Rising Tide: Game Changing Competition in the Global Aerospace & Defense Market

80% of A&D executives believe their competitive landscape will increase next year, led by disruptive competitors with low cost offerings in China, closely followed by those in Asia, MENA, and Latin America.

Most are not ready for this seismic change that impacts nearly all A&D markets. To remain competitive, firms should follow a “global competitiveness dashboard” to assess their strategies and measure results.

Aerospace and defense executives find growing allure in international strategies. Yet the rising tide in global defense spending is creating a much more competitive market than is currently appreciated. Industry leaders forecasting easy wins are setting themselves, and investors, up to be disappointed.

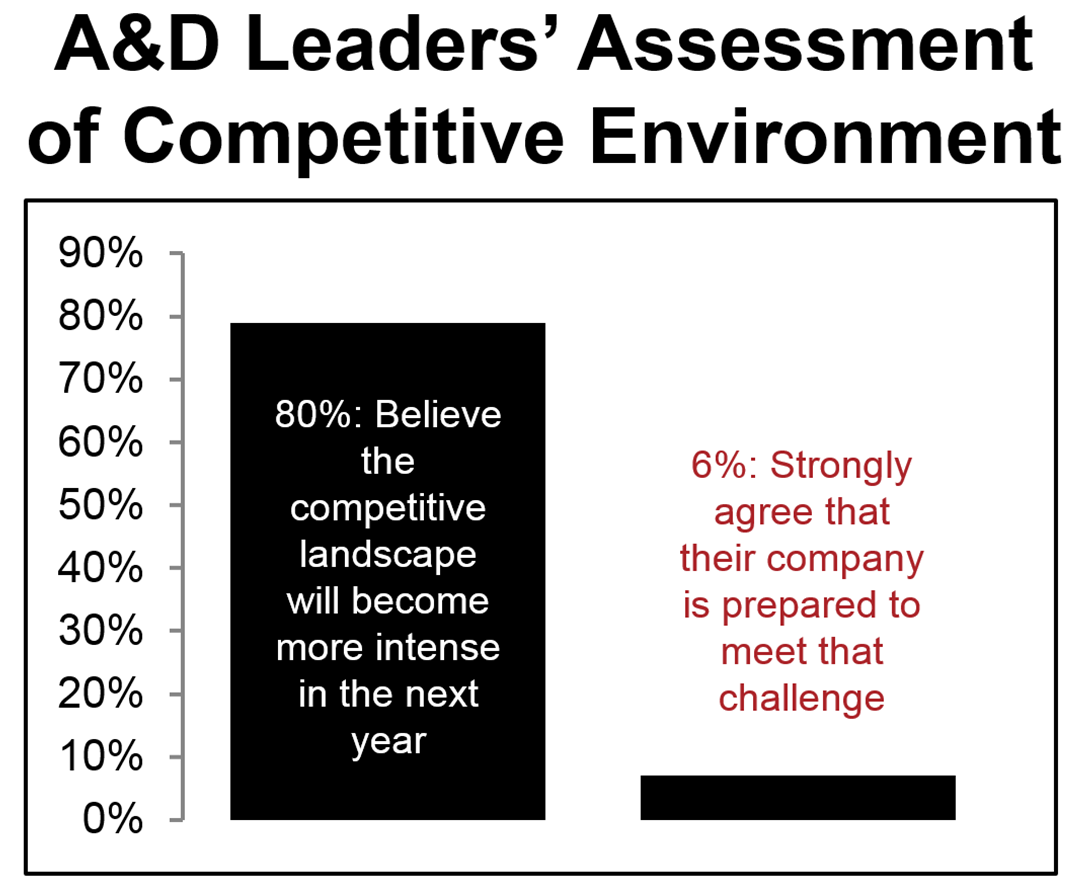

Avascent and FleishmanHillard’s June 2014 survey of nearly 350 senior A&D leaders on global competitiveness highlights this rapidly shifting competitive landscape. The survey shows 80% of executives believe the competitive landscape will increase outside of their home markets in the next year. However, only 6% strongly agree that their company is well prepared for the global competitive market.

The stakes are high. Last year, an Avascent survey revealed 93% of senior aerospace and defense leaders believe foreign markets will be increasingly important in the coming years. Recent comments by CEOs at market-leading firms bear this out. They know U.S. defense spending is flattening out while spending in the rest of the world is expected to top $500 billion in 2016, up from just over $300 billion in 2008.

The competition for international defense related items is heating up to fever pitch due in part to lagging U.S. sales but also due to ITAR regulations throttling the market to such a narrow family of products, and fewer companies able to effectively navigate the international business culture.

