What are the long term COVID-19 implications for key industries?

COVID-19 has brought about a complete change in the way we work, educate, and go about nearly every facet of our daily lives. The markets Avascent follows were no exception, and across the US federal government and highly regulated agencies like healthcare and air travel, major shifts in operations in response to COVID were rapid and profound.

What are the long term COVID-19 implications for industry? With vaccines being distributed and the prospect of a return to “normalcy” on the horizon, which of those changes might persist? Will any of the technological enhancements brought about to keep us physically distant prove to be superior? Avascent experts make their predictions in five main areas:

- Overall federal budget

- DOD digital initiatives

- Federal healthcare

- Aviation

- Federal M&A environment

Long term COVID-19 implications for Federal Markets: Impact on the Federal Budget Outlook – Doug Berenson

The COVID-19 pandemic will have a lasting impact on Government markets in ways we may not fully appreciate at this juncture. But in one critical area – the Federal budget – the effects are clear.

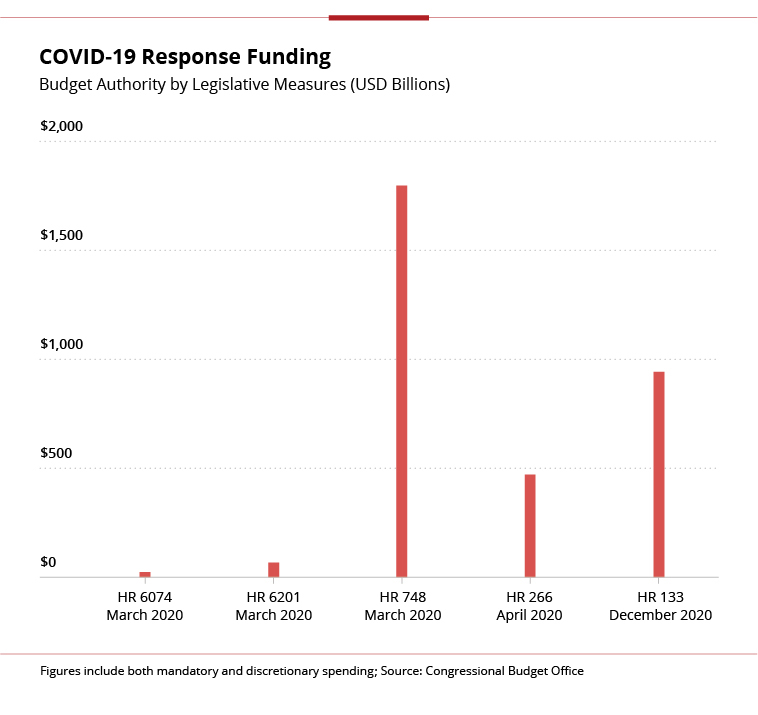

The Congress provided more than $3 trillion in Federal funds to combat the COVID-19 crisis. These measures also reduced some taxes to ease the burden on a population reeling from lockdown.

All told, the effect of COVID-19-related legislation has pushed the Federal budget deficit to depths not seen since World War II. Congress has now passed five separate legislative measures funding COVID-19 response, totaling approximately $3.3 trillion in Federal spending.

The deepening deficit is making politicians take notice. A number of Republican lawmakers in the House and Senate opposed passage of HR 133, the FY21 Omnibus Appropriation Act, arguing that it is now time to reign in the budget deficit.

This raises the question of how Congress may limit growth in Federal spending in the near- and mid-term. With a razor-thin majority in the Senate, Democrats will have limited latitude for further deficit spending without offering concessions to Republicans.

This could include commitments to contain growth in future Federal spending. This might resemble the 2011 Budget Control Act, which put tight limits on the kinds of discretionary spending accounts that fund most contractor-addressable programs.

Across both defense and civil activities, the Federal government has a wide array of needs. But the “hangover” from COVID-19 could leave long-lasting limits on the Federal budget and the opportunity space for government contractors.

Long term COVID-19 implications for Defense: DoD’s Digital-Driven Modernization and Readiness – Kelleigh Bilms

COVID-19 has accelerated DoD investment in virtualization and digitization of several capabilities that were in motion prior to the onset of the pandemic, especially in training, wargaming, and design, test, and maintenance.

