Drone Pizza Delivery & Flying Taxis: The Future of UAS Traffic Management

As of March 2021, the FAA has registered 866,000 drones, 43% for commercial purposes. Amazon and UPS are among the first to receive FAA approval for “beyond the visual line of sight” (BVLOS) operations.

Unsurprisingly, the number of unmanned aerial systems (UAS) operating in very-low-level (VLL) urban airspace is expected to skyrocket in the next decade. Operations will require comprehensive UAS traffic management (UTM) systems for safety and efficiency and the creation of new UTM entities to monitor the ecosystem and coordinate with ANSPs.

While this largely pertains to UAS in the near-term, manned and (eventually) unmanned advanced air mobility (AAM) aircraft will also need to coordinate through UAS traffic management systems.

What will UAS Traffic Management in Congested Environments Look Like?

In a single urban environment, there are a variety of possible UTM scenarios. These fall into three general categories:

- A Single UTM Provider: Individual providers may provide all UTM services for all VLL users within a geographic region (country, city neighborhood).

- Several Providers: A single region may have a limited number of providers from which VLL users can select.

- Fragmented Landscape: Large commercial fleets use proprietary UTM systems with smaller fleets selecting from a variety of UTM providers.

The several providers model seems most likely resulting from a competitive environment limited by data sharing requirements and funding. Regardless of end state, UTM pilots are occurring primarily at critical infrastructures (esp. airports) and in some suburban areas where multiple service providers are not yet an issue.

While early AAM activities are expected to involve smaller fleets in less-congested environments, long-term UAS traffic management for AAM will likely be based on the same UTM systems as UAS or, at the very least, must work in close conjunction with them.

