Trimming the Sails: Difficult Budget Environment Should Not Push Navy, Industry off Course

As U.S. naval capabilities become a top priority, the naval budget is not poised to match functional expectations with reality.

However, improved collaboration between industry and the U.S. Navy could yield private sector growth as well as taxpayer savings.

Time to Act

Remain Engaged Despite Austerity

Over the past decade and a half, high levels of U.S. defense spending focused on wartime priorities in Iraq and Afghanistan. While defense executives had a relatively clear foundation for strategic planning because overall military spending kept rising, U.S. naval priorities were frequently eclipsed by one of America’s longest-running counterinsurgency campaigns.

No more.

The U.S. Navy’s topline budget is likely to remain relatively flat in the coming years. But under a flat budget, there is still room to be aggressive and find opportunities for growth.

For the 239 year old U.S. Navy and its industry partners, seapower is once again a priority. Yet daunting challenges remain in the current fiscal and political environment. For many there is a sense that Navy budgets turn as an aircraft carrier changing course: slowly. The naval industry’s fate, thinking goes, has been sealed for the next few years – and if anything, will only get worse amid austerity’s political doldrums. This is a moment when industry partners may be tempted to back off, but the impulse to hunker down is the wrong one. Leaders who ask the right questions about their future and that of America’s naval forces will be positioned to act decisively both in the near term and over the long run.

The U.S. Navy’s topline budget is likely to remain relatively flat in the coming years. But under a flat budget, there is still room to be aggressive and find opportunities for growth. Proactive steps to manage through the next few years will become the foundation for a thriving future.

Finding Ways To Innovate

New Opportunities on the Horizon

…while the mission shift takes place, budgets remain relatively flat – meaning there is an ever-widening gap between expectation and reality.

The reality is that the U.S. Navy has already effectively set its broad, near-term agenda for a force that can operate forward and conduct a full spectrum of naval operations. Among its evolving missions, the Navy must be prepared to check China and demonstrate a sustained commitment to America’s allies in the Pacific.

China’s economic and energy interests are well documented, and global in nature. While naval maneuvers off contested territories in the South China Sea receive the most coverage, its naval ambitions are for a global presence as counter-piracy operations off the Horn of Africa demonstrate. For another, the global economic system depends on reliable sea lines of trade and communications, which the Navy will continue to have as a mainstay mission, whether it shares this responsibility with other countries or not.

