First Movers Begin to Shape the AAM Market

Despite COVID-19 macroeconomic headwinds, Advanced or Urban Air Mobility (AAM/UAM) momentum has continued apace over the last 18 months.

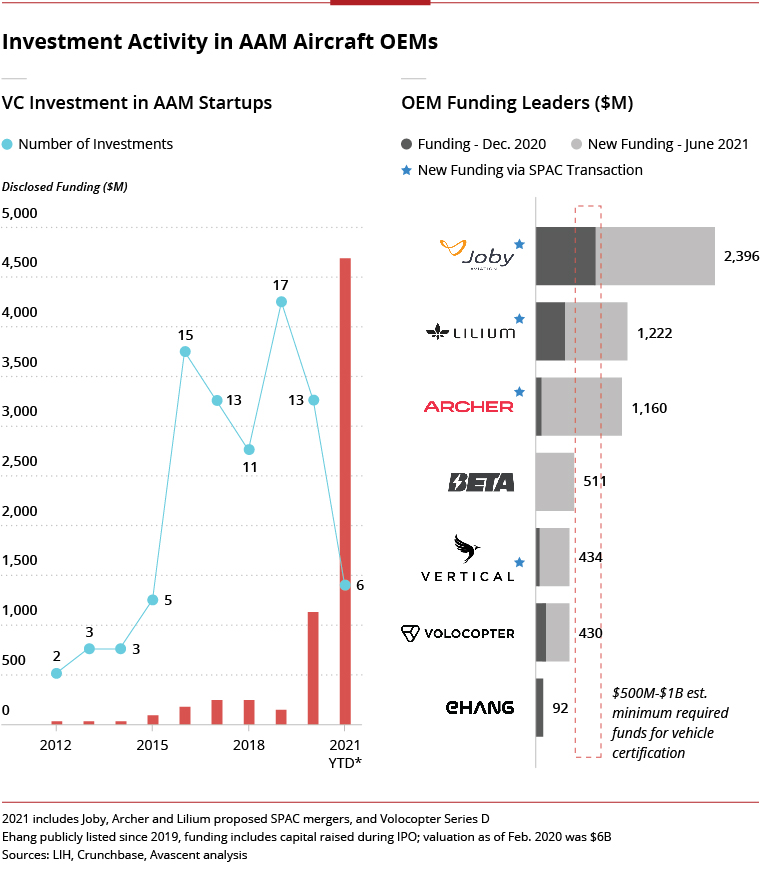

A distinct set of industry leaders is emerging from the competitive fray: seven OEMs have captured over 90% of the nearly $6B in publicly announced AAM market funding to date, with 70% of this capital coming in 2021 via Special Purpose Acquisition Corporations (SPAC).

While this SPAC movement is noteworthy in and of itself, the associated regulatory filings for Archer, Joby Aviation, Lilium, and Vertical Aerospace provide newfound visibility into how these first movers expect to establish and develop the AAM market – especially as they all intend to both manufacture and play a notable role in operating these revolutionary new aircraft at an unprecedented scale.[1]

Similar philosophies underpin the companies’ projections, and all of them even expect to turn profitable in 2025. Yet those paths to profitability are built on different strategic and tactical approaches, which supporting partners must begin to assess as they develop their own business cases.

AAM Aircraft Production

Archer, Joby, Lilium, and Vertical’s paths to 2025 profitability in the AAM market are built on high-volume production plans that can quickly scale and drive down unit costs.

Similar building blocks are in place, including automotive partners and leadership teams with strong aerospace pedigrees, which will undoubtedly help the OEMs as they aim to ramp annual build rates to 250+ aircraft by 2025. This would exceed the annual output of any current or former passenger aircraft used for commercial operations, save for the well-established Boeing 737 and Airbus A320 airliner programs[2].