For a sector that traditionally moves at a measured pace, this is rapid change. Aggressive new competitors have arrived, with China cited as the top challenger. Surveyed executives cited Israel, India, Brazil, Canada, South Korea, Turkey and UAE as emerging A&D rivals.

American firms also appear vulnerable in strategically important markets where the U.S. has long held leadership positions. These increasingly competitive markets include unmanned aerial platforms, intelligence surveillance and reconnaissance, missiles, and satellites, according to the survey. The importance and challenges of succeeding in this competitive global landscape are considerable for Western firms and their home markets, particularly where only 7% of A&D executives strongly believe that their own governments are providing effective support for global sales. According to one senior leader: “The competition for international defense related items is heating up to fever pitch due in part to lagging U.S. sales but also due to ITAR regulations throttling the market to such a narrow family of products, and fewer companies able to effectively navigate the international business culture.”

A&D Leaders’ Perspective: Competition Everywhere and Led by China

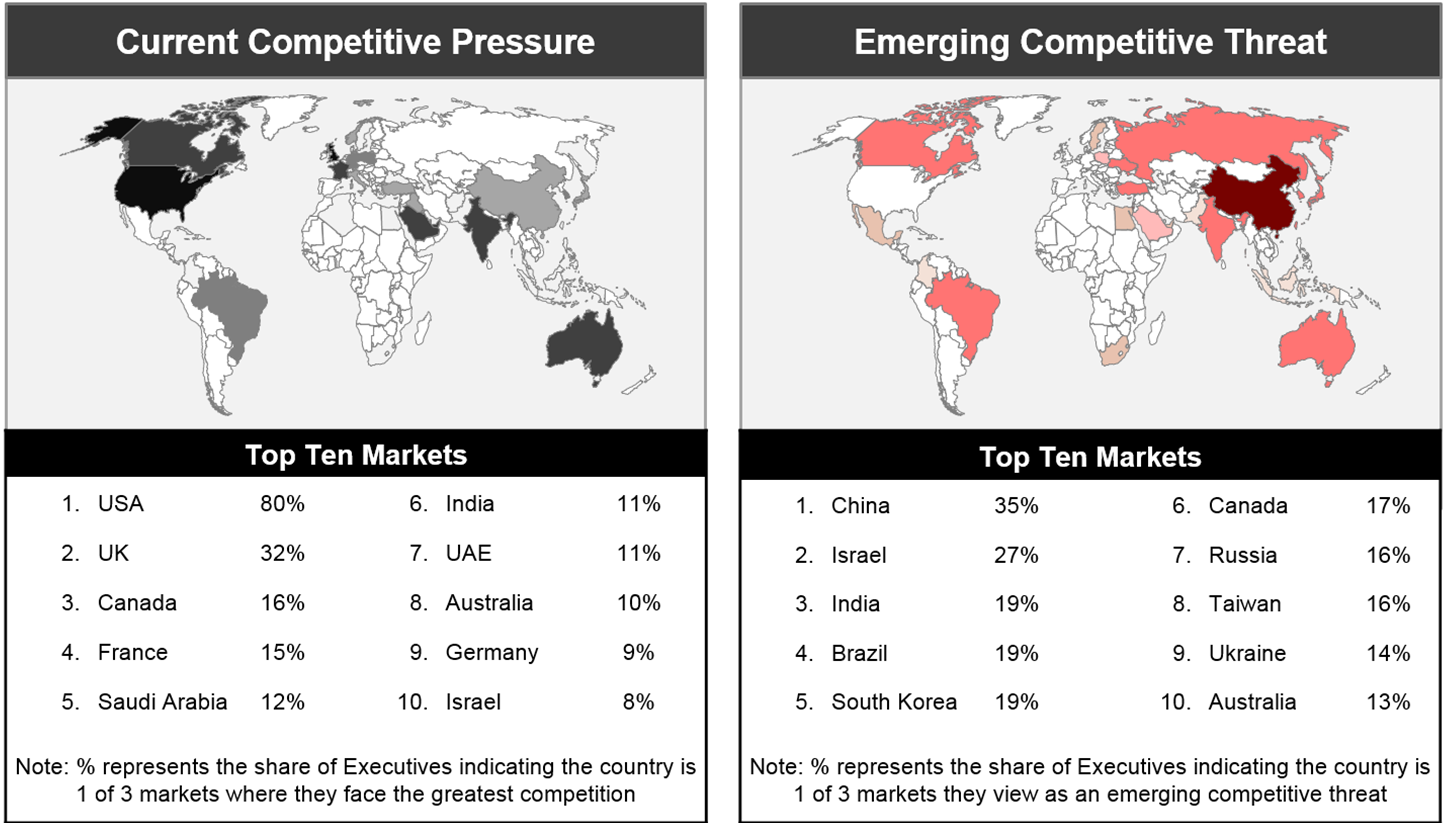

With a reassessment of aerospace and defense competitiveness comes a fresh look at the markets producing the most competitive firms. In Avascent’s survey of the global A&D sector, several key themes become clear.