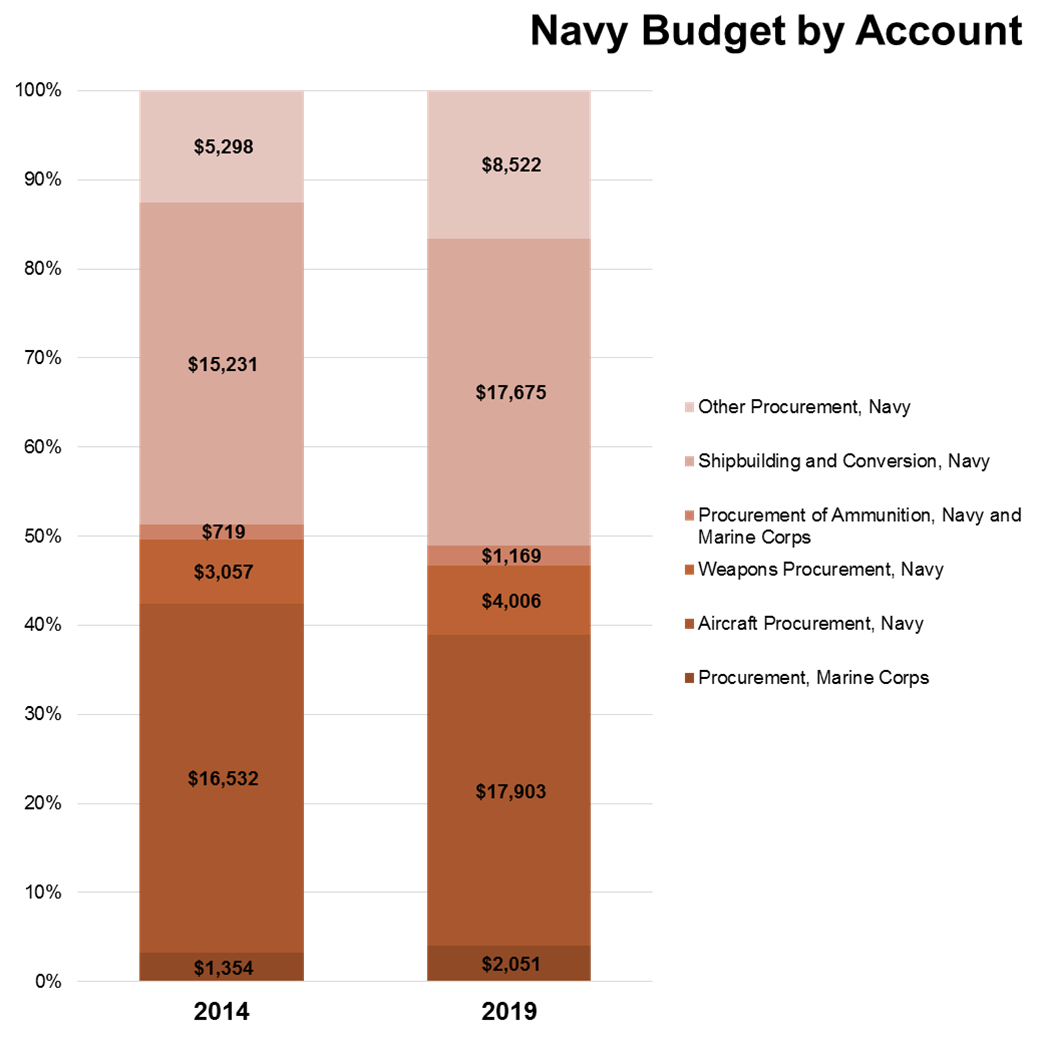

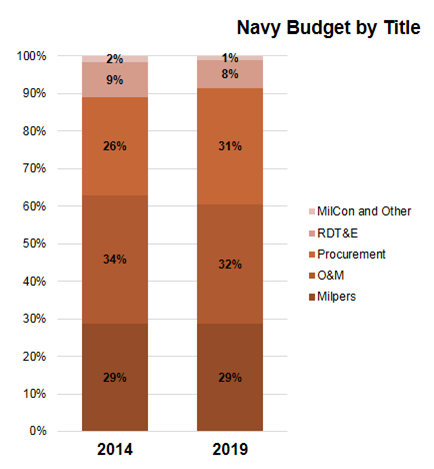

However, despite various indicators pointing to the “ascendance” of the Navy mission relative to its contributions in more recent conflicts, the Navy is not yet “pivoting” its budget or growing its relative share of the defense budget as quickly as the mission arguably requires. The current U.S. Navy base budget for FY2014 is $161 billion, with total FYDP (FY15-19) spending expected to be $800 billion. Of this FY14 total, procurement stands at $42 billion, research, development, test and evaluation (RDT&E) at $14 billion, and operations and maintenance (O&M) at $55 billion. Of the three accounts, only procurement (at a 2% compound annual growth rate) is expected to growth through 2019. So while the mission shift takes place, budgets remain relatively flat – meaning there is an ever-widening gap between expectation and reality.

This gap, however, is also an opportunity for industry to do things differently and find innovative ways to address the Navy’s most pressing needs. Indeed, just because the Navy has set a broad agenda and budgets are relatively flat does not mean there are few new avenues for growth. This market presents many targeted opportunities beyond shipbuilding, including ancillary platforms, weapons and services the Navy depends on in the 21st Century. Finding opportunity for new growth is achievable but innovation, perseverance, and improved dialogue between Navy and industry will be required to make it happen. Openness to change is as important as any advances in science or engineering.

Take the case of Directed Energy, a “revolutionary capability” in the words of Chief of Naval Research Rear Admiral Matthew Klunder. By using advanced laser technology to for missions like anti-ship missile defense, the Navy will complement kinetic weapons with new technology and ensure an asymmetric advantage. Compared to some large-scale development programs, research and development has been a relative bargain for the Navy customer. The capability was largely developed through corporate independent research and development and military laboratories. Directed Energy technology would not be where it is without industry and DoD working together to find a new, potentially game-changing solution that doesn’t break the bank.

Commercial, off the shelf technology may be increasingly used for everything from new ship coatings to electronics components.

Finding new opportunities for advancement need not sound like science fiction. The O&M account, for example, is an area ripe for disruption and innovative ways to shape opportunities that ultimately benefit the Navy. It is time to ask whether outdated military specifications are keeping affordable, quality commercial components from saving taxpayer dollars. Commercial, off the shelf technology may be increasingly used for everything from new ship coatings to electronics components. Onboard ship systems monitoring, with predictive analytics, is another way to find savings by addressing problems before they happen. And in the not too distant future robotics may be used to improve ship maintenance, both in port and at sea.

More broadly, there are other innovations that the Navy and industry partners may consider. This could include ways to support longer range and duration cruises with dynamic missions, from submarine blockades to humanitarian assistance and disaster relief. And with personnel costs continuing to rise, perhaps more “multi-mission” sailors should be trained – in other words, smaller crews that, thanks to improved technology, are equipped to do more with less. It is a crucial endeavor considering crew costs can be the largest expense over a ship’s long life of service. This is already being done with the Littoral Combat Ship, thanks to innovative technology and design.

It is worth exploring whether new technology advances on other ships may allow for the same sort of innovative and, ultimately cost-saving approach in the future.

How to Thrive During and After the Next Few Years

Start by Asking the Right Questions

The Navy’s mission is dynamic and reflects the complicated geopolitical and global technological environment. Like the other armed services, its future effectiveness depends on higher efficiency, integrating technological breakthroughs and increasing operational adaptability. These will be enduring aspects of the Navy’s future relationship with industry and the moment to get in sync on finding innovative ways to expand capabilities is now. This is the time for both industry and the Navy to be bold.

The first step in this process is a dialogue centered on asking the right questions. For example:

- How to make better use of commercial technology, both advanced (e.g., robotics) and everyday (e.g., coatings)?

- What regulations must change in order to make that happen?

- What incremental, but potentially breakthrough, technology gains can be made through common-sense investments and partnerships?

- Can new ways of operating drive efficiencies in the Navy O&M account?

In this global security environment, lucid conversation is even more important because the Navy’s needs change faster than the topline budget can.

In this global security environment, lucid conversation is even more important because the Navy’s needs change faster than the topline budget can. Addressing these questions (and others) will set the stage for cultivating opportunity over the next few years and thriving afterwards.

If there is one thing that the Navy is suited to it is change, be it at sea or at home. Technology and doctrine over the Navy’s nearly two and a half centuries have made significant leaps during both peacetime and wartime, and it seems as if another inflection point is ahead. How the service and the companies that support it approach the coming years will be crucial to charting a sound course during what may be challenging conditions.