terms of customer demand and revenue outlook, existing inventory value, and product mix. As new technologies continue to supplant traditional engine design elements, firms across the supply chain will have to undertake a series of strategic moves to endure in a changing market environment.

While those strategic decisions are unique to each firm and its position in the market, they must be grounded on an objective, up-to-date understanding of their market, emerging customer requirements, and the changing competitive landscape. Specifically, senior executives across the supply chain must:

Define the Addressable Market Baseline

The high specificity of the applications for which many small products are designed has left many firms without a comprehensive view of their addressable market size and has limited their visibility into platform presence. For instance, forecasts exist for major sub-systems like fluid management devices, but not for the smaller mechanical components like tubing or valves that are integral to these devices. Determining the firm’s actual addressable market given recent technological developments is absolutely essential to creating an actionable strategic plan.

Assess the Impact of Future Sourcing Patterns

Determining how changing engine designs will affect the firm’s market, and the rate of this change at a detailed level – which components or sub-systems are more prone to major design adjustments or substitutions – is the essential second step. Answers will vary for each company depending on platform content and supply chain position, as well as the cost, size and weight of produced components. Combined, the addressable market baseline and future sourcing trends analysis reveal how much revenue the firm can depend on from the existing product suite and quantify the gap between that baseline and the firm’s growth objectives.

Craft a Winning Strategy

With a stable base forecast, companies must then decide how to shift to new products that will secure content on future engine types to support revenue growth. A winning strategy may require new capabilities in materials, coatings, and 3D processes developed organically or acquired through non-organic means. Broadening one’s addressable market will ultimately serve as a foundation for a long-term strategy that dictates how to allocate business development resources, make appropriate organic investments, and execute well-timed and targeted M&A decisions.