First, companies typically view their most competitive markets as large Western markets, dominated by U.S. companies and then Western European companies. Second, emerging competitors represent a very different list. China is considered the greatest competitive threat with Israel, India, Brazil, Turkey, Canada and South Korea close behind. Finally, the result is competition coming from many relatively new market entrants simultaneously across multiple product areas.

Redefining A&D Competitiveness: 80% Solutions at 20% Cost

The conventional wisdom holds that large Western aerospace and defense firms compete with similar firms. For decades, big companies leveraged engineering know-how and political acumen in their pursuit of the world’s biggest budgets, namely those of the U.S. Department of Defense and NATO-allied defense ministries in Europe. The rest of the world was in the margins.

Avascent believes aerospace and defense global competitiveness is defined by a firm’s ability to offer cost competitive, adaptive products. This requires a commitment to prevailing in intensely regional opportunities and building a business culture that rewards collaboration and innovation over conventional strategies.

The industry’s most competitive companies will look less and less like the rivals that dominated major international defense deals during the past decades.

Competition is emerging in promising new markets, in new forms and with new models that will change the future of the aerospace and defense industry.

Competitiveness itself is contextual. In the U.S., the definition of a competitive bid might be an 80%-90% capable solution at a comparable level of reduced cost. But in other parts of the world, it might be achieving 80% capability at 20% of the cost. For established firms, the biggest threat may be a company never considered to be a rival.

Understanding the New A&D Competitive Landscape: Case Studies

Sales models that worked even two years ago are no longer effective, and “rising” competitors with less restrictive export/compliance environments are winning at our expense.

The following examples show how firms are becoming more competitive by redefining the concept of aerospace and defense competitiveness itself, and highlight comments by senior A&D leaders in the survey, such as:“Sales models that worked even two years ago are no longer effective, and “rising” competitors with less restrictive export/compliance environments are winning at our expense.”

Armed Chinese UAVs:

The export of China’s armed drones shows how a country can offer a cutting-edge capability without actually having to produce a market’s most advanced systems. Availability can trump technology. There are at least three Chinese armed drones under development, according to the Defense Department, and their export is unhindered by treaties, such as the Missile Technology Control Regime. China’s Yilong unmanned aircraft, made by Aviation Industry Corp., closely resembles a General Atomics Predator.

Deploying what has been a signature U.S. battlefield advantage may be too much to resist: Saudi Arabia is reportedly interested in armed Chinese drones. These platforms can also displace or augment costlier systems such as attack helicopters. It is a fast-growing market. From 2014 to 2017, UAS spending outside of the U.S. will grow by 16% per year, well ahead of the relatively flat U.S. defense budget, while procurement of Combat UAS will increase from $359 million in 2014 to $1.18 billion by 2019, according to Avascent analysis. Competitive firms must adapt, and develop export-ready variants. Still, U.S. firms face a daunting long-term challenger in China, as the survey results show.

Saab Gripen NG

European defense firm Saab generated interest in the latest iteration of the JAS-39 Gripen fighter by equipping the jet with AESA radar and electronic warfare capabilities typically found on bigger, more expensive jets. Yet the Gripen NG’s price is competitive and Saab is pursuing alternative sales models. In Asia, Malaysia may lease the Gripen. The company’s double-barreled approach on price and capability gives it a disruptive presence as its deal with Brazil showed. Brazil picked the Gripen NG with a 36-jet order over the Boeing F/A-18 and the Dassault Rafale last year after a lengthy marketing campaign. Capability and price need not be mutually exclusive.

A regional sale can have the effect of closing out an opportunity for a U.S. or European company. Competitive regional firms leverage existing ties and elevate local partners beyond what established firms will do.

Abu Dhabi Shipbuilding

Offsets have been a traditional feature in international deals, so much so that the outstanding commitments added up to $90B worldwide from 2011-2013, according to Avascent analysis. Those offsets are bearing fruit, as Abu Dhabi Shipbuilding demonstrates in the Middle East. While Abu Dhabi Shipbuilding may not yet be a global challenger, its Baynunah corvette shows it is a formidable entrant in a crucial market. A regional sale can have the effect of closing out an opportunity for a U.S. or European company. Competitive regional firms leverage existing ties and elevate local partners beyond what established firms will do.