With ambitions to produce over 2,000 aircraft annually by the end of the decade, an exploration of key underlying considerations is warranted:

- Ramp up timing:

Aircraft type certification (TC) is of course the major first milestone. Joby and Lilium both have received an initial certification basis and are targeting 2023 for a full TC, while Archer and Vertical expect their TCs in 2024. The realism of these timelines are worthy of separate discussion, but assuming they hold, the production certificate (PC) is the next critical piece: it proves the OEM can replicate its own design and self-certify each aircraft for airworthiness, instead of relying on regulators to sign off on each new aircraft. Recent first-time PC applicants such as HondaJet and Epic Aircraft achieved a 6-month turnaround between TC and PC award, a timeline which current eVTOL OEMs appear to be counting on. Other recent first-time applicants took nearly two years (e.g., Cirrus) or saw applications mired in controversy (e.g., Eclipse), struggling to prove an effective quality system and supplier oversight. With so many new, bespoke part types being introduced on eVTOL aircraft (e.g., battery systems, motors, etc.), timely PCs will necessitate aggressive planning across the AAM supply chain.

- Unit Costs:

A variety of new manufacturing processes and technology inputs aim to help drive down production costs over the long run, but initial development investments will weigh heavily for the AAM market. Each program’s certification and testing expenses could likely approach $1B alone; meanwhile, manufacturing infrastructure, tooling, advanced automation equipment (in line with stated interest in adopting automotive techniques) and other capex needed for high production rates could reach, if not exceed $500M.[3] Amortizing this estimate against an optimistic scenario of 4,000 total aircraft produced (and excluding cost of capital) results in $300,000 per aircraft, or nearly 25% of Joby’s published unit cost of $1.3M. The OEMs and their automotive partners are rightly focused on identifying innovative production methods to drive down cost, and yet just as important is the cultivation of a proper operating ecosystem that can ensure there is sufficient demand to close the manufacturing business plan.

AAM Market Operations

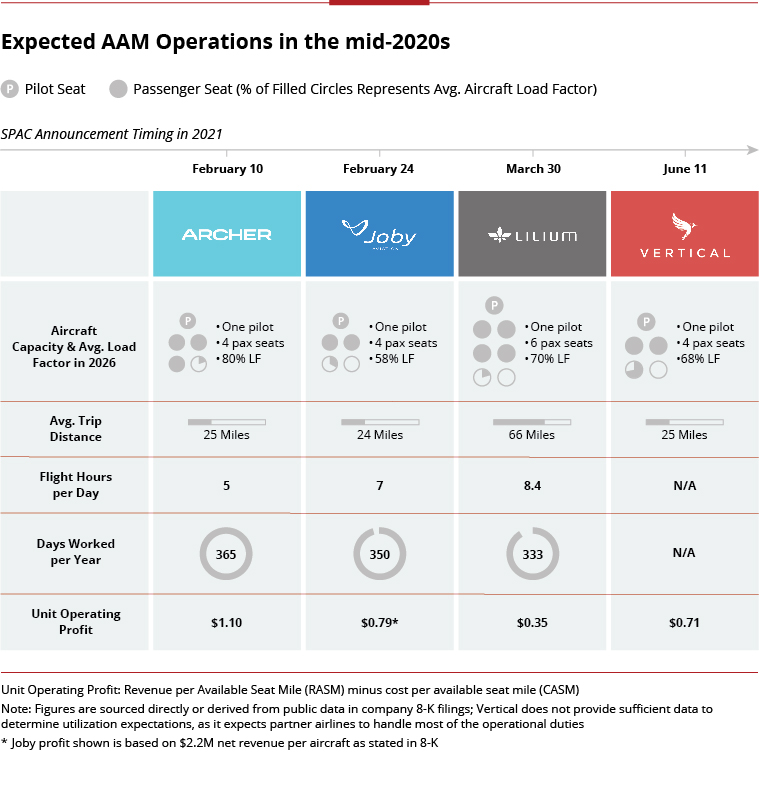

The initial business plans are aligned in many respects, but show notable differences across various operational philosophies, resulting in divergent (albeit still notional) unit profitability outlooks.[4]

Joby and Archer appear destined to become direct competitors, as both seek to establish early route networks with average trip lengths of approximately 25 miles in urban areas like

- Los Angeles,

- San Francisco,

- Miami, and

- New York.[5]

Archer expects to slightly edge Joby in annual revenue per aircraft ($2.4M vs. $2.2M), yet Archer expects each aircraft will fly only 5 hours per day on average (25 flights) relative to Joby’s 7 hours per day (42 flights).