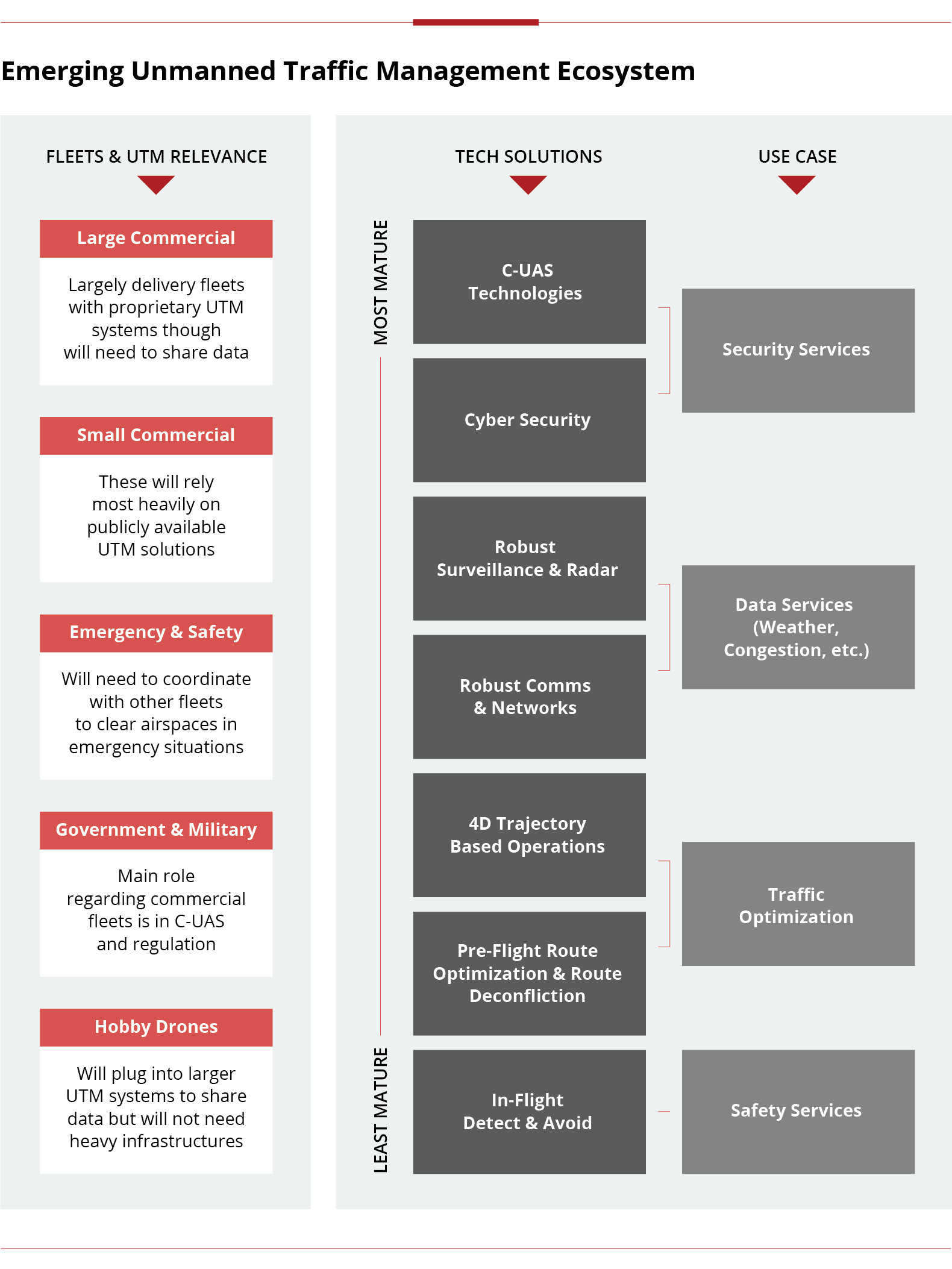

Regardless of the provider options, all congested environments will have similar stakeholder types, services, and technology to support their UTM platforms.

Who is Shaping the Future of UAS Traffic Management?

Large multinational firms with a focus on air cargo (e.g., Google’s Wing, Amazon’s Prime Air, and UPS’ Flight Forward) are taking a prominent role in shaping future of the UAS Traffic Management, using deep pockets and preexisting regulatory influence across the supply chain. Last-mile delivery of small cargo items is the most immediate use case for air delivery systems.

![]()

"Everyone comes up with their own standards,

like Google [and Amazon], which means that they

want to corner the market by ‘shaping."

- Leading UTM Developer

The UTM concepts from Amazon and UPS are for internal use as of now, which is where startups and established aero come into play.

New companies such as Altitude Angel, Unifly, and Airmap solely focus on developing UTM platforms for broader market use.

These firms are more likely to form large-scale partnerships, especially in the European Union (EU), for example, where Altitude Angel is working with Frequentis and Norway’s ANSP, Avinor, to develop a UTM platform for Norway’s major airports.

Established aerospace firms are also developing their own solutions, often through subsidiaries or subgroups like Boeing’s Skygrid – though these have attracted less press than the start-ups.

Skygrid, as well as others like Airbus and Thales, also do significant UTM technical research and develop ecosystem blueprints to supplement UTM platforms and influence policy.

Government regulators (e.g., FAA, EASA, ANSPs) also play a critical role through shaping certification standards.

While vital to safety and security, regulations have become a roadblock to the UTM market especially due to heavy restrictions on BVLOS flight and flights over people and lack of clarity on Remote ID.

Demand for these capabilities and services exist now, but hesitant regulators are causing delays in the market.

Major Challenges

Interoperability and Data Sharing:

UTM providers will need to be able to integrate with diverse technologies, data sources, and regulators across geographies. Interacting with different sources will require highly modular, open architectures systems.

Open data sharing systems are also critical for individual UAS traffic management platforms to map their own fleets against others and avoid crashes.

Latency:

This is expected to become an increasing safety concern as large fleets interface with a variety of sensors and ground operators, which will delay telemetry information and cause safety issues.

These can be mitigated by cutting down on required interfacing through algorithms like detect & avoid and increased drone-based processing power. UTM providers can use these developments to further automate their systems.

Funding & Revenues:

Lack of a clear path forward in regulating and loosening current restrictions are causing strain for UTM businesses.

In 2020 Airmap underwent layoffs in addition to finding a new CEO. Even firms with heftier backings have faced cutbacks, including GE’s AirXOS which shutdown in February 2021.

While future predicted demand is promising and consolidation of players is inevitable, lack of movement on restrictions is cutting down on competition prematurely.

Despite current challenges, the market potential for UTM is enormous and requires a diverse set of technologies to support an autonomous, drone ecosystem in newly congested environments.

Market players across the board should look now to see how they might influence and adapt to future demand.

Subscribe to the Avascent Altimeter

We invite you to subscribe to the Avascent Altimeter – Insights delivered to your inbox on critical issues shaping the Commercial Aerospace industry’s future.