Air Cargo Demand Fuels Amazon’s Market Disruption

The severe disruption of passenger air travel over the last year has overshadowed the relatively healthy performance of the air cargo market.

But much has changed beneath the surface to enable stable air cargo demand, warranting newfound attention from all aerospace industry stakeholders.

Despite the tremors felt from the passenger capacity crunch, which left capacity (available cargo ton kilometers [ACTK]) down 19% annually, air cargo demand has remained steady during the pandemic, largely resulting from the e-commerce boom.

In fact, IATA reports that CTK (demand) was up 4.4% in March 2021 relative to 2019, an all-time high.

Ecommerce’s pre-pandemic cargo volume share of 15% has been well exceeded, fueling cargo revenue growth to $152B, a predicted 33% of total 2021 commercial operator revenues.

How Has Amazon Shaped Air Cargo Demand?

With none other than Amazon at the forefront, e-commerce’s growth has been driven by surging online consumer demand. Amazon has generated faster lead times and increased customer satisfaction by utilizing:

- Predictive analytics,

- Reverse logistics, and

- Operational integration

Amazon’s continued innovation has reinforced its pursuit of more efficient and cost-effective transport methods, while exposing some of the inefficiencies of traditional air cargo transport via passenger aircraft or traditional freight operators.

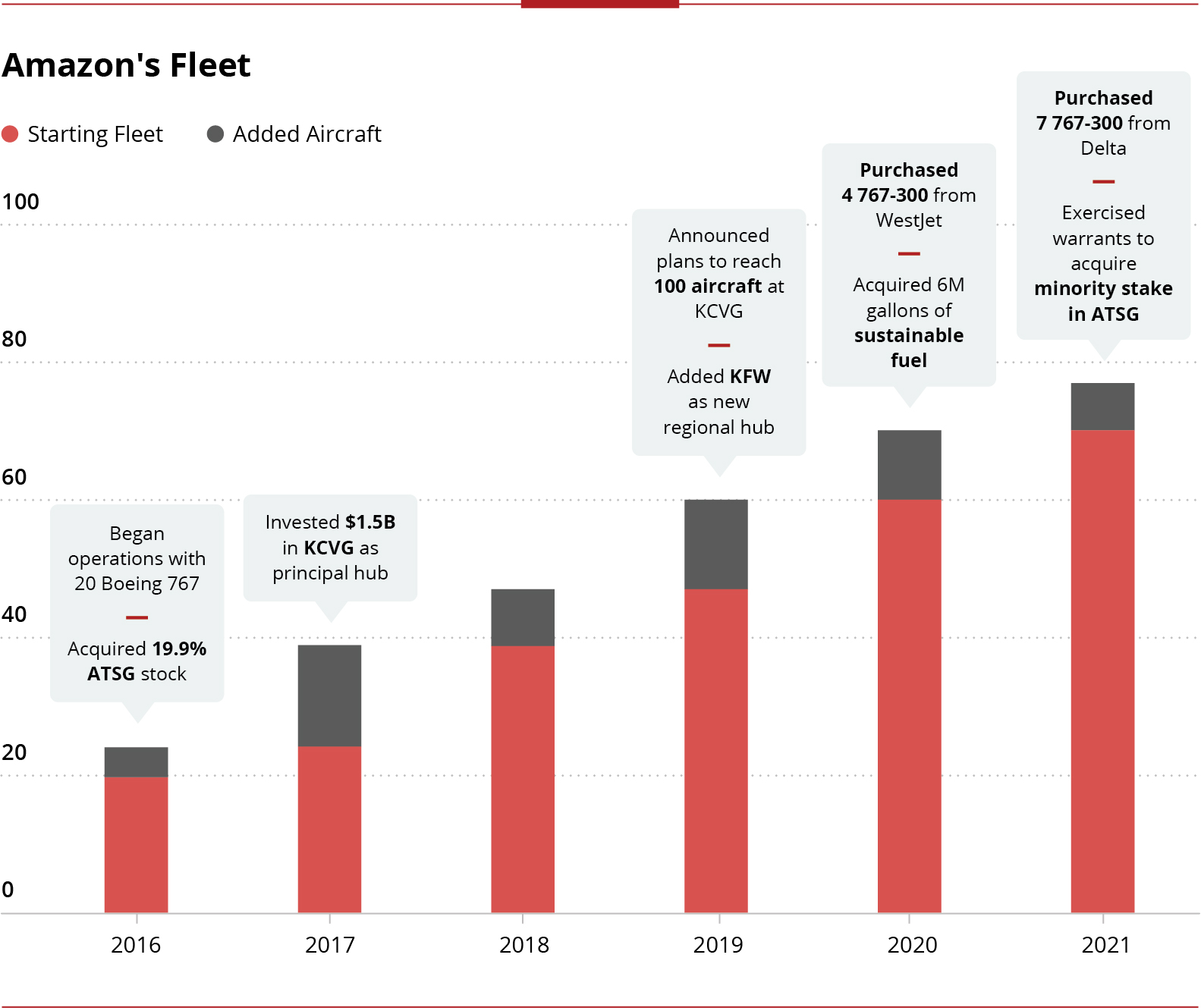

Amazon’s expansion has been in the works since 2015, when they first began leasing Boeing 767’s and acquired a minority stake in lessors ATSG and Atlas Air.

Over the past six years, Amazon has built up their cargo operations through a $1.5B investment in a new principal hub in Northern Kentucky, as well as an expanded presence in Fort Worth, Texas, all while growing its fleet through multiple lease agreements.

Grounded passenger fleets have heavily depressed the values of older widebody aircraft, leading Amazon to acquire seven relatively young 767-300’s from Delta and four from WestJet – likely at prices that justify the costly freighter conversion process.

Acquisitions like these are indicative of broader market conditions; lead times for passenger-to-freighter conversions are now at record levels, incentivizing a host of new entities like Delta TechOps to invest in conversion capabilities.

Amidst record quarters of profitability, Amazon has also expanded its leasing footprint by acquiring a minority stake in ATSG. With all of this considered, Amazon’s timely fleet expansion presents the optimal balance between conserving cash and aggressive progression towards gaining cargo operating share.

What Does Amazon’s Growing Role mean for Aerospace?