1. Live, Virtual, and Constructive Training and Remote Learning

COVID-19 has emphasized the need for Live, Virtual, and Constructive (LVC) training environments, particularly as training exercises such as Cold Response 20 and Defender Europe 2020 have been cancelled or scaled down to mitigate risks to military personnel.

LVC training enables military personnel operating actual defense systems in live environments and virtual/computer-simulated entities operating in synthetic environments to collaborate or compete in an integrated training simulation.

COVID-19 has amplified the Services’ existing interest in expanded LVC and remote learning capabilities and demonstrated the power of resilient and flexible training solutions. LVC environments and distributed connections can network disparate players across geographical locations to decrease travel requirements and minimize COVID risk.

For example, the Army accelerated efforts to mature the virtual Persistent Cyber Training Environment, which enabled remote participation in the Cyber Flag exercise in June, despite the pandemic. In another instance, USAF has built out the ability to deliver Electronic Signals training virtually.

2. Digital Wargaming

COVID and its associated personnel travel restrictions have accelerated the Service’s need to advance digital wargaming, which DoD was already prioritizing in order to effectively assess multi-domain conflict scenarios with near-peer competitors.

With renewed focus on wargames, the DoD has invested to increase the cadence of games, improve player skills, and – more recently – apply digital tools to enhance games. The Department has traditionally run wargames as in-person tabletop, seminar, or workshop-based efforts using highly manual processes and analog tools.

Digital wargaming tools such as USAF’s “SWIFT” web-based wargaming application have been especially useful in the COVID era because they can enable distributed players, particularly allies and partners, to participate even when travel is restricted.

For example, the Marine Corps converted its ~250 person Pacific Challenge X wargame into a virtual, remote game. This game leveraged a variety of digital tools including DARPA’s PROTEUS wargame to increase participation and optimize wargame inputs and outputs. USMC recently announced plans to break ground on an advanced wargaming center at Quantico this year.

We can expect to see increasing DoD focus on digital wargaming both to enhance strategic planning and to ensure games can persist despite environmental disruptions.

3. Digital Design, Test, and Maintenance of Defense Systems

DoD’s investment in digital tools for design, test, and maintenance of defense systems seeks to increase pace of developing and fielding new capabilities. These tools also decrease reliance on large teams of in-person, co-located DoD and support personnel, reducing overall vulnerability to the COVID-19 virus.

The pandemic is reinforcing that DoD and industry players are operating in an acquisition and engineering environment that is increasingly digital, and that they must invest in the tools to keep pace.

The DoD, particularly USAF, has accelerated focus on digital engineering for high-priority efforts such as the Advanced Battle Management System and Next Generation Air Dominance. DoD is also seeking to expand application of model-based computational testing, reducing reliance on ground and flight tests that typically require large, in-person teams, to refine and validate designs.

Additionally, DoD is looking to leverage digital “twins”—which facilitate responsive and predictive maintenance of systems and reduce reliance on touch labor—to improve maintenance. Digital twins enable remote maintenance efforts, which the Navy is currently conducting by tapping into data collected by on-board sensors even when ships are not in port.

As DoD looks to classify more – not less – information, it will need to continue investing in distributed, secure networks, supporting infrastructure, and facility clearances. Given most current training, wargaming, and engineering and maintenance efforts are at least partially classified, the DoD has a dependency on in-person participation and classified networks like SIPR.

Investment in secure, distributed networks can reduce limitations on remote training, wargaming, and engineering efforts.

Long term COVID-19 implications for Federal Markets: Federal Healthcare – Rachel Jenkins

COVID-19 has spurred change across every element of our healthcare system and underscored the importance of a coordinated government response. As we look at the changes COVID-19 brought, three in particular stand out:

1. Unprecedented Pace of Vaccine Development:

The US was able to bring not one, but multiple vaccines through development, clinical trials, and approval in under a year, a truly unprecedented endeavor. This rapid development cycle was in large part enabled by the maturation of new vaccine technology (mRNA), which will have impact far beyond COVID-19.

Looking ahead, industry should consider how scientific and regulatory agencies such as NIH and FDA may need to adapt their processes, workflows and systems to adapt to this new cycle. And for those in life sciences, can we expect this level of collaboration with government to continue?

2. National Preparedness & Public Health Infrastructure:

The pandemic quickly exposed the limitations of our national public health infrastructure, designed for regional rather than national incidents.