How to Respond: The Avascent Global Competitiveness Dashboard

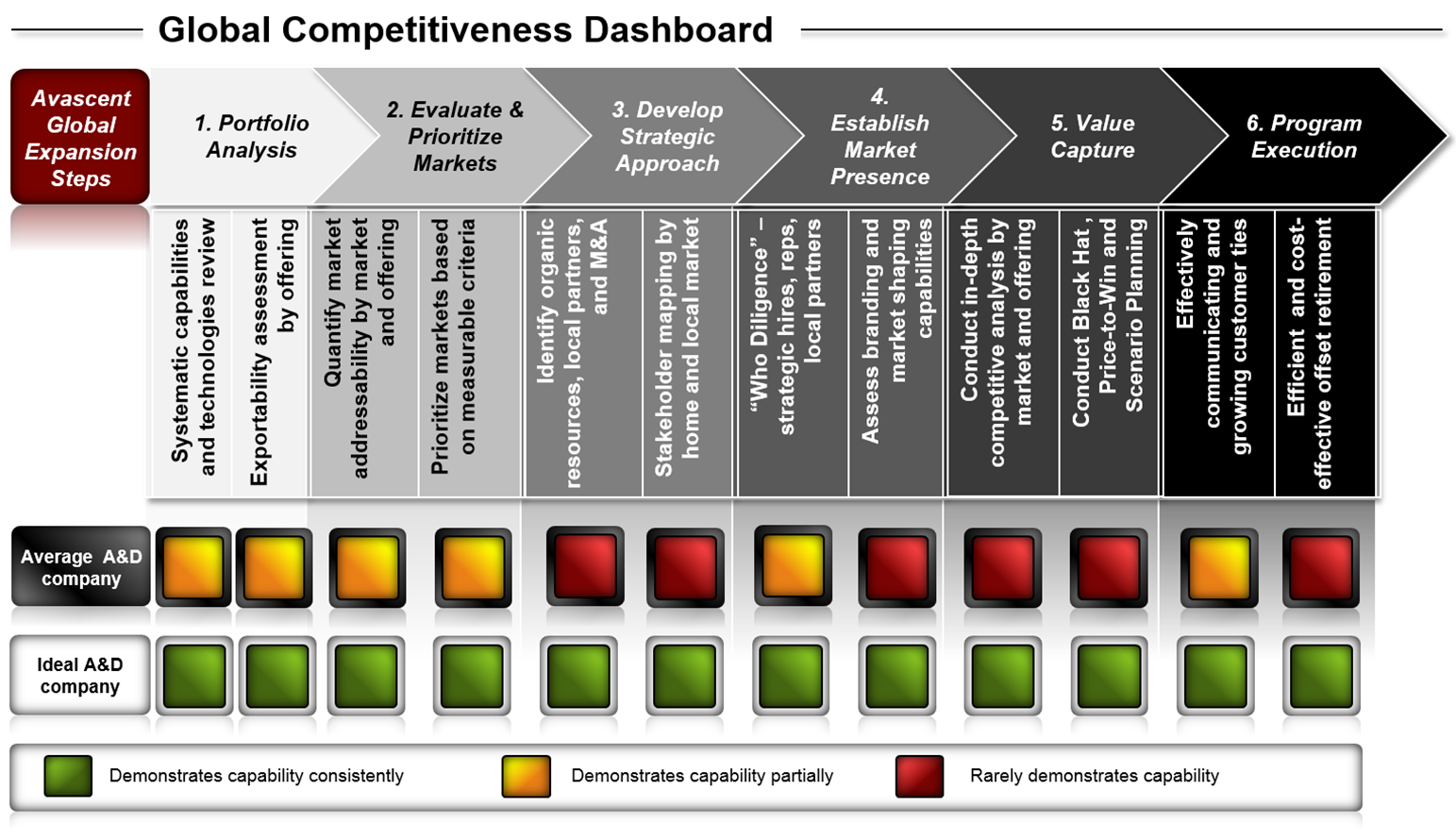

In response to this rapidly shifting competitive environment, The Avascent Global Competitiveness Dashboard highlights six key steps for companies to address in order to achieve optimal results globally:

- Portfolio Analysis

- Evaluate & Prioritize Markets

- Develop Strategic Approach

- Establish Market Presence

- Value Capture

- Program Execution

According to the survey responses, A&D firms on average do not consistently perform any of the key tasks required for successful global expansion, which are shown as green on the Avascent Global Competitiveness Dashboard. Notably, a majority of companies receive scores of red for rarely performing or never performing key activities including: identification of international partners and global M&A opportunities, performing analyses of international stakeholders, conducting effective branding and market shaping and effectively managing offsets.

Going forward, companies should conduct a thorough and objective assessment of their internal performance relative to the Avascent Global Competitiveness Dashboard. In areas where activities are not being consistently performed, targeted action plans and strategies should be developed and implemented.

Whether U.S. or international defense firms can capture international opportunities or will see them slip from their grasp depends on if they are willing to become truly competitive in the 21st Century aerospace and defense market.