A new prominent cargo aircraft owner with scalable cargo operations provides aerospace entities with additional opportunities, especially as Amazon shows no indication of slowing its growth pace. Air cargo operators UPS & FedEx outsource a large share of their intensive MRO work, and Amazon currently does the same.

Heavy maintenance and other aftermarket service providers will benefit, especially as Amazon’s average fleet age of 24 years (exceeding that of UPS and FedEx, which both average 20 years old will necessitate higher-spend services.

Aftermarket firms may not be the only ones to benefit from air cargo demand. While Amazon currently operates converted aircraft, there is a growing possibility it could explore new-build programs.

A key potential motivator is its ambition to become carbon-neutral by 2040. Amazon Air’s recent purchase of 6 million gallons of sustainable aviation fuel was a notable first step, well beyond FedEx’s still commendable commitment to purchase 3 million gallons annually through 2024.

As it evaluates its fleet expansion options, a newly produced 777F provides cargo operators with longer range and a roughly 20% fuel-per-ton advantage over existing freighters.

Meanwhile, the purported A350 freighter that Airbus may soon launch would offer the longest range and a 25% fuel burn improvement over any widebody, with the lowest fuel burn per ton of cargo.

The A350F is no sure bet for Amazon, given the high acquisition cost and a range that outpaces Amazon’s domestically oriented route network. Yet with sustainability’s newfound attention and the expected future expansion of its overseas operations, the A350F may in fact be a natural fit for Amazon’s late 2020s fleet.

Amazon may not provide a perfect paradigm for how other e-commerce companies will evolve their air freight operations, but its activity is indicative of how the market may change with the growth of e-commerce.

Amazon has set a new standard for air cargo performance by cutting lead times with innovative logistics technology.

Although air cargo was hamstrung by limited capacity during the pandemic, this phenomenon ultimately revealed some inefficiencies in the current system, which in turn may create opportunity for other dedicated freight operators to capitalize on this influx of air cargo demand.

With strong demand drivers in place, aerospace entities should closely monitor the freighter world as operators reassess the relentless balance of efficiency, cost, and now, sustainability.

Subscribe to the Avascent Altimeter

We invite you to subscribe to the Avascent Altimeter – Insights delivered to your inbox on critical issues shaping the Commercial Aerospace industry’s future.