As the pandemic continues to rage and a new Administration takes office, the role of the federal government in public health is being reimagined from initiatives like the DOD’s National Emergency Tele-Critical Care Network (NETCCN) to debates over the role of the CDC and HHS in testing, tracing, and vaccine distribution.

Change will almost certainly come to these agencies though it is not yet clear at what scale. In the near-term, contractors might consider ways to help these agencies rebuild credibility at scale through their communications and engagement with citizens, do more with the data and systems they already have, and prepare for transformation once the immediate crisis has passed.

3. Telehealth at Scale:

The pandemic sparked a widespread and instant adoption of telehealth. For example, the VA saw telehealth video appointments increase from 10,000 to 120,000/week between February and May 2020.

Going forward, beneficiaries will expect the option of telehealth, meaning telehealth is finally here to stay. However, it raises a host of new operational challenges from managing a hybrid remote/live schedule and integrating technologies, to increased need for care coordination and case management.

Contractors who can support government with advisory and/or technology will be best positioned to enable this transition.

Long term COVID-19 implications for Aviation – Jay Carmel

COVID-19 is the greatest crisis that the modern aviation industry has ever faced. Passenger traffic plummeted nearly 70% in 2020, driving airline losses beyond $115B and inflicting pain across the airline and aerospace workforce.[1]

A partial-recovery mid-decade appears plausible, with the industry being shaped by three key trends in the short-term.

- A surplus of wide body aircraft, due to depressed international travel demand, is projected to persist for years. This surplus includes numerous Boeing B777s or Airbus A330s, and is expected to pressure the secondhand market, disrupt aftermarket parts demand, and crater sales for new B787s or A350s. Widebody production rates are unlikely to return to 2019 levels this decade.

- Resurgent interest in regional turboprop is driven by airlines’ focus on improving profitability on short-haul routes that have more stable demand. With most of the current turboprop fleet based on 1980s designs, OEMs across the globe are exploring modern replacements, to include more eco-friendly replacements such as hybrid or hydrogen powertrains.

- A newfound focus on passenger health will reshape the travel experience. Whether with “contactless” or more digital tools, airports and airlines are investing to improve and sustain air travel confidence well into the future.

Long term COVID-19 Implications for M&A in Aerospace, Defense and Government – Tim Garnett

As industries driven by mission, travel, and a “boots on the ground” and “resilience mentality,” Aero/Defense/Government (ADG) markets certainly resisted the screeching halt of M&A deal activity that many other sectors faced in 2020.

Following what was arguably the most exciting M&A quarter (Q12020) for the industry in recent history (Dynetics/Leidos, Amentum/Lindsay Goldberg and American Securities, Cobham/Advent and the closing of the RTX merger all in Q1), owners, corporate development teams, and leadership teams hit the pause button in Q2 2020 as they prioritized focus on customer needs and employee challenges in continuing to deliver critical capabilities to militaries, first responders and society as a whole.

Moreover, the overhang of various COVID impacts on supply chain disruptions, PPP funding overhang, workforce restrictions made valuing assets challenging for all segments, if not impossible for industries like aerospace.

That said, by summer (Q32020), the M&A machine was restarted, and deal flow and processes picked up quickly and notably as strategic and financial buyers and sellers continued to develop and execute theses around new priorities and realities presenting new opportunities for growth and success, ranging from continued interest in space, hypersonics, and defense electronics, to more nuanced focus on IT modernization and security (highlighted by WFH dynamics), trusted supply chain, commercialization, and the emergence of new value added services and business models.

Looking forward, we expect 2021 to be an incredibly active year for M&A in ADG as strategic and financial buyers alike become further incentivized to transact. For strategic buyers and sellers, the potential topline budgetary pressure in the near- to mid-term related to massive COVID funding overhang combined with the Biden administration’s newly defined priorities will encourage more aggressive inorganic growth strategies and portfolio reshaping.

Private equity buyers and sellers will have to consider the potential for increased market headwinds and currently healthy valuations vs the underlying stability and fundamentals of the market vs other segments, the continued opportunities for disruptive innovation in the industrial base, the return of commercial aerospace and renewed focus on “big government.”

Ultimately, the confluence of these factors will drive highly active degree of discussions as well as processes (perhaps still virtual), ultimately fueling opportunities for buyers and sellers to unite and continue the momentum started in 2020

[1] IATA 24 November 2020