With a lower daily utilization, Archer is perhaps implicitly acknowledging that the operational learning curve will be steep as many issues are addressed, including but not limited to:

- Traffic management,

- Passenger processing,

- Battery management,

- Weather, and

- Temporal demand patterns.

Lilium appears similarly aligned, claiming it will include 20-minute boarding and charging times at each destination.

Despite its lower utilization, Archer still outpaces Joby in aircraft revenue by utilizing three other operational levers:

- Fares:

Archer expects to charge $3.30 per passenger mile, for an average fare of $83 for a 25-mile flight – exceeding both Joby and Vertical’s average fares for a nearly equivalent distance by more than 10%. The realism of these fares will depend on the specific regional markets served and eventual consumer behavior, but given the overlap in targeted markets, Archer’s price premium is worth noting. Meanwhile, Lilium’s yield of $1.98 appears to reflect a more cautious awareness of the realities of serving longer-distance routes that may generate greater competition from trains and constrain its pricing power.[6] - Load Factor:

Archer data implies an 80% average load factor, indicating reliance on strong, steady passenger interest as well as confidence that it can consistently match demand with supply via its network management and booking system known as “Prime Radiant.” Joby, fresh off its January 2021 acquisition of Uber Elevate’s network planning tools, indicates it expects a 58% average load factor in 2026, a relatively more conservative vision for the early years of AAM. Optimizing networks and scheduling to maximize its available seat miles amidst temporal demand surges in urban environments will remain a key focus for each OEM. - Fleet Uptime:

Archer’s 8-K filing highlights 365 days of aircraft use per year, raising questions about its fleet maintenance approach. Joby incorporates more operational buffer, with an estimated 350 average active days per year.[7] Meanwhile, Lilium is more conservative as well, with approximately 333 days of uptime. Simpler designs, fewer mechanical parts, and advanced health management solutions should reduce eVTOLs maintenance needs relative to traditional aircraft, especially in their early lives. Nonetheless, operating these aircraft under Part 135 commercial rules will still require intensive checks (e.g., inspections every 100 flight hours), such that each OEM’s maintenance program will meaningfully shape the achievability of the financial forecast.

Key Takeaways on AAM Market Economics

With the benefit of SPAC filings, the industry now has an opportunity to see the rough outlines of an AAM ecosystem taking shape and can begin to unite around common end goals.

At the same time, the unique differences across business plans still reinforce that solving the many technical, regulatory, and cultural challenges of the AAM market will be an ongoing learning process for years to come.

[1] Lilium and Vertical intend to own and operate the backend digital operations platform, but outsource actual airline operations to 3rd parties.

[2] Rare cases of piston engine aircraft that have exceeded 250 aircraft per year (e.g., Cirrus SR22, Cessna 172) are not widely considered commercial aircraft.

[3] Avascent analysis of aircraft and automotive development costs; aligns with Joby’s June 2021 estimate of ~$250M in capex for the first phase production facilities.

[4] Each OEM provides topline operating cost estimates per aircraft, but no underlying detailed justifications; Avascent analysis therefore incorporates these data points but does not evaluate the merit of these figures.

[5] Lilium’s plans meanwhile call for slightly longer intercity stage lengths of ~65 miles, limiting a direct comparison but with occasional points of reference for consideration. Vertical provides limited data on its route networks, also limiting a strong analytical comparison.

[6] Reflects Lilium’s summary business plan data points, which diverges from other case studies it provides in its 8-K.

[7] 350 days assumes $2.4M in revenue per aircraft, which is used to achieve Joby’s stated $1.73 RASM but diverges from its $2.2M net revenue figure also used in its 8K.

Subscribe to the Avascent Altimeter

We invite you to subscribe to the Avascent Altimeter – Insights delivered to your inbox on critical issues shaping the Commercial Aerospace industry